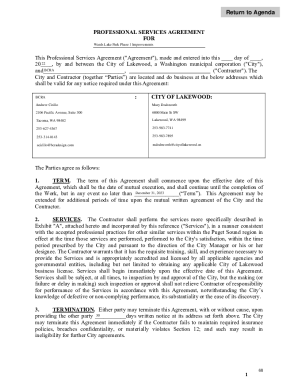

Get the free Loan Variation Request - Product - QPCU

Show details

Queensland Police Credit Union Limited Level 1, 231 North Quay, Brisbane QLD 4000 PO Box 13003, George Street QLD 4003 ABN 79 087 651 036 ADSL×Australian Credit License 241413 Phone: 13 77 28 Fax:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your loan variation request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan variation request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit loan variation request online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit loan variation request. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out loan variation request

How to fill out loan variation request:

01

Start by gathering all relevant documentation, such as your loan agreement, financial statements, and any supporting documents related to the requested variation. Make sure you have a clear understanding of the specific changes you want to make to your loan terms.

02

Fill out the loan variation request form provided by your lender. This form may be available online or can be obtained from your lender's office. Ensure that you accurately provide all requested information, including personal details, loan account number, and the reason for the requested variation.

03

Clearly explain the changes you are seeking in a concise and professional manner. Specify the exact modifications you are looking for in terms of interest rate adjustment, repayment schedule changes, or any other specific modifications.

04

Attach any supporting documentation that may strengthen your case for the loan variation. For example, if you have experienced a change in financial circumstances, provide evidence such as pay stubs, bank statements, or a letter explaining the situation.

05

Double-check your completed form and attached documents for accuracy and completeness. Ensure that all required fields are filled out and that all supporting documents are included.

06

Submit your loan variation request to your lender through the designated channel. This can typically be done via mail, email, or through the lender's online portal, depending on their preferred method of communication.

07

Keep a record of your loan variation request, including a copy of the completed form and any supporting documents. It is always a good idea to have a clear paper trail in case any issues arise in the future.

Who needs loan variation request?

01

Individuals who have an existing loan and wish to make changes to their loan terms or conditions may require a loan variation request. This could include adjustments to the interest rate, repayment schedule, loan duration, or any other specific modifications to the original loan agreement.

02

Businesses or organizations that have taken out loans for their operations may also need a loan variation request if they encounter changes in their financial circumstances or need to adjust the terms of their loan agreement.

03

In some cases, lenders may require borrowers to complete a loan variation request when certain conditions are met, such as when borrowers are seeking a forbearance or loan modification due to temporary financial hardship.

Note: The specific requirements for a loan variation request may vary between lenders and depend on the type of loan or loan agreement. It is essential to familiarize yourself with your lender's guidelines and procedures for submitting a loan variation request.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is loan variation request?

A loan variation request is a formal application submitted to the lender to make changes to the terms and conditions of an existing loan agreement.

Who is required to file loan variation request?

The borrower or their authorized representative is required to file a loan variation request.

How to fill out loan variation request?

To fill out a loan variation request, the borrower must provide details of the requested changes, their reasons for the changes, and any supporting documentation.

What is the purpose of loan variation request?

The purpose of a loan variation request is to request changes to the terms and conditions of an existing loan agreement to better suit the borrower's current financial situation.

What information must be reported on loan variation request?

The loan variation request must include details of the requested changes, reasons for the changes, current financial situation of the borrower, and any supporting documentation.

When is the deadline to file loan variation request in 2024?

The deadline to file a loan variation request in 2024 is December 31st.

What is the penalty for the late filing of loan variation request?

The penalty for the late filing of a loan variation request may include additional fees or interest charges.

How do I complete loan variation request online?

pdfFiller has made filling out and eSigning loan variation request easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an electronic signature for the loan variation request in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your loan variation request in minutes.

How do I edit loan variation request on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign loan variation request. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Fill out your loan variation request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.