Get the free Forms Of Business Organization - Investopedia

Show details

Doing Business in Ireland www.bakertillyinternational.com Contents 1 Fact Sheet 2 2 Business Entities and Accounting 2.1 Companies 2.2 Partnerships 2.3 Sole Proprietorship 2.4 Branches 2.5 Trusts

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your forms of business organization form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your forms of business organization form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing forms of business organization online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit forms of business organization. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

How to fill out forms of business organization

How to fill out forms of business organization?

01

Start by gathering all the necessary information about your business, such as its name, address, and contact details.

02

Determine the type of business organization you are forming, whether it's a sole proprietorship, partnership, corporation, or LLC.

03

Fill out the appropriate form specific to your chosen business organization type. Each form may require different information, so read the instructions carefully and provide accurate details.

04

Include details about the owners or partners involved in the business, their names, addresses, social security numbers, and any other required information.

05

Provide information about the nature of your business, including its purpose, activities, and any necessary licenses or permits.

06

Include any additional information or attachments required, such as financial statements, business plans, or agreements.

07

Review the completed form thoroughly to ensure all information provided is accurate and complete.

08

Sign and date the form as required and submit it to the appropriate authority, whether it's a government agency, business registrar, or any other governing body.

Who needs forms of business organization?

01

Individuals who wish to establish their own business need forms of business organization. Whether they are starting a small sole proprietorship or a large corporation, proper documentation is necessary to legally form and operate the business.

02

Entrepreneurs looking to pursue partnerships with other individuals or entities also need forms of business organization. This ensures that each party's rights, responsibilities, and ownership stakes are properly outlined and established.

03

Existing businesses that wish to change their legal structure or incorporate their operations may also need forms of business organization. This allows them to comply with legal requirements and gain the benefits and protections associated with their desired business structure.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is forms of business organization?

Forms of business organization refer to the different legal structures that businesses can adopt, such as sole proprietorship, partnership, corporation, and limited liability company (LLC). Each form has its own characteristics and implications in terms of ownership, liability, taxation, and management.

Who is required to file forms of business organization?

Any individual or group planning to start a business and establish a legal entity must file the necessary forms of business organization. This includes entrepreneurs, partnerships, corporations, and LLCs.

How to fill out forms of business organization?

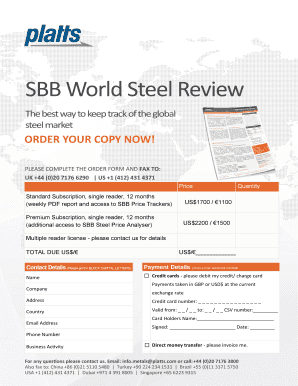

The process of filling out forms of business organization varies depending on the specific legal structure chosen. Generally, it involves providing information such as the business name, address, ownership details, type of organization, and relevant tax ID numbers. It is advisable to consult with a legal professional or use online resources provided by government agencies to ensure accurate and complete completion of the forms.

What is the purpose of forms of business organization?

The purpose of forms of business organization is to establish a legal entity for a business. These forms define the structure, ownership, and management of the business, as well as determine the rights, responsibilities, and liabilities of the individuals involved. They also serve as a means for complying with legal and regulatory requirements, such as taxation and reporting obligations.

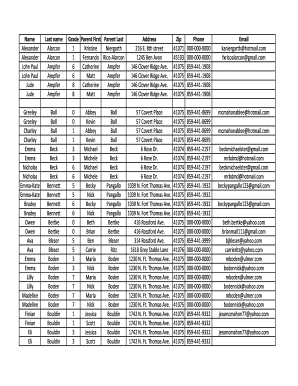

What information must be reported on forms of business organization?

Forms of business organization require various pieces of information to be reported, including the business name, physical address, mailing address, type of organization, ownership details, names and addresses of owners or shareholders, tax identification numbers, and other relevant details depending on the specific form being filed. It is essential to provide accurate and complete information to ensure compliance and avoid potential legal issues.

When is the deadline to file forms of business organization in 2023?

The specific deadline to file forms of business organization in 2023 may vary depending on the jurisdiction and type of organization. It is crucial to consult with the relevant government agency or legal professionals to determine the exact deadline applicable to your situation.

What is the penalty for the late filing of forms of business organization?

The penalty for late filing of forms of business organization can vary depending on the jurisdiction and legal requirements. It may result in fines, penalties, or additional fees imposed by government agencies or regulatory bodies. The exact penalties will be determined by the specific laws and regulations of the jurisdiction in which the business operates. It is advisable to file the forms within the prescribed deadline to avoid any potential penalties or legal consequences.

How can I get forms of business organization?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the forms of business organization. Open it immediately and start altering it with sophisticated capabilities.

How do I complete forms of business organization online?

Completing and signing forms of business organization online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit forms of business organization on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign forms of business organization right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Fill out your forms of business organization online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.