Get the free VOID CORRECTED PAYER S name, street address, city, state, ZIP ...

Show details

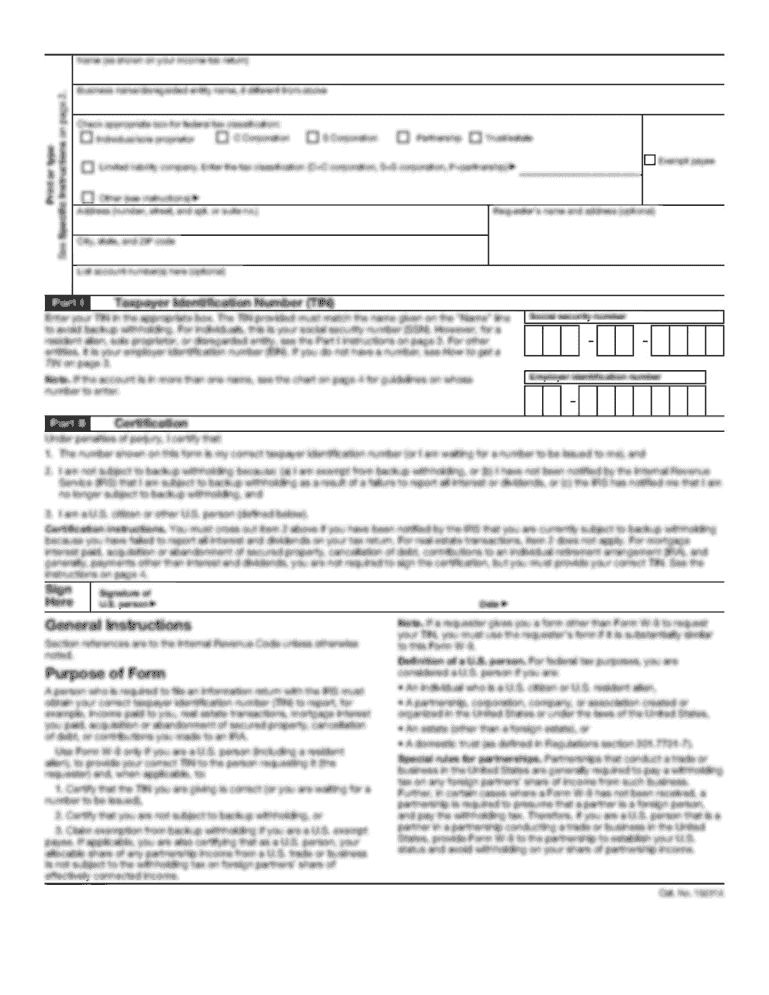

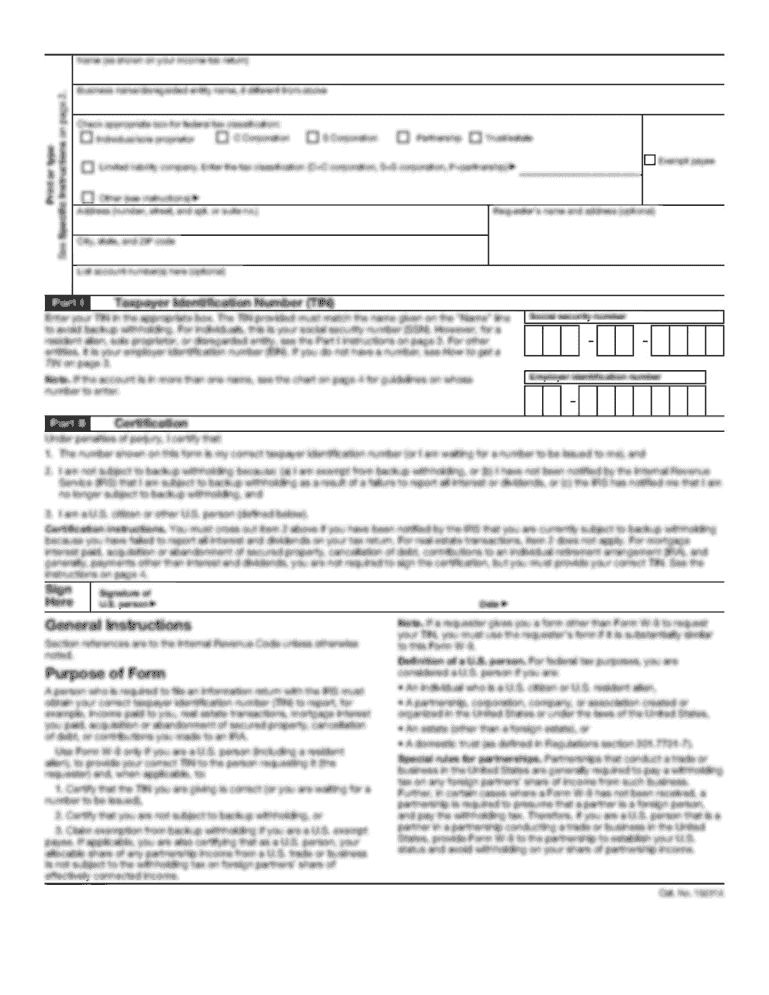

VOID CORRECTED PAYER? S name, street address, city, state, ZIP code, and telephone no. 1 Original issue discount for 2008 OMB No. 1545-$011708 2 Other periodic interest 1099-OID $ RECIPIENT? S identification

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your void corrected payer s form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your void corrected payer s form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing void corrected payer s online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit void corrected payer s. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

How to fill out void corrected payer s

How to fill out void corrected payer s:

01

Obtain a void corrected payer s form from the appropriate source. This can typically be done online or by contacting the relevant tax authority.

02

Ensure that you have all the necessary information and documents required to fill out the form. This may include details such as your name, address, tax identification number, and the reason for voiding the original payer s.

03

Carefully read and follow the instructions provided on the form. This will guide you on how to complete each section accurately.

04

Provide the requested information in the appropriate fields. Double-check your entries for any errors or inaccuracies before submitting the form.

05

Attach any supporting documentation that may be required. This could include copies of the original payer s, proof of voiding, or any other relevant paperwork.

06

Review the completed form once again to ensure that all information is correct and complete.

07

Sign and date the form as instructed. Failure to do so may result in the form being rejected or delayed.

08

Submit the void corrected payer s form to the designated authority or address specified on the form. Be sure to follow any additional submission requirements or deadlines.

Who needs void corrected payer s:

01

Individuals or businesses who have made errors or inaccuracies on their original payer s may need to fill out void corrected payer s.

02

Those who have received payer s that are missing vital information, contain incorrect data, or have been issued in error may also require void corrected payer s.

03

Void corrected payer s may be necessary for individuals or businesses who need to rectify any mistakes made in the original payer s for tax or financial reporting purposes.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is void corrected payer s?

Void corrected payer s are corrected forms that are submitted to the IRS to replace previously filed forms that contained errors or incorrect information.

Who is required to file void corrected payer s?

Any individual or business that has previously filed payer forms with errors or incorrect information is required to file void corrected payer s.

How to fill out void corrected payer s?

To fill out void corrected payer s, you need to obtain the correct payer form from the IRS, provide the correct information in the corresponding fields, and submit the form to the IRS.

What is the purpose of void corrected payer s?

The purpose of void corrected payer s is to correct any errors or incorrect information on previously filed payer forms.

What information must be reported on void corrected payer s?

Void corrected payer s must include the corrected information and any necessary explanations for the previously reported errors or incorrect information.

When is the deadline to file void corrected payer s in 2023?

The deadline to file void corrected payer s in 2023 is typically January 31st.

What is the penalty for the late filing of void corrected payer s?

The penalty for the late filing of void corrected payer s can vary depending on the specific circumstances, but it is typically a monetary penalty imposed by the IRS.

Where do I find void corrected payer s?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the void corrected payer s in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit void corrected payer s on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign void corrected payer s right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I complete void corrected payer s on an Android device?

Use the pdfFiller app for Android to finish your void corrected payer s. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your void corrected payer s online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.