Get the free In-Kind Donation Deed of Gift Form.pdf - skydivingmuseum

Show details

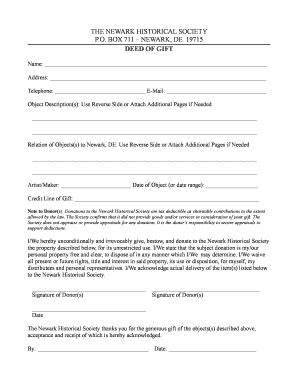

Inking Donations Inking Contribution Deed of Gift Form This form, to be filled in and signed by each donor of library×museum materials, conveys property rights to the National Skydiving Museum. Place

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your in-kind donation deed of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your in-kind donation deed of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit in-kind donation deed of online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit in-kind donation deed of. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out in-kind donation deed of

How to fill out an in-kind donation deed:

01

Gather the necessary information: Before starting to fill out the in-kind donation deed, make sure you have all the required information handy. This includes the donor's name and contact details, the recipient organization's name and contact details, a detailed description of the donated item(s), the estimated value of the donation, and the date of the donation.

02

Identify the purpose: Clearly state the purpose of the in-kind donation. This could be for charitable, educational, or any other specific purpose. Providing a brief explanation of why the donation is being made can help clarify the intent.

03

Describe the donated item(s): In a concise and clear manner, describe the item(s) being donated. Include relevant details such as the brand, model, condition, and any unique features. If there are multiple items, consider listing them separately or providing an attachment with a comprehensive inventory.

04

Indicate the estimated value: Determine the estimated value of the donation. It might be helpful to research similar items to determine a fair market value. If the donated item(s) were appraised, include the appraised value and attach any supporting documentation if applicable.

05

Signatures and contact information: Both the donor and the recipient organization should sign the in-kind donation deed. Include the full legal name, signature, and contact details of both parties. Also, consider adding any witnesses to ensure the document is legally valid.

Who needs an in-kind donation deed:

01

Charitable organizations: Non-profit organizations and charities often require an in-kind donation deed to acknowledge and document the donation received. It helps them track their assets, comply with legal regulations, and express gratitude towards donors.

02

Donors: Individuals or businesses making significant in-kind donations can benefit from having an in-kind donation deed. It serves as proof of their philanthropic efforts for tax purposes, allowing them to claim deductions or credits based on the value of the donation.

03

Legal entities and institutions: In some cases, legal entities such as trusts, foundations, or educational institutions may need an in-kind donation deed to provide transparency and accountability for donated assets.

Overall, an in-kind donation deed is a valuable document for both the donor and the recipient organization. It ensures proper documentation, establishes the intent of the donation, and serves as evidence for the value of the donated items.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my in-kind donation deed of in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your in-kind donation deed of and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I execute in-kind donation deed of online?

Completing and signing in-kind donation deed of online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I fill out the in-kind donation deed of form on my smartphone?

Use the pdfFiller mobile app to fill out and sign in-kind donation deed of. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Fill out your in-kind donation deed of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.