Get the free Format of Indemnity Bond for Plan Sanction - BBMP - bbmp gov

Show details

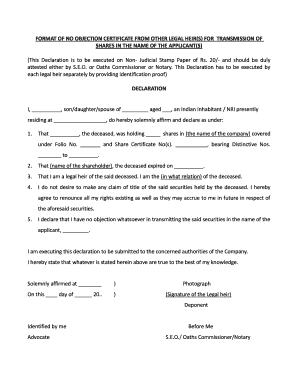

THIS DEED OF INDEMNITY is made this day of 2015 by Sri. , owner of the property No. , Bangalore. Where I am the holder, Sum. Of Plot No. Bangalore, measuring And whereas I propose to construction

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your format of indemnity bond form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your format of indemnity bond form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit format of indemnity bond online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit format of indemnity bond. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

How to fill out format of indemnity bond

How to fill out format of indemnity bond:

01

Begin by gathering all the necessary information and details required for the indemnity bond. This includes the names and addresses of both the indemnifier (person providing the indemnity) and the indemnified party (person being protected).

02

Start by clearly stating the purpose of the bond and what it covers. Specify the specific risks or liabilities that the indemnifier will be responsible for.

03

Include a clause that outlines the duration of the bond and whether it has an expiration date or is valid until the specified obligations are fulfilled.

04

Clearly outline the terms and conditions of the indemnity. This includes any limitations or exclusions to the coverage, as well as any specific actions or steps that need to be taken for the indemnity to be effective.

05

Attach any necessary supporting documents or evidence that may be required to validate the indemnity. This could include financial statements, insurance policies, or any other relevant paperwork.

06

Ensure that all parties involved sign the indemnity bond. This includes both the indemnifier and the indemnified party, as well as any witnesses if necessary.

07

Make copies of the completed indemnity bond for all parties involved to keep for their records.

Who needs format of indemnity bond?

01

Individuals or businesses who are entering into agreements where one party is providing protection or compensation to the other party in case of certain risks or liabilities.

02

Entities involved in high-risk activities or industries where the potential for financial loss or injury is greater. Examples include construction companies, financial institutions, and healthcare providers.

03

Any situation where the indemnified party wants to ensure they will be protected from specific risks or liabilities and require a legally binding agreement to enforce this protection.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is format of indemnity bond?

The format of an indemnity bond typically includes the following elements:

1. Heading: The document should have a title such as "Indemnity Bond" at the top to clearly identify its purpose.

2. Parties: The bond should clearly identify the parties involved, including the name and address of the indemnifier (party providing indemnity) and the name of the indemnified party (the party being protected).

3. Recitals: This section explains the background and reason for the indemnity bond, providing context for the agreement. It may outline any specific transactions or events that led to the need for indemnity.

4. Indemnity Clause: This clause states that the indemnifier agrees to indemnify and hold harmless the indemnified party from any loss, damage, or liability that may arise from a specified event or circumstance. The clause should clearly define the extent of the indemnity and any limitations or exclusions.

5. Obligations: This section outlines the specific obligations and responsibilities of the indemnifier, such as timely notification of any claims or disputes and cooperation in any legal proceedings related to the indemnity.

6. Liability Limitations: The bond may include provisions specifying any limitations on the indemnifier's liability, such as monetary caps or exclusions for certain types of damages.

7. Governing Law and Jurisdiction: This part states the governing law and jurisdiction that will be applicable to any disputes arising from the indemnity bond.

8. Execution and Witnessing: The bond should be signed and dated by the indemnifier, and may require signatures of witnesses to validate the agreement.

It is important to note that the format of an indemnity bond can vary depending on the specific requirements of the situation and the jurisdiction where it is being used. It is recommended to consult with legal professionals to ensure the appropriate format and language for a specific case.

Who is required to file format of indemnity bond?

Typically, the party that is requesting indemnity will require the other party to file the format of an indemnity bond. This could include situations such as a landlord requiring a tenant to file an indemnity bond for damages or a company requiring an employee to file an indemnity bond for certain responsibilities or actions. The specific requirements for filing such a bond can vary depending on the jurisdiction and the terms of the agreement. It is advisable to consult with legal professionals or relevant authorities to ensure compliance with the specific requirements.

How to fill out format of indemnity bond?

To fill out the format of an indemnity bond, follow these steps:

1. Begin by stating the title of the document, such as "Indemnity Bond."

2. Write the name of the person or company providing the indemnity (indemnitor) on the top left side of the document. Include their full legal name and contact information.

3. On the top right side of the document, write the name of the person or entity being indemnified (indemnitee). Provide their full legal name and contact information.

4. In the main body of the document, clearly state the purpose and terms of the indemnity bond. This includes outlining the specific actions or situations for which the indemnitor will be held liable and the extent of their indemnification.

5. Specify the amount of the bond or the maximum liability of the indemnitor. This amount should be clearly mentioned in the document.

6. Include any additional terms, conditions, or clauses that are relevant to the indemnity agreement. This could include provisions relating to termination, breach, reimbursement, or dispute resolution.

7. Leave spaces for the indemnitor and indemnitee to sign and date the document. Below the signature lines, include their printed names and titles (if applicable).

8. Add a section for witnesses to sign and date the document. This ensures the validity and enforceability of the indemnity bond.

9. Review the document to ensure all necessary information is correctly entered, and make sure it is easy to read and understand.

10. Provide copies of the completed indemnity bond to all involved parties for their records.

Note: It is highly recommended to consult with a legal professional to ensure that the indemnity bond complies with all applicable laws and regulations in your jurisdiction.

What is the purpose of format of indemnity bond?

The purpose of an indemnity bond is to provide a legally binding agreement between two parties, where one party (the indemnitor) promises to compensate the other party (the indemnitee) for any losses, damages, or liabilities that may arise due to a certain event or activity. The format of the indemnity bond specifies the terms and conditions of this agreement, including the obligations, responsibilities, and limits of liability of both parties. It helps to ensure that the indemnitor fulfills their financial obligations and provides the necessary protection to the indemnitee.

What information must be reported on format of indemnity bond?

The specific information required on an indemnity bond may vary depending on the jurisdiction and the purpose of the bond. However, some common information that may be included on an indemnity bond includes:

1. Names and addresses of the parties involved: This includes the name and address of the indemnifier (the party providing the indemnity) and the name and address of the indemnified party (the party being protected by the indemnity).

2. Date: The date when the indemnity bond is being executed.

3. Consideration: The amount or value being provided as consideration for the indemnity.

4. Description of the obligation: The specific obligation or event for which the indemnity is being provided. This could be a contractual obligation, a legal requirement, or any other stated purpose.

5. Terms and conditions: The terms and conditions of the indemnity, including any limitations, exclusions, or restrictions on the indemnifier's liability.

6. Duration: The duration or period for which the indemnity is valid or in effect.

7. Signatures: The indemnifier and indemnified party must sign the indemnity bond to acknowledge their acceptance of the terms and conditions.

8. Witness: Depending on the jurisdiction, the indemnity bond may require one or more witnesses to sign and attest to the authenticity of the signatures.

It is important to consult with legal professionals or authorities in your jurisdiction to ensure compliance with local regulations and to obtain accurate and specific guidance regarding the format and content of an indemnity bond.

How can I manage my format of indemnity bond directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign format of indemnity bond and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I sign the format of indemnity bond electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your format of indemnity bond in seconds.

How do I fill out format of indemnity bond using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign format of indemnity bond and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Fill out your format of indemnity bond online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.