Get the free IT-Estate. Resident Decedent - Estate Tax Return - Form and Instructions

Show details

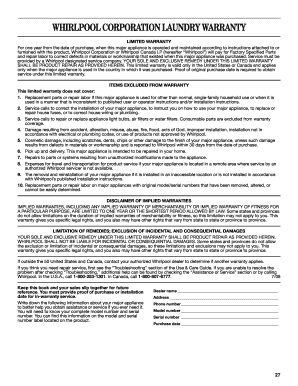

STATE OF NEW JERSEY IT-Estate (04-03) (68) For Division Use Only Resident Decedent Transfer Inheritance Tax PO Box 249 Trenton, NJ 08695-0249 ESTATE TAX RETURN (Instructions on reverse side) Decedent

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your it-estate resident decedent form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it-estate resident decedent form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing it-estate resident decedent online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit it-estate resident decedent. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

How to fill out it-estate resident decedent

How to fill out it-estate resident decedent?

01

Gather necessary documents: Start by collecting all the relevant paperwork, including the death certificate, will or trust, and any other legal documents related to the decedent's estate.

02

Identify the decedent's assets and liabilities: Make a comprehensive list of the decedent's assets, such as property, bank accounts, investments, and debts or loans that need to be settled.

03

Notify relevant parties: Inform key individuals and institutions about the decedent's passing, such as family members, lawyers, financial advisors, and relevant government agencies.

04

Determine if probate is required: Depending on the size and complexity of the estate, it may be necessary to go through the probate process. Consult a legal professional to determine if probate is necessary in your specific situation.

05

Appoint an executor or administrator: If probate is required, choose an executor or administrator who will be responsible for managing the estate and distributing assets according to the decedent's wishes.

06

Inventory and evaluate the estate: The executor or administrator should conduct a thorough inventory of the decedent's assets and arrange for their valuation if needed. This information will be important for the estate administration process.

07

Pay off debts and taxes: Use the estate's assets to settle any outstanding debts, loans, or taxes owed by the decedent. Consult with a financial professional to ensure all obligations are met correctly.

08

Distribute assets: Once all debts and taxes are settled, the executor or administrator can distribute the remaining assets to the beneficiaries as specified in the will or trust.

Who needs it-estate resident decedent?

01

Family members and beneficiaries: The family members and beneficiaries of the deceased individual will need the it-estate resident decedent form to understand how the estate will be administered and how the assets will be distributed.

02

Legal professionals: Attorneys or legal professionals assisting with the estate administration process will require the it-estate resident decedent form to accurately handle the legal aspects of managing the estate.

03

Financial institutions: Banks, investment firms, and other financial institutions involved in managing the decedent's assets will need the it-estate resident decedent form to properly handle the transfer or distribution of funds.

04

Government agencies: Relevant government agencies, such as tax authorities, may require the it-estate resident decedent form to ensure compliance with tax regulations and to process any necessary documentation for the transfer of assets.

05

Executors or administrators: The individuals appointed to manage and oversee the estate administration process will rely on the it-estate resident decedent form to guide their actions and ensure proper distribution of assets according to the decedent's wishes.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is it-estate resident decedent?

An it-estate resident decedent refers to a deceased individual who had a taxable estate or assets subject to estate tax.

Who is required to file it-estate resident decedent?

The executor or administrator of the estate is required to file the it-estate resident decedent.

How to fill out it-estate resident decedent?

To fill out the it-estate resident decedent, the executor or administrator needs to gather information about the deceased's assets, liabilities, and other relevant information related to the estate. This information is then reported on the appropriate estate tax return form.

What is the purpose of it-estate resident decedent?

The purpose of the it-estate resident decedent is to determine if the estate is subject to estate tax and calculate the tax liability on the estate.

What information must be reported on it-estate resident decedent?

The it-estate resident decedent requires reporting of various information including the value of assets owned by the deceased, any debts or liabilities, transfers of property, and any applicable deductions or exemptions.

When is the deadline to file it-estate resident decedent in 2023?

The deadline to file it-estate resident decedent in 2023 is typically within 9 months from the date of the decedent's death. However, it is recommended to consult with a tax professional or refer to the relevant tax authority for the specific deadline.

What is the penalty for the late filing of it-estate resident decedent?

The penalty for the late filing of it-estate resident decedent can vary depending on the jurisdiction and the specific circumstances. It is advisable to consult with a tax professional or refer to the relevant tax authority for information on the applicable penalties.

How do I make changes in it-estate resident decedent?

With pdfFiller, the editing process is straightforward. Open your it-estate resident decedent in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit it-estate resident decedent in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing it-estate resident decedent and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I edit it-estate resident decedent on an Android device?

You can make any changes to PDF files, like it-estate resident decedent, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your it-estate resident decedent online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.