Get the free EZ ' oepararem of the rreasuy Imam Revenue sevice ch N Under section 501(c ), 527, o...

Show details

Form 990.EZ separate of the Treasury Imam Revenue service ch N Under section 501×c), 527, or 4947×aX1) of the Internal Revenue Code (except black lung benefit trust or private foundation) For organizations

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your ez oepararem of form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ez oepararem of form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ez oepararem of form online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ez oepararem of form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

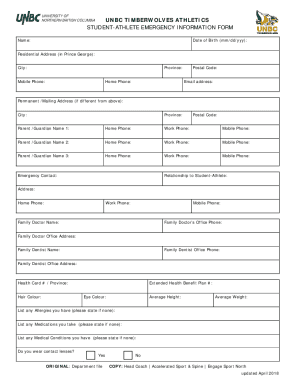

How to fill out ez oepararem of form

01

Start by gathering all the necessary information and documents. This might include personal identification, financial details, and any relevant supporting evidence.

02

Carefully read through the instructions and guidelines provided with the ez oepararem of form. Make sure you understand all the requirements and any specific instructions for filling out each section.

03

Begin by filling in your personal information accurately and legibly. This may include your name, address, contact details, and Social Security Number.

04

Move on to the specific sections of the form, providing the requested information in a clear and concise manner. Double-check the instructions to ensure you're providing the correct details for each question or section.

05

If required, attach any necessary supporting documents, such as proof of income, identification documents, or additional forms.

06

Review your completed form thoroughly to avoid any errors or missing information. Take the time to verify that all the provided details are accurate and up-to-date.

07

Sign and date the form as instructed. Some forms may require a witness or notary public to validate your signature.

08

Keep a copy of the filled-out form for your records before submitting it. This will help you have a reference in case you need to refer back to it in the future.

Who needs ez oepararem of form?

01

Individuals who are eligible for and need to apply for certain government assistance programs, such as unemployment benefits, housing assistance, or healthcare benefits, may need to fill out the ez oepararem of form.

02

Employers, especially small business owners, may require the ez oepararem of form when hiring new employees and maintaining payroll records.

03

Accountants and tax professionals might need the ez oepararem of form to accurately calculate and file taxes for individuals or businesses.

04

Legal professionals may use the ez oepararem of form when handling legal matters related to financial transactions or contracts.

05

Students applying for financial aid or scholarships might encounter the ez oepararem of form as part of the application process.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ez oepararem of form?

EZ Oepararem of form is a simplified tax form used for reporting certain income and expenses.

Who is required to file ez oepararem of form?

Individuals and businesses with specific types of income and expenses are required to file ez oepararem of form.

How to fill out ez oepararem of form?

EZ Oepararem of form can be filled out manually or electronically, following the instructions provided by the tax authority.

What is the purpose of ez oepararem of form?

The purpose of ez oepararem of form is to report income and expenses in a simplified manner for tax purposes.

What information must be reported on ez oepararem of form?

Income sources, expenses, deductions, and any other relevant financial information must be reported on ez oepararem of form.

When is the deadline to file ez oepararem of form in 2024?

The deadline to file ez oepararem of form in 2024 is April 15th.

What is the penalty for the late filing of ez oepararem of form?

The penalty for late filing of ez oepararem of form can vary depending on the tax authority, but typically includes fines and interest on unpaid taxes.

How can I manage my ez oepararem of form directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your ez oepararem of form and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I edit ez oepararem of form from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your ez oepararem of form into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I fill out ez oepararem of form using my mobile device?

Use the pdfFiller mobile app to complete and sign ez oepararem of form on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Fill out your ez oepararem of form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.