Get the free 401(K) RETIREMENT SAVINGS PLAN

Show details

TRACTOR SUPPLY COMPANY

401×K) RETIREMENT SAVINGS PLANSUMMARY PLAN DESCRIPTIONEffective January 1, 2009TSC755532SPD06×09

3.EPC75532025.100Information was provided by Tractor Supply Company. Fidelity

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 401k retirement savings plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 401k retirement savings plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

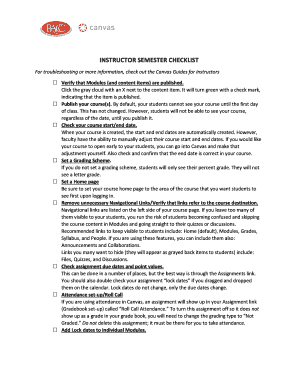

Editing 401k retirement savings plan online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 401k retirement savings plan. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

How to fill out 401k retirement savings plan

How to fill out a 401k retirement savings plan:

01

Start by collecting the necessary documents. You will need your social security number, employment information, and any other relevant financial documents.

02

Contact your employer or HR department to inquire about the availability and enrollment process for a 401k plan. They can provide you with the necessary forms and information.

03

Review the information provided by your employer, including the plan details, investment options, and any matching contributions they may offer.

04

Carefully read through the enrollment forms and instructions. Pay attention to deadlines and any required contribution amounts.

05

Consider your retirement goals and financial situation when choosing your contribution amount. It is generally recommended to contribute as much as you can afford, up to the maximum allowed by the plan.

06

Determine how you want to invest your contributions. Many plans offer a range of investment options, such as mutual funds or target-date funds. Research these options, or consult with a financial advisor if you are unsure.

07

Fill out the required forms accurately and completely. Double-check your information before submitting.

08

If you have any questions or need assistance, reach out to your employer or plan administrator for guidance.

09

Keep a copy of all documents and forms for your records. It's important to keep track of your contributions and monitor your account regularly.

10

Once you have successfully completed the enrollment process, monitor your 401k regularly, review investment performance, and make any necessary adjustments to stay on track with your retirement goals.

Who needs a 401k retirement savings plan:

01

Individuals planning for retirement: A 401k plan is an excellent tool for individuals who want to save and invest for their retirement years. It allows them to contribute pre-tax dollars, potentially benefit from employer matches, and grow their savings over time.

02

Employees with access to a 401k plan: Many employers offer 401k plans as part of their employee benefits package. If you have access to a 401k plan at work, it is typically a wise financial decision to participate and take advantage of this opportunity.

03

Individuals seeking tax advantages: Contributions made to a 401k plan are typically made with pre-tax dollars, meaning they are not subject to income tax until withdrawn in retirement. This can provide immediate tax savings and allow your investments to grow tax-deferred over time.

04

Individuals looking for retirement income: A 401k plan helps individuals accumulate savings for retirement. By contributing regularly and investing wisely, you can build a substantial nest egg that can provide you with income during your retirement years.

05

Individuals who want to benefit from employer matches: Many employers offer matching contributions to their employees' 401k plans. This means that for every dollar you contribute, your employer may also contribute a certain amount. This is essentially free money that can significantly boost your retirement savings.

Remember, it's always advisable to consult with a financial advisor or retirement specialist to determine the best course of action based on your specific financial situation and long-term goals.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 401k retirement savings plan?

A 401k retirement savings plan is a retirement account sponsored by an employer that allows employees to save and invest a portion of their salary before taxes are taken out.

Who is required to file 401k retirement savings plan?

Employers are required to offer and administer 401k retirement savings plans for their employees.

How to fill out 401k retirement savings plan?

Employees can fill out a 401k retirement savings plan by selecting their contribution amount, investment options, and beneficiary information through their employer's online portal or HR department.

What is the purpose of 401k retirement savings plan?

The purpose of a 401k retirement savings plan is to help employees save for their retirement by providing a tax-advantaged way to invest and grow their savings over time.

What information must be reported on 401k retirement savings plan?

401k retirement savings plans must report information such as employee contributions, employer matching contributions, investment options, and account balances.

When is the deadline to file 401k retirement savings plan in 2024?

The deadline to file 401k retirement savings plan in 2024 is typically the same as the deadline for filing W-2 forms, which is January 31, 2025.

What is the penalty for the late filing of 401k retirement savings plan?

The penalty for late filing of 401k retirement savings plan can vary but may include fines imposed by the IRS for each day the plan is not filed.

Where do I find 401k retirement savings plan?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific 401k retirement savings plan and other forms. Find the template you need and change it using powerful tools.

How do I make changes in 401k retirement savings plan?

With pdfFiller, the editing process is straightforward. Open your 401k retirement savings plan in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit 401k retirement savings plan straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing 401k retirement savings plan, you need to install and log in to the app.

Fill out your 401k retirement savings plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.