Get the free Give to the 2009 Year End Appeal Your support enables us to cont - preservationmass

Show details

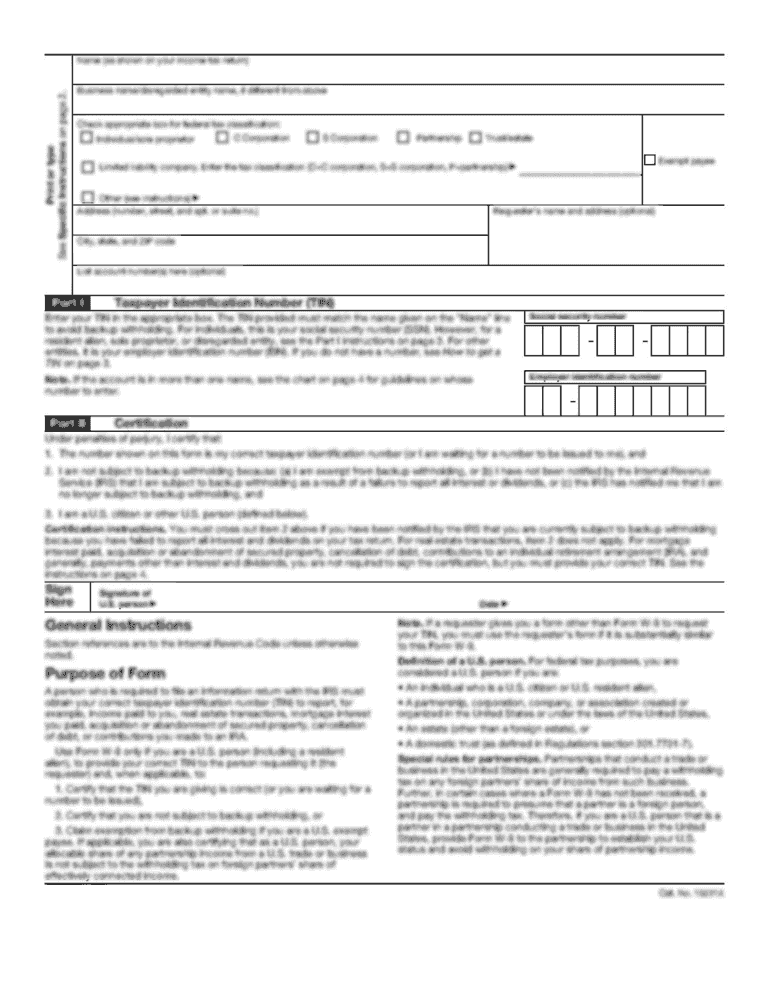

Join Preservation Massachusetts in Preserving our Commonwealth! Give to the 2009-Year End Appeal Your support enables us to continue our mission advocating, protecting and educating! Name: Organization:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your give to form 2009 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your give to form 2009 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit give to form 2009 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit give to form 2009. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out give to form 2009

How to fill out give to form 2009:

01

Obtain a copy of form 2009 from the appropriate government agency or download it from their website.

02

Begin by carefully reading the instructions provided with the form. This will give you information on how to properly complete each section.

03

Provide your personal information in the designated sections of the form. This may include your name, address, social security number, and other relevant details.

04

Fill in the details of the gift you are giving in the appropriate section. This may include the type of gift, its value, and any additional information required.

05

If you have made multiple gifts, ensure that you accurately record each one separately and provide all necessary details and documentation.

06

Make sure to sign and date the form as required. Failure to sign the form may result in it being considered incomplete or invalid.

07

Double-check all the information provided on the form for accuracy and completeness before submitting it. Mistakes or omissions could lead to delays or potential issues.

08

Keep a copy of the completed form and any supporting documents for your records.

Who needs give to form 2009:

01

Individuals who have made charitable donations and want to claim a deduction on their taxes.

02

Taxpayers who have made gifts to qualified organizations and need to report these gifts for tax purposes.

03

People who want to ensure they are complying with tax laws and regulations regarding charitable giving.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is give to form year?

Give to form year is a document that organizations use to report any monetary or non-monetary gifts given to individuals or other organizations.

Who is required to file give to form year?

Any organization or individual that has given gifts totaling over a certain threshold amount to recipients in a calendar year is required to file give to form year.

How to fill out give to form year?

Give to form year can be filled out by providing information on the donor, recipient, amount of gift, date of gift, and any other relevant details.

What is the purpose of give to form year?

The purpose of give to form year is to report gifts given to individuals or organizations for tax and record-keeping purposes.

What information must be reported on give to form year?

Information such as the name and address of the donor and recipient, amount of gift, date of gift, and description of the gift must be reported on give to form year.

When is the deadline to file give to form year in 2024?

The deadline to file give to form year in 2024 is typically January 31st of the following year.

What is the penalty for the late filing of give to form year?

The penalty for late filing of give to form year can vary, but it may include fines or interest charges on the unpaid taxes associated with the gifts.

How can I edit give to form 2009 on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing give to form 2009, you can start right away.

How do I fill out give to form 2009 using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign give to form 2009 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I fill out give to form 2009 on an Android device?

Complete your give to form 2009 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your give to form 2009 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.