Get the free Five Minutes - Bank X

Show details

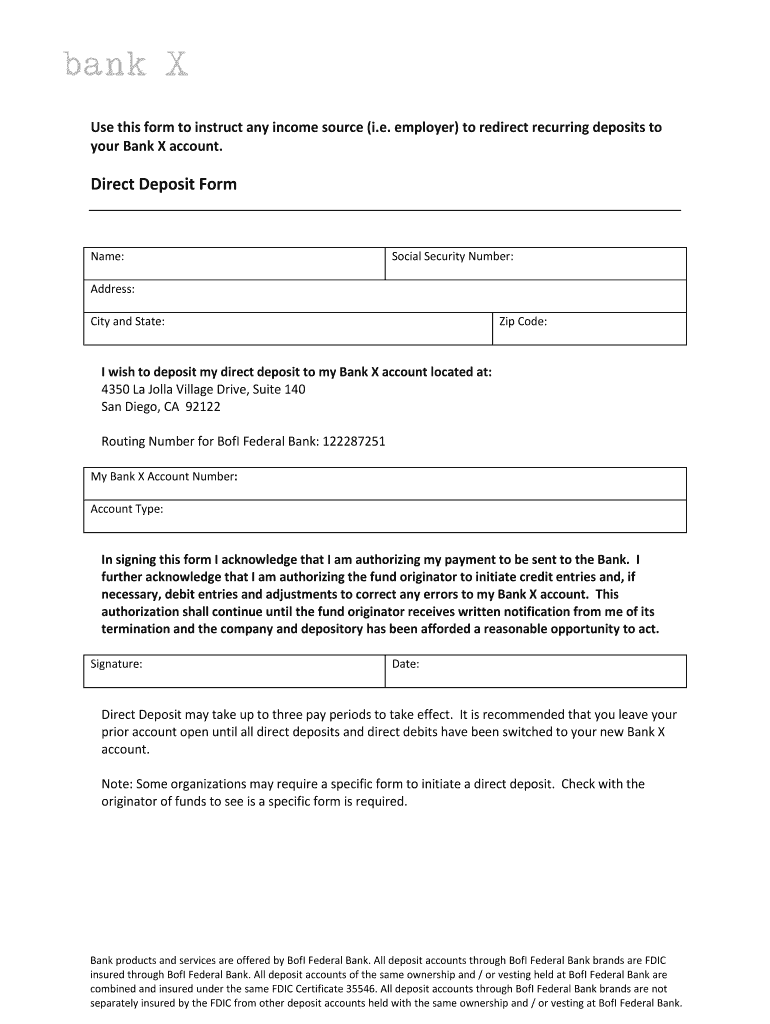

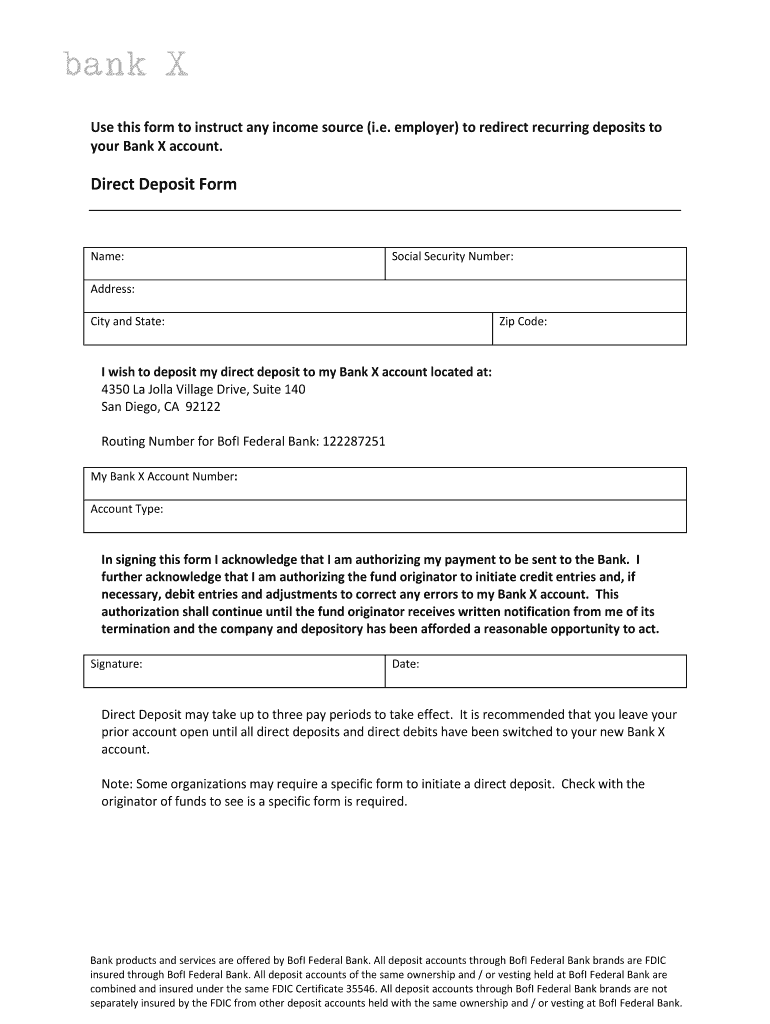

Bank X Switch Kit Five Minutes. . . That's all the time it takes to change an account from your current bank to Bank X. Switching to Bank X has never been easier. Our Switch Kit ensures any existing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your five minutes - bank form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your five minutes - bank form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit five minutes - bank online

Follow the steps below to use a professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit five minutes - bank. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out five minutes - bank

How to Fill Out Five Minutes - Bank:

01

Gather necessary documents: Start by collecting all the required documents such as identification proof, address proof, Social Security Number, and any other documentation required by the bank.

02

Choose the type of account: Decide which type of bank account you want to open. It could be a savings account, checking account, or any other specific account that suits your needs.

03

Research different banks: Explore different banks and compare their features, services, and fees. Look for a bank that offers competitive interest rates, convenient branch locations, and excellent customer service.

04

Visit the bank: Once you have selected a bank, visit the nearest branch in person. Alternatively, some banks also offer the option to open an account online or through their mobile app.

05

Meet with a representative: When you arrive at the bank, ask to meet with a representative who can assist you with opening an account. They will guide you through the process and provide you with the necessary forms to fill out.

06

Fill out the application form: Complete the application form provided to you. Make sure to provide accurate information and double-check all the details before submitting the form.

07

Submit required documents: Along with the application form, submit all the required documents as mentioned earlier. The bank representative will verify the documents and may ask for additional identification if needed.

08

Initial deposit: Depending on the bank's policy, you may need to make an initial deposit to open the account. The representative will inform you about the minimum deposit required and the available payment methods.

09

Review terms and conditions: Before finalizing the account opening process, carefully read and understand the terms and conditions of the bank. This includes details about interest rates, fees, withdrawal limits, and any other important information.

10

Receive account details: Once the account opening process is complete, the bank representative will provide you with your account details such as the account number and any other relevant information. They may also issue a debit card or checks if applicable.

Who Needs Five Minutes - Bank:

01

Individuals looking to open a new bank account: Whether you are a student, professional, or retiree, if you are looking for a reliable bank to open an account, the Five Minutes - Bank is an ideal option.

02

People wanting quick and convenient banking solutions: The Five Minutes - Bank focuses on providing efficient and hassle-free services. If you value a bank that values your time, this bank caters to your needs.

03

Those seeking competitive interest rates: The Five Minutes - Bank offers competitive interest rates on their savings accounts. If you want to earn more from your savings, this bank can be a suitable choice.

04

Individuals looking for excellent customer service: Providing exceptional customer service is one of the core principles of the Five Minutes - Bank. If you value personalized attention and prompt support, this bank is worth considering.

05

Customers who prefer a wide network of branches: The Five Minutes - Bank boasts a vast network of branches, making it convenient for customers to access their accounts from various locations.

In conclusion, anyone who needs a quick and convenient banking experience with competitive interest rates and excellent customer service can benefit from the services provided by the Five Minutes - Bank.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is five minutes - bank?

Five minutes - bank is a document that records the time spent on a specific task or activity in increments of five minutes.

Who is required to file five minutes - bank?

Anyone who needs to track their time spent on various tasks or activities can use a five minutes - bank.

How to fill out five minutes - bank?

To fill out a five minutes - bank, simply record the time spent on each task or activity in increments of five minutes.

What is the purpose of five minutes - bank?

The purpose of a five minutes - bank is to accurately track and record the time spent on different tasks or activities.

What information must be reported on five minutes - bank?

The information that must be reported on a five minutes - bank includes the task or activity performed and the amount of time spent on it.

When is the deadline to file five minutes - bank in 2024?

The deadline to file a five minutes - bank in 2024 is typically at the end of each reporting period or project.

What is the penalty for the late filing of five minutes - bank?

The penalty for late filing of a five minutes - bank may vary depending on the specific requirements, but it could result in inaccurate tracking of time or information.

How do I modify my five minutes - bank in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your five minutes - bank and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I edit five minutes - bank on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing five minutes - bank right away.

How do I fill out the five minutes - bank form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign five minutes - bank and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Fill out your five minutes - bank online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.