Get the free Audit planning and analytical procedures

Show details

This document covers key topics related to audit planning, including the importance of understanding the client's business, the significance of analytical procedures, and the overall audit process.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign audit planning and analytical

Edit your audit planning and analytical form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your audit planning and analytical form via URL. You can also download, print, or export forms to your preferred cloud storage service.

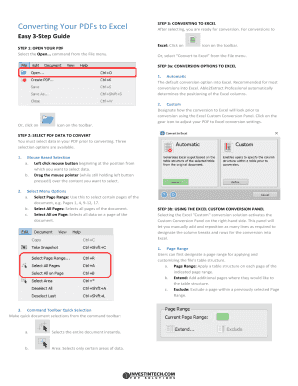

How to edit audit planning and analytical online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit audit planning and analytical. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out audit planning and analytical

How to fill out audit planning and analytical:

01

Start by gathering relevant information about the organization and its operations. This may include financial statements, internal control documentation, and previous audit reports.

02

Identify risks and assess their potential impact on the organization. Analyze internal controls to determine their effectiveness in mitigating these risks.

03

Develop an audit plan that outlines the objectives, scope, and timeline of the audit. This plan should also include the specific procedures to be performed.

04

Use analytical procedures to evaluate financial data and identify any unusual trends or discrepancies. This may involve comparing current year figures to prior years, industry benchmarks, or budgeted amounts.

05

Document the planning and analytical procedures performed, along with the results and any recommendations for improvement.

Who needs audit planning and analytical:

01

Organizations that want to ensure the accuracy and reliability of their financial statements.

02

Companies that need to comply with regulatory requirements or industry standards.

03

Stakeholders, such as shareholders, lenders, or investors, who rely on the audited financial statements to make informed decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute audit planning and analytical online?

Filling out and eSigning audit planning and analytical is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit audit planning and analytical on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign audit planning and analytical right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I complete audit planning and analytical on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your audit planning and analytical, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is audit planning and analytical?

Audit planning and analytical is a process that involves the development of a detailed strategy to conduct an audit and the analysis of relevant data to support the audit objectives.

Who is required to file audit planning and analytical?

Audit planning and analytical is typically required to be filed by auditors or audit firms who are responsible for conducting audits of financial statements.

How to fill out audit planning and analytical?

To fill out audit planning and analytical, auditors need to gather relevant information about the audited organization, assess the risks, develop audit procedures, and document the planned approach.

What is the purpose of audit planning and analytical?

The purpose of audit planning and analytical is to ensure that audits are conducted efficiently, effectively, and in accordance with applicable auditing standards. It helps auditors identify areas of high risk, establish the scope of the audit, and plan their procedures accordingly.

What information must be reported on audit planning and analytical?

Audit planning and analytical typically involves reporting on the auditor's understanding of the audited organization's business, the risk assessment process, the planned audit procedures, the expected timing of the audit, and any significant findings or issues identified during the planning phase.

Fill out your audit planning and analytical online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Audit Planning And Analytical is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.