Get the free Oracle Financials for Greece User Guide - Oracle Documentation

Show details

Oracle? Financials for Greece User Guide Release 11i May 2000 Part No. A81227-01 Oracle Financials for Greece User Guide, Release 11i Part No. A81227-01 Copyright ? 1999, 2000, Oracle Corporation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

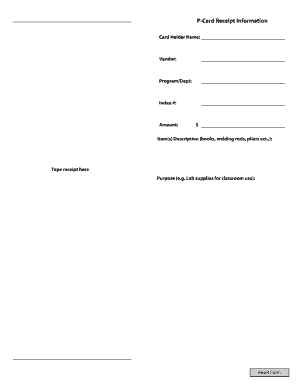

Edit your oracle financials for greece form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oracle financials for greece form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit oracle financials for greece online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit oracle financials for greece. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is oracle financials for greece?

Oracle Financials for Greece is a comprehensive financial management solution specifically designed for businesses operating in Greece. It includes modules for general ledger, accounts payable and receivable, cash management, fixed assets, and more, to help businesses effectively manage and track their financial operations in compliance with Greek accounting regulations.

Who is required to file oracle financials for greece?

Any business operating in Greece and subject to Greek accounting regulations is required to file Oracle Financials for Greece. This includes both domestic companies and foreign entities with a presence in Greece.

How to fill out oracle financials for greece?

Filling out Oracle Financials for Greece involves inputting and maintaining accurate financial data in the system. This includes recording transactions, reconciling accounts, and generating financial reports in compliance with Greek accounting standards and regulations. It is typically done by trained finance personnel or accountants using the Oracle Financials software.

What is the purpose of oracle financials for greece?

The purpose of Oracle Financials for Greece is to provide businesses operating in Greece with a comprehensive financial management solution that enables them to effectively manage and track their financial operations in compliance with Greek accounting regulations. It helps businesses maintain accurate financial records, generate financial reports, and ensure financial transparency and accountability.

What information must be reported on oracle financials for greece?

Oracle Financials for Greece requires businesses to report various financial information, including but not limited to: general ledger transactions, accounts payable and receivable, cash flow statements, balance sheets, income statements, tax-related information, and other financial reports required by Greek accounting regulations.

When is the deadline to file oracle financials for greece in 2023?

The deadline to file Oracle Financials for Greece in 2023 is typically determined by Greek accounting regulations and the specific financial year-end of each business. It is recommended to consult with a local accountant or tax advisor to determine the exact deadline for a particular business.

What is the penalty for the late filing of oracle financials for greece?

The penalty for the late filing of Oracle Financials for Greece varies depending on the specific circumstances and the severity of the delay. It can result in financial penalties, interest charges, and potential legal consequences. It is important for businesses to comply with the filing deadlines to avoid penalties and maintain good standing with Greek authorities.

How do I make changes in oracle financials for greece?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your oracle financials for greece and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit oracle financials for greece in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing oracle financials for greece and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How can I edit oracle financials for greece on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing oracle financials for greece right away.

Fill out your oracle financials for greece online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.