Get the free Royal Poinciana Playhouse IRS form 1023 (3May2011 revised 7Dec2011) 20Jan2011

Show details

Rug 18 05 03:23p 718-460-4853 c o l EGE point p. 1 Supreme Court of the State of New York Court of Appeals !i Town of Montauk, Inc. Petitioner -against Hon, George E. Atari, Esq., Governor of the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

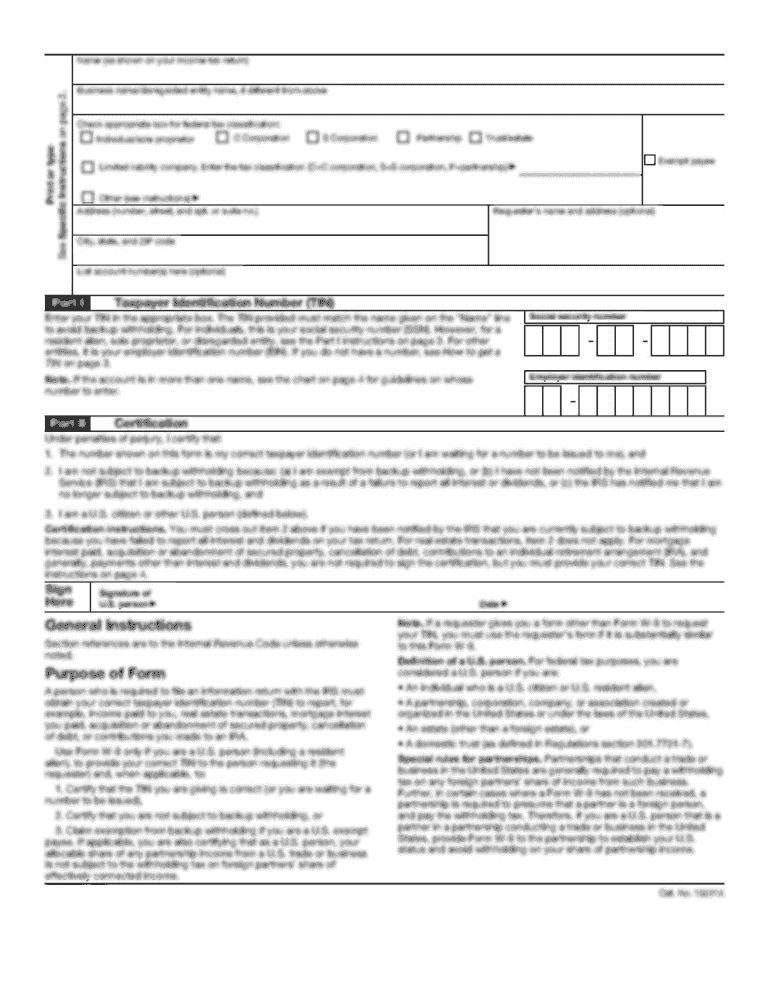

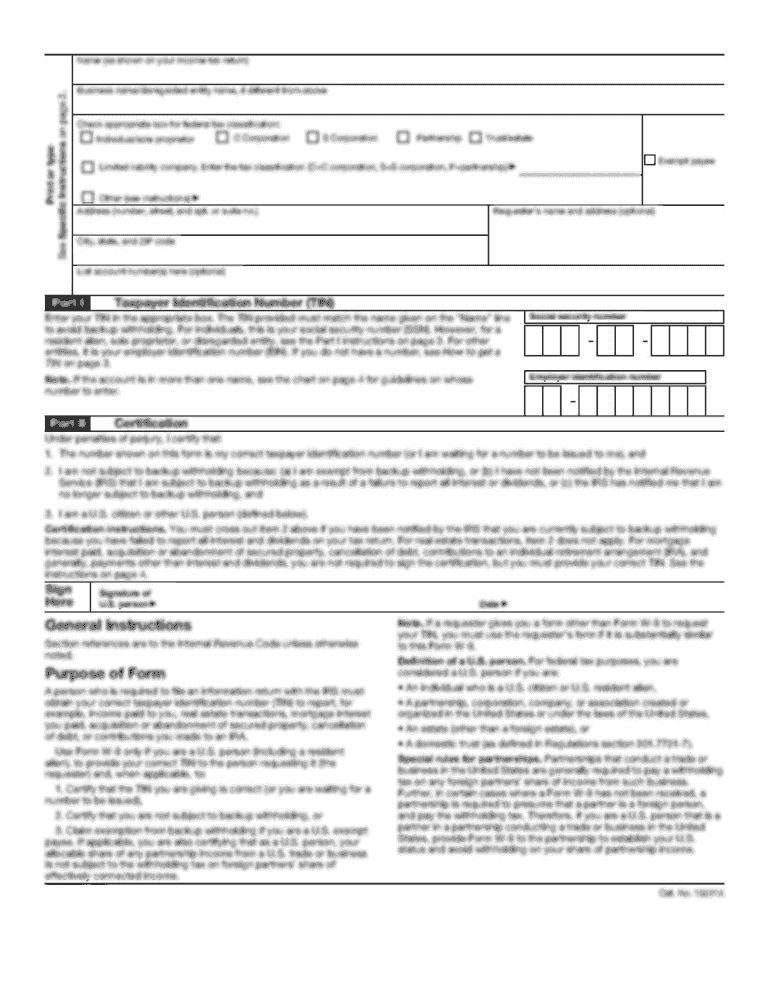

Edit your royal poinciana playhouse irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your royal poinciana playhouse irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit royal poinciana playhouse irs online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit royal poinciana playhouse irs. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is royal poinciana playhouse irs?

The Royal Poinciana Playhouse is a former theater located in Palm Beach, Florida. The term 'IRS' stands for Internal Revenue Service, which is the United States federal agency responsible for collecting taxes and enforcing tax laws.

Who is required to file royal poinciana playhouse irs?

The filing requirements for the Royal Poinciana Playhouse IRS would depend on the specific tax-related activities and circumstances of the entity associated with the playhouse. It is recommended to consult with a tax professional or refer to the official IRS guidelines for more accurate information.

How to fill out royal poinciana playhouse irs?

The process of filling out the Royal Poinciana Playhouse IRS forms would again depend on the specific tax-related activities and circumstances of the entity associated with the playhouse. It is recommended to refer to the official IRS guidelines or seek assistance from a tax professional for accurate instructions.

What is the purpose of royal poinciana playhouse irs?

The purpose of the Royal Poinciana Playhouse IRS would depend on the specific tax-related activities and circumstances of the entity associated with the playhouse. Generally, the purpose would be to comply with federal tax laws and regulations, report financial information, and fulfill tax obligations.

What information must be reported on royal poinciana playhouse irs?

The specific information to be reported on the Royal Poinciana Playhouse IRS forms would depend on the type of tax form being filed and the nature of the tax-related activities. It would typically include details such as income, expenses, deductions, credits, and other relevant financial information.

When is the deadline to file royal poinciana playhouse irs in 2023?

The deadline to file the Royal Poinciana Playhouse IRS forms in 2023 would depend on the specific reporting requirements and the applicable tax forms. Generally, the deadline for filing federal income tax returns for most taxpayers in the United States is April 15th, unless an extension has been granted.

What is the penalty for the late filing of royal poinciana playhouse irs?

The penalties for the late filing of the Royal Poinciana Playhouse IRS would be determined by the IRS guidelines and regulations, and they can vary based on several factors such as the type of tax form, the amount of taxes owed, and the duration of the delay. It is recommended to refer to the official IRS guidelines or consult with a tax professional for accurate information specific to the playhouse and its tax-related activities.

How can I edit royal poinciana playhouse irs from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your royal poinciana playhouse irs into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send royal poinciana playhouse irs for eSignature?

When you're ready to share your royal poinciana playhouse irs, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I complete royal poinciana playhouse irs on an Android device?

Use the pdfFiller mobile app to complete your royal poinciana playhouse irs on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your royal poinciana playhouse irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.