Get the free Construction Contract Insurance,

Show details

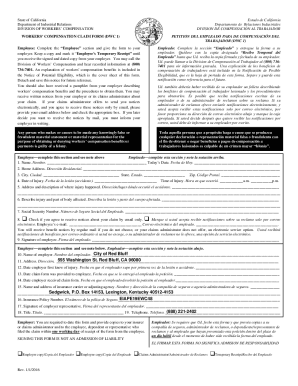

Presenting a live 90minute webinar with interactive Construction Contract Insurance, Indemnification and Limitations on Liability Clauses Structuring and Negotiating Key Provisions to Allocate Risk

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your construction contract insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your construction contract insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing construction contract insurance online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit construction contract insurance. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

How to fill out construction contract insurance

How to fill out construction contract insurance:

01

Begin by gathering all relevant information and documents related to the construction project, such as the contract itself, project plans, specifications, and any requested insurance requirements.

02

Review the insurance requirements outlined in the construction contract. These requirements may include specific types and amounts of coverage, as well as any additional insured or waiver of subrogation endorsements needed.

03

Contact your insurance agent or broker to discuss the insurance requirements and determine if your current insurance policies meet the necessary criteria. If not, you may need to secure additional coverage or make adjustments to your existing policies.

04

Obtain certificates of insurance from your insurance provider(s) for the required coverage. These certificates should list the appropriate policy numbers, coverage limits, and endorsements as outlined in the contract.

05

Submit the certificates of insurance to the appropriate party, such as the project owner or general contractor, as evidence of compliance with the insurance requirements. Ensure that you do this before the construction project begins or as specified in the contract.

06

Keep copies of all insurance documents and certificates for your own records, as well as proof of delivery to the other party. This will serve as documentation should any issues or disputes arise later on.

Who needs construction contract insurance:

01

Contractors: Whether you are a general contractor or a subcontractor, having construction contract insurance is crucial. It protects you from potential liabilities and risks associated with the construction project. It is often a requirement by project owners or general contractors before you can begin work.

02

Project owners: Construction contract insurance provides project owners with financial protection against potential damages, injuries, or other liabilities that may arise during the construction process. It safeguards their investment and ensures that they are not held responsible for any accidents, property damage, or delays caused by the contractors.

03

Lenders and financial institutions: Banks or lenders that finance construction projects may require construction contract insurance to protect their investment. This safeguards them in case any claims or lawsuits arise during the construction process.

04

Subcontractors and suppliers: Subcontractors and suppliers may also need construction contract insurance to protect themselves and their assets in case of accidents, property damage, or other liabilities arising from their work on the project. It ensures that they have the necessary coverage to fulfill their contractual obligations and mitigates the risk of financial losses.

05

Other stakeholders: Depending on the nature and complexity of the project, other parties involved in the construction process, such as architects, engineers, or consultants, may also be required to have construction contract insurance. This ensures that everyone involved has appropriate coverage to address any potential risks or liabilities that may arise from their professional services.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is construction contract insurance?

Construction contract insurance provides coverage for risks associated with construction projects, including property damage, injuries, and liabilities.

Who is required to file construction contract insurance?

Contractors, subcontractors, and construction companies are typically required to have construction contract insurance.

How to fill out construction contract insurance?

To fill out construction contract insurance, you will need to provide detailed information about the project, coverage requirements, and any relevant documentation.

What is the purpose of construction contract insurance?

The purpose of construction contract insurance is to protect parties involved in a construction project from risks and liabilities that may arise during the project.

What information must be reported on construction contract insurance?

Information that must be reported on construction contract insurance includes project details, coverage limits, policy number, and contact information for the insurer.

When is the deadline to file construction contract insurance in 2024?

The deadline to file construction contract insurance in 2024 may vary depending on the project timeline and contract requirements. It is important to consult with the relevant parties to determine the exact deadline.

What is the penalty for the late filing of construction contract insurance?

The penalty for late filing of construction contract insurance may include fines, suspension of work, or termination of the contract. It is crucial to comply with filing requirements to avoid penalties.

How do I complete construction contract insurance online?

Easy online construction contract insurance completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an eSignature for the construction contract insurance in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your construction contract insurance and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out construction contract insurance using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign construction contract insurance. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Fill out your construction contract insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.