Get the free Insurance Agents & Brokers - Sierra Specialty

Show details

Application Supplement for Insurance Agents and Brokers All questions must be completed in full. 1. Name of Applicant: 2. On what date did the present management assume control, management or ownership

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your insurance agents amp brokers form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance agents amp brokers form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit insurance agents amp brokers online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit insurance agents amp brokers. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

How to fill out insurance agents amp brokers

How to fill out insurance agents amp brokers:

01

Begin by gathering all the necessary information about your insurance needs. This includes details about the types of coverage you need, the amount of coverage required, and any specific policy features you are looking for.

02

Research different insurance agents and brokers in your area. Look for professionals who have experience and expertise in the specific type of insurance you are seeking. You can ask for recommendations from friends or family, or search online directories for licensed and reputable agents.

03

Contact the selected insurance agents or brokers. Schedule a consultation or meeting to discuss your insurance needs in detail. During this meeting, provide the information you have gathered and ask any questions you may have.

04

Listen carefully to the recommendations and advice provided by the agents or brokers. They will evaluate your needs and suggest suitable insurance options based on their expertise.

05

Compare the proposals and quotes provided by different agents or brokers. Review the coverage details, policy terms, and prices to determine the best option for you. Consider factors such as reputation, customer service, and claims handling when making your decision.

06

Once you have chosen an agent or broker, complete the necessary paperwork to initiate the insurance policy. Pay attention to the details and ensure accuracy in providing all the required information.

07

Review the finalized policy documents thoroughly before signing. Make sure you understand the terms and conditions, exclusions, and any additional clauses included in the policy.

08

Keep a copy of the signed policy documents for your records. It is important to regularly review and update your insurance coverage as your needs change over time. Stay in touch with your agent or broker to address any questions or concerns that may arise.

Who needs insurance agents amp brokers:

01

Individuals or businesses seeking specialized or complex insurance coverage may benefit from the expertise of insurance agents and brokers. They can provide guidance and assistance in navigating the intricacies of insurance policies.

02

Busy individuals who lack the time or knowledge to research and compare insurance options may find value in outsourcing the task to insurance agents or brokers. These professionals can handle the legwork and provide tailored recommendations based on the individual's unique needs.

03

Insurance agents and brokers are particularly beneficial for those who are unsure about the intricacies of insurance policies or have limited knowledge in the field. They can explain policy details, answer questions, and clarify any confusion to ensure individuals fully grasp what they are purchasing.

04

Business owners who need to secure insurance coverage for their organizations can turn to agents and brokers for assistance. These professionals can help assess potential risks, identify suitable insurance products, and negotiate favorable terms on behalf of the business.

05

Individuals who have experienced difficulties in the past, such as high-risk individuals or those with poor claims history, might benefit from insurance agents or brokers who can help find insurers willing to provide coverage. These professionals have access to a wide network of insurers and can often help secure coverage in such situations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is insurance agents amp brokers?

Insurance agents and brokers are professionals who help individuals and businesses navigate the insurance industry. They act as intermediaries between insurance companies and policyholders, assisting with the purchase, renewal, and claims processes.

Who is required to file insurance agents amp brokers?

Insurance agents and brokers who are engaged in the business of selling or negotiating insurance policies are generally required to file their information with the appropriate regulatory bodies. The specific requirements may vary depending on the jurisdiction and the type of insurance being sold.

How to fill out insurance agents amp brokers?

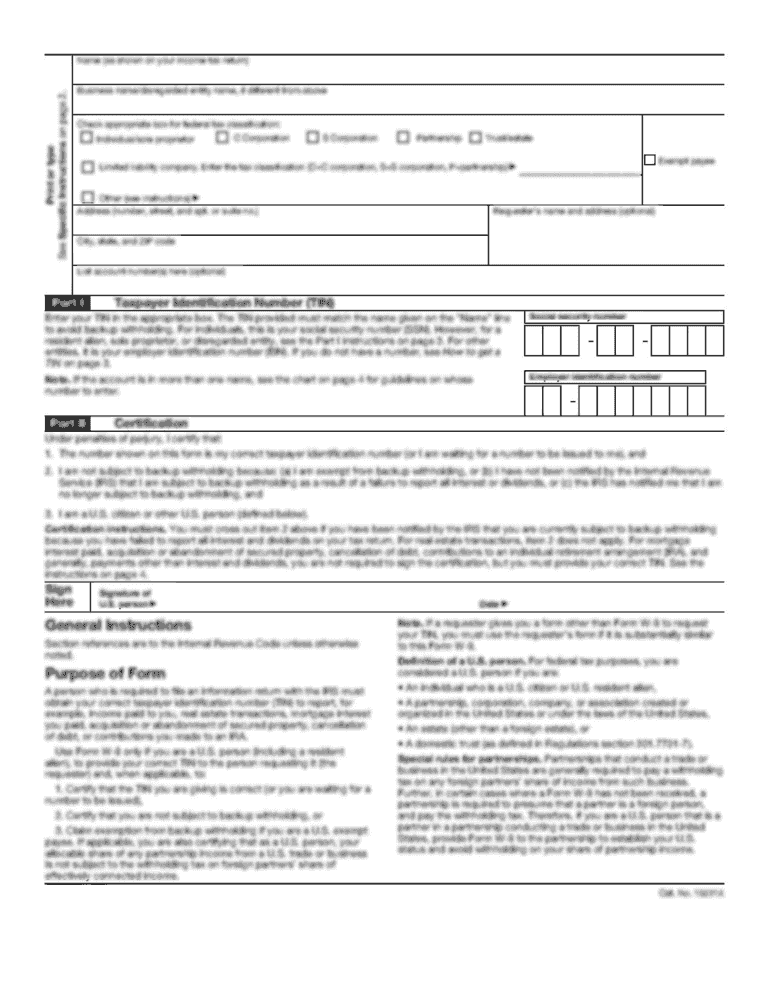

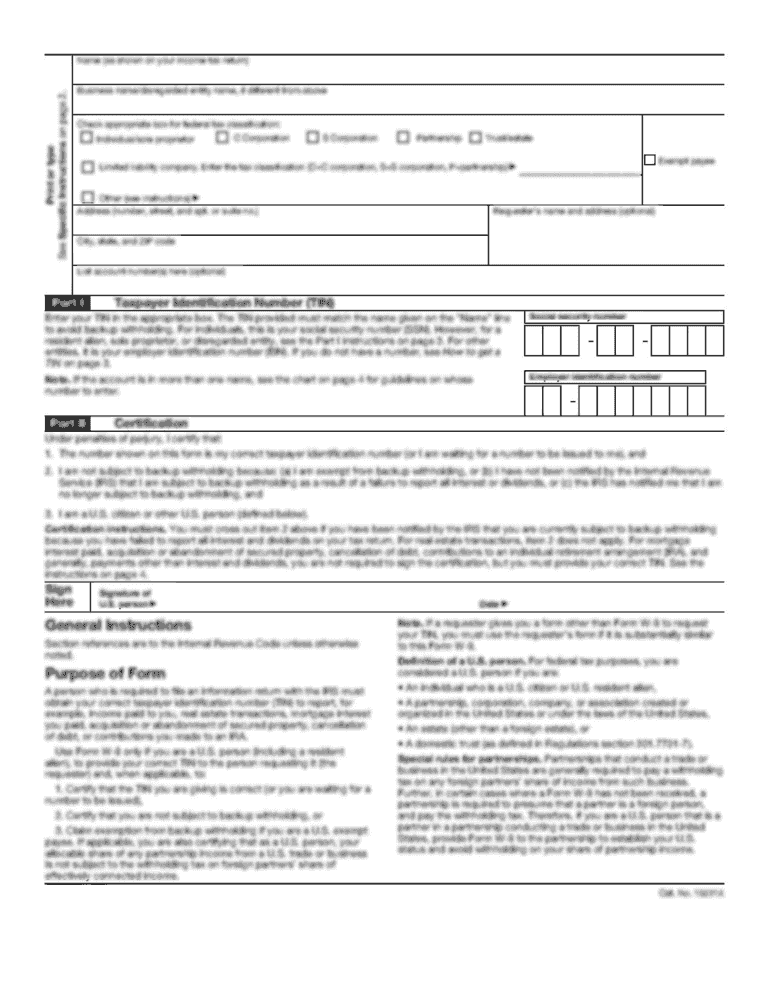

To fill out the insurance agents and brokers information, you will typically need to provide details about your business, such as your name, contact information, licensing information, and any relevant certifications. You may also need to disclose information about your clients and the insurance policies you have sold or negotiated.

What is the purpose of insurance agents amp brokers?

The purpose of insurance agents and brokers is to assist individuals and businesses in obtaining suitable insurance coverage based on their needs and risk profile. They provide professional advice, evaluate different insurance options, negotiate policy terms, and help clients understand the terms and conditions of their insurance policies.

What information must be reported on insurance agents amp brokers?

The information that must be reported on insurance agents and brokers typically includes details such as their name, address, contact information, licensing information, certifications, and any relevant regulatory filings. Additionally, information about the insurance policies sold or negotiated, commissions or fees earned, and client demographics may also be required.

When is the deadline to file insurance agents amp brokers in 2023?

The specific deadline for filing insurance agents and brokers information in 2023 may vary depending on the jurisdiction and the regulatory requirements. It is recommended to consult the relevant regulatory body or agency to determine the exact deadline in your specific case.

What is the penalty for the late filing of insurance agents amp brokers?

The penalties for late filing of insurance agents and brokers information may vary depending on the jurisdiction and the specific regulations in place. It is crucial to adhere to the filing deadlines to avoid potential penalties, which may include fines or other disciplinary actions imposed by the regulatory authorities.

How can I get insurance agents amp brokers?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific insurance agents amp brokers and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How can I edit insurance agents amp brokers on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit insurance agents amp brokers.

How can I fill out insurance agents amp brokers on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your insurance agents amp brokers. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your insurance agents amp brokers online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.