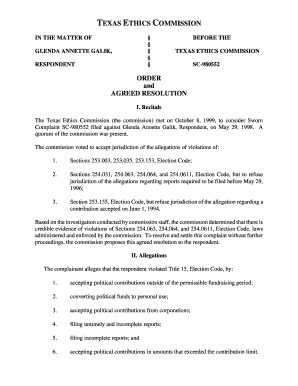

Get the free voluntary withdrawal from llc template form

Show details

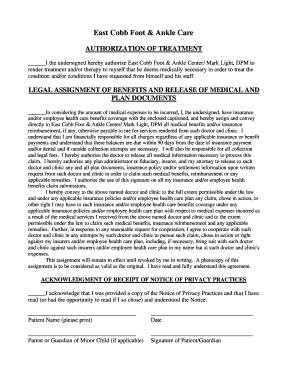

Voluntary? Withdrawal? Form? ? Participant’s? Name:? Client?ID#: ? Docket?#:? ? I?am?requesting?that? I?be?allowed?to?voluntarily?withdraw?from?program?participation?due?to:? Furthermore, I?will?permanently?move?out?of?the?

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your voluntary withdrawal from llc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your voluntary withdrawal from llc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing voluntary withdrawal from llc template online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit voluntary withdrawal from llc template form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out voluntary withdrawal from llc

How to fill out voluntary withdrawal from llc:

01

Complete a withdrawal form: Start by obtaining a withdrawal form from the state agency responsible for LLC filings. This form typically requires information such as the LLC's name, date of withdrawal, reason for withdrawal, and the signatures of the withdrawing member(s).

02

Provide required documentation: Along with the withdrawal form, you may need to submit certain supporting documents. These could include a copy of the LLC's articles of organization and any amendments, as well as a copy of the operating agreement.

03

Pay any necessary fees: Check the state agency's website or contact them directly to determine if there are any fees associated with withdrawing from an LLC. If fees are required, make sure to include the payment along with the withdrawal form and documents.

04

Notify other LLC members: It is important to communicate your intention to withdraw from the LLC to the other members. You can do this by providing them with a copy of the completed withdrawal form and any other relevant documentation.

05

Update external entities: Inform any external entities, such as banks, vendors, or clients, about your withdrawal from the LLC. This ensures that they are aware of the change in membership and can update their records accordingly.

Who needs voluntary withdrawal from LLC:

01

Members looking to exit the business: Any member of an LLC who wishes to leave the company voluntarily may need to go through the process of filling out a voluntary withdrawal form. This could be due to various reasons such as retirement, pursuing other business ventures, or personal circumstances.

02

Dissatisfied members: In some cases, members may become dissatisfied with the LLC's operations, decision-making, or financial performance. Voluntary withdrawal allows them to disassociate themselves from the LLC and potentially avoid further liabilities or obligations.

03

Members with changing interests: As personal or professional circumstances change, a member might find that their interests no longer align with those of the LLC. In such cases, voluntary withdrawal offers a way to formally sever their ties with the company and potentially enable the remaining members to adjust the ownership structure as needed.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is voluntary withdrawal from llc?

Voluntary withdrawal from an LLC is when a member decides to leave the LLC. This can be voluntary or involuntary, depending on the LLC’s operating agreement. In a voluntary withdrawal, the member typically relinquishes their membership in the LLC and any financial interest in the company. They no longer have any rights to the company or its assets.

What information must be reported on voluntary withdrawal from llc?

If a member of an LLC voluntarily withdraws from the LLC, the LLC must provide notice to the other members and to the Secretary of State. The notice must include the member's name, the date of withdrawal, the member's address, and the date that the withdrawal is effective. The LLC must also provide any other information required by the governing documents or the state law of formation.

What is the penalty for the late filing of voluntary withdrawal from llc?

The penalty for late filing of a voluntary withdrawal from an LLC depends on the state in which the LLC was formed and registered. Generally, the penalty for late filing of a withdrawal form with the state is a fine or late fee, which can range from a few dollars up to a few hundred dollars. The LLC may also be subject to dissolution if the withdrawal is not filed in a timely manner.

Who is required to file voluntary withdrawal from llc?

An individual who is a member or owner of a limited liability company (LLC) can file a voluntary withdrawal from the LLC. The LLC's operating agreement may outline the specific process and requirements for a member to withdraw. In some cases, a member may need approval from the other members or may be required to give notice to the other members or the LLC itself. It is always recommended to consult with an attorney or review the operating agreement to ensure compliance with the specific requirements of the LLC.

How to fill out voluntary withdrawal from llc?

To fill out a voluntary withdrawal from an LLC, follow these steps:

1. Obtain the required form: Most states provide a specific form for LLC members to voluntarily withdraw. You can visit your state's secretary of state website or other relevant authority to download the form.

2. Personal Information: Fill in your personal information, including your full name, address, phone number, and email address.

3. LLC Information: Provide the name of the LLC, its address, and the state in which it was formed.

4. Effective Date: Specify the effective date of your withdrawal. This may be the date you submit the form or a future date as per your choice.

5. Reason for Withdrawal: Indicate the reason for your withdrawal. This could be retirement, resignation, personal reasons, or any other circumstance that applies.

6. Sign and Date: Sign and date the form at the designated spaces.

7. Submit the Form: After filling out the form, make copies for your records and submit the original to the appropriate authority. This is usually the secretary of state's office or the department that handles business registrations in your state. Some states may require a filing fee, so be prepared to pay if necessary.

8. Notify Other Members or Parties: Inform the other members of the LLC about your decision to withdraw. This allows them to make necessary adjustments or decisions regarding the business's future.

It is crucial to consult an attorney or seek professional advice to ensure compliance with your state's specific requirements and regulations before initiating the voluntary withdrawal process from an LLC.

What is the purpose of voluntary withdrawal from llc?

The purpose of voluntary withdrawal from an LLC (Limited Liability Company) is to cease one's involvement and membership in the company. This means that the withdrawing member will no longer have any rights or responsibilities related to the LLC, including any ownership interest, voting rights, or decision-making authority. The withdrawal can be initiated by a member who no longer wishes to be a part of the LLC and wants to disassociate themselves from its activities, potentially due to personal or business reasons. It is important to follow the procedures laid out in the LLC operating agreement or state laws to properly withdraw and avoid any potential legal or financial obligations.

How do I make changes in voluntary withdrawal from llc template?

The editing procedure is simple with pdfFiller. Open your voluntary withdrawal from llc template form in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I sign the voluntary withdrawal from llc template electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your voluntary withdrawal from llc template form in seconds.

Can I create an eSignature for the voluntary withdrawal from llc template in Gmail?

Create your eSignature using pdfFiller and then eSign your voluntary withdrawal from llc template form immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Fill out your voluntary withdrawal from llc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.