Get the free Salary Exchange

Show details

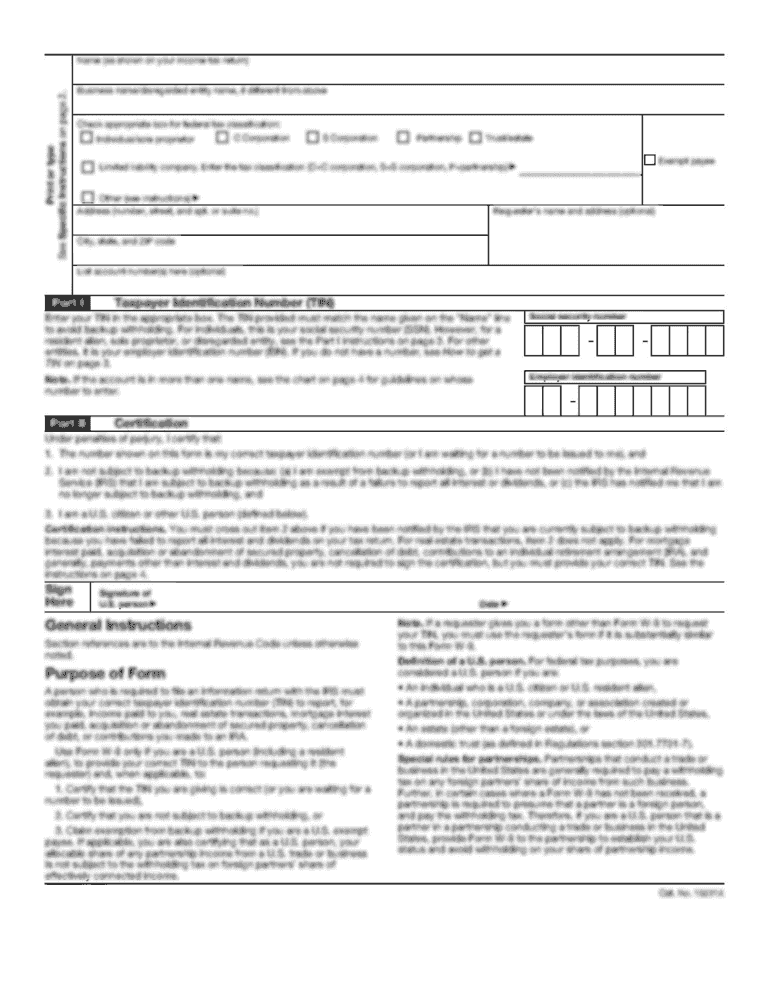

Diageo Pension Scheme A guide to Salary Exchange for Pensions A smarter way to save for your pension A smarter way to save for your pension Questions and answers continued Diageo Pension Scheme 13.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your salary exchange form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your salary exchange form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing salary exchange online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit salary exchange. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out salary exchange

How to fill out salary exchange:

01

Obtain the necessary forms from your employer or human resources department.

02

Fill out personal information such as your name, employee ID, and contact details.

03

Provide accurate details about your current salary and any applicable deductions or benefits.

04

Indicate the amount or percentage of your salary that you wish to redirect towards the salary exchange program.

05

If required, specify the desired destination for the exchanged salary, such as retirement savings, health insurance, or other benefits.

06

Review the completed form for any errors or missing information, and make corrections if necessary.

07

Submit the filled out form to the appropriate department or personnel.

Who needs salary exchange:

01

Employees who wish to allocate a portion of their salary towards benefits or retirement savings.

02

Individuals who want to reduce their taxable income by utilizing salary exchange programs.

03

Workers who are interested in maximizing their employee benefits and taking advantage of savings opportunities.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

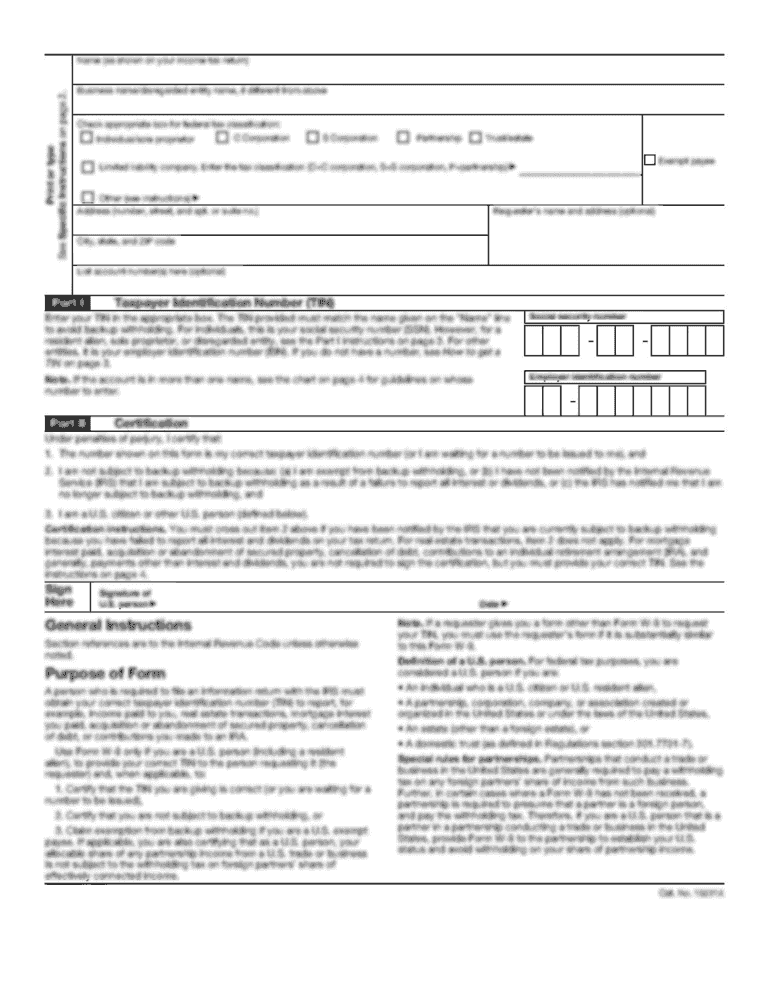

What is salary exchange?

Salary exchange is a scheme where an employee agrees to a reduction in their salary in exchange for non-cash benefits, such as pension contributions or childcare vouchers.

Who is required to file salary exchange?

Employers are required to report salary exchange arrangements to the appropriate tax authorities.

How to fill out salary exchange?

To fill out salary exchange, employers need to provide details of the employee, the reduced salary amount, and the non-cash benefit being exchanged.

What is the purpose of salary exchange?

The purpose of salary exchange is to allow employees to receive certain non-cash benefits with potential tax and National Insurance savings.

What information must be reported on salary exchange?

The information that must be reported on salary exchange includes the employee's details, the reduced salary amount, and the details of the non-cash benefit being exchanged.

When is the deadline to file salary exchange in 2023?

The deadline to file salary exchange in 2023 may vary depending on the tax jurisdiction. It is recommended to check with the appropriate tax authorities for the specific deadline.

What is the penalty for the late filing of salary exchange?

The penalty for the late filing of salary exchange may vary depending on the tax jurisdiction. It is recommended to check with the appropriate tax authorities for the specific penalty.

How can I send salary exchange to be eSigned by others?

Once you are ready to share your salary exchange, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit salary exchange straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing salary exchange right away.

How do I fill out salary exchange using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign salary exchange and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Fill out your salary exchange online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.