Get the free Sweet Holiday Savings! - Aircraft Spruce

Show details

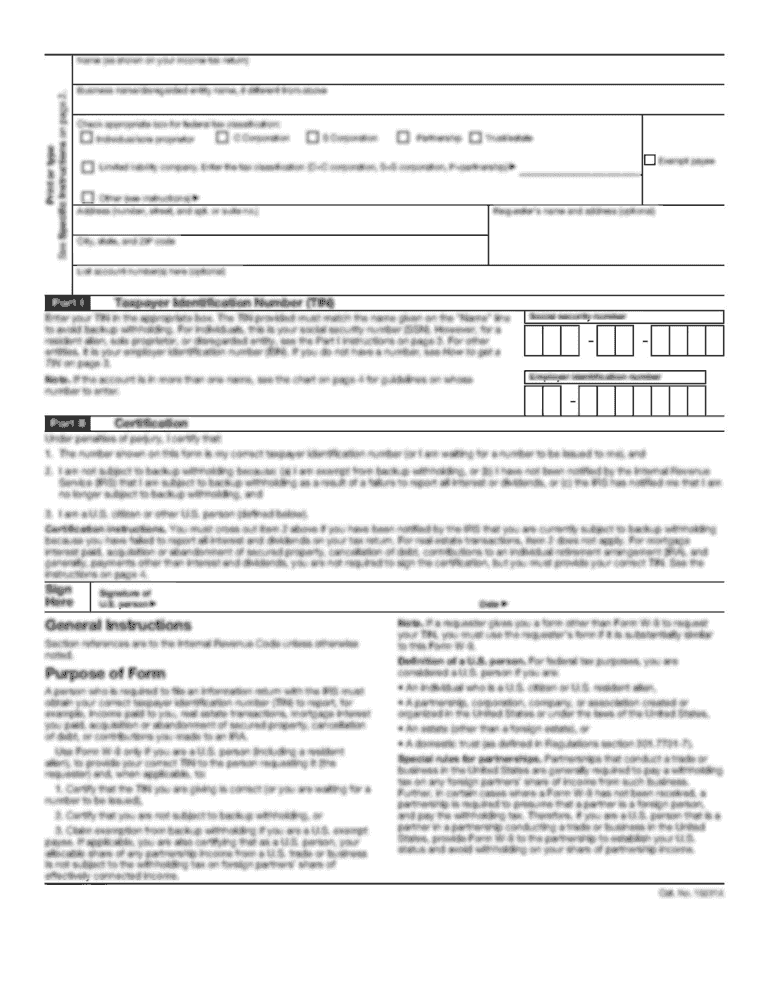

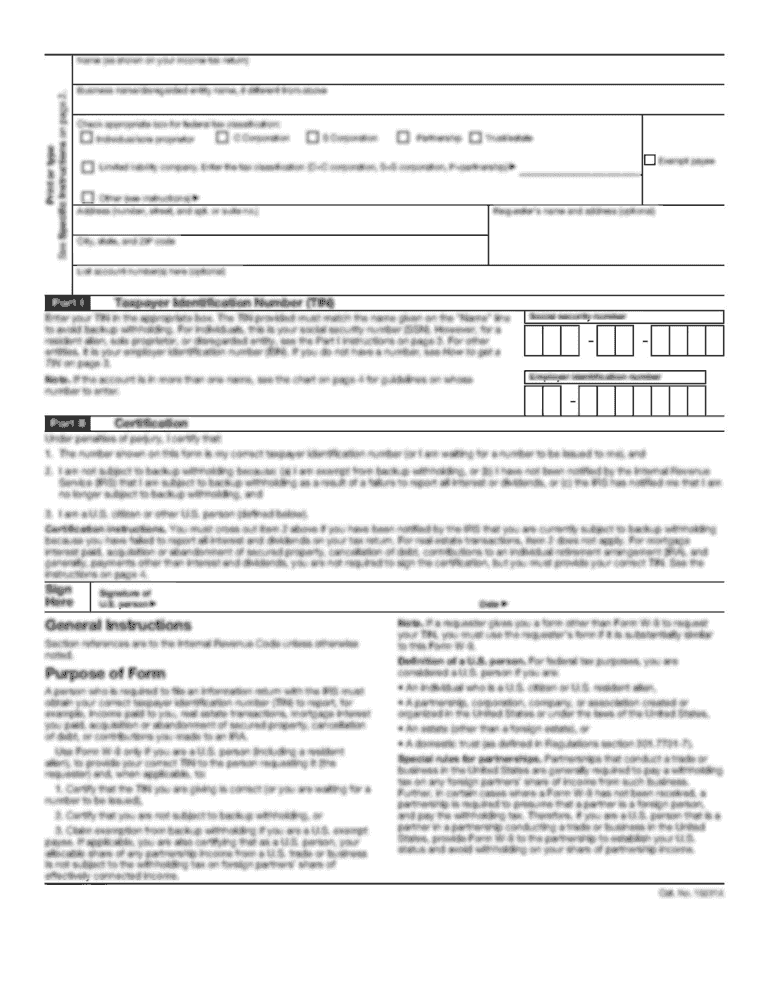

Sweet Holiday Savings! A6 ... SAVE ... ×20.00 A24 ... SAVE ... ×40.00 LIMITED TIME OFFER*: Purchase must be made between 11/1/10 and 12/31/10. Mail in the following 3 items: 1. A copy of the sales

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your sweet holiday savings form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sweet holiday savings form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sweet holiday savings online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit sweet holiday savings. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out sweet holiday savings

How to fill out sweet holiday savings?

01

Make a budget: Start by determining how much you can afford to save for your holiday expenses. Consider your income, expenses, and any extra money you can allocate towards savings.

02

Set savings goals: Identify specific targets for your holiday savings, such as the amount you want to save overall or the amount you want to allocate to specific expenses like gifts, travel, or decorations.

03

Track your spending: Keep a record of your expenses to monitor your progress and ensure you are staying within your budget. This will help you identify areas where you can cut back and save more.

04

Cut unnecessary expenses: Look for opportunities to reduce your spending on non-essential items. This can include eating out less, cancelling unused subscriptions, or finding more affordable alternatives for activities or gifts.

05

Find ways to earn extra income: Consider taking on a part-time job, freelancing, or selling unwanted items to generate additional funds to put towards your holiday savings.

06

Automate your savings: Set up automatic transfers from your checking account to a dedicated savings account specifically for your holiday savings. This will help ensure consistent saving without having to rely solely on your willpower.

07

Explore saving options: Look for high-yield savings accounts or other saving vehicles that offer competitive interest rates to maximize the growth of your holiday savings.

08

Stay motivated: Keep reminding yourself of the benefits of having sweet holiday savings. Visualize how it will allow you to enjoy your holiday season without financial stress and be able to give meaningful gifts to your loved ones.

Who needs sweet holiday savings?

01

Individuals or families who want to have a memorable holiday season without going into debt.

02

People who want to be financially prepared for expenses like gift-giving, travel, food, and decorations during the holiday season.

03

Anyone who wants to be able to enjoy the holidays without the stress and worry of not being able to afford it.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sweet holiday savings?

Sweet holiday savings is a special program that offers discounted prices and promotions on various holiday-related items and services.

Who is required to file sweet holiday savings?

Sweet holiday savings is not something that requires filing. It is a program offered to consumers.

How to fill out sweet holiday savings?

Sweet holiday savings does not require any specific form or filling out. It is a program that provides discounts and savings to consumers.

What is the purpose of sweet holiday savings?

The purpose of sweet holiday savings is to provide consumers with discounted prices and promotions during the holiday season to help save money and make holiday shopping more affordable.

What information must be reported on sweet holiday savings?

There is no specific information that needs to be reported for sweet holiday savings. It is simply a program that offers discounts and savings to consumers.

When is the deadline to file sweet holiday savings in 2023?

As sweet holiday savings does not require filing, there is no deadline.

What is the penalty for the late filing of sweet holiday savings?

Since sweet holiday savings does not require filing, there are no penalties for late filing.

How can I send sweet holiday savings for eSignature?

Once you are ready to share your sweet holiday savings, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit sweet holiday savings on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign sweet holiday savings right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I edit sweet holiday savings on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as sweet holiday savings. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your sweet holiday savings online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.