CO NTD 81-10-06 2007-2024 free printable template

Show details

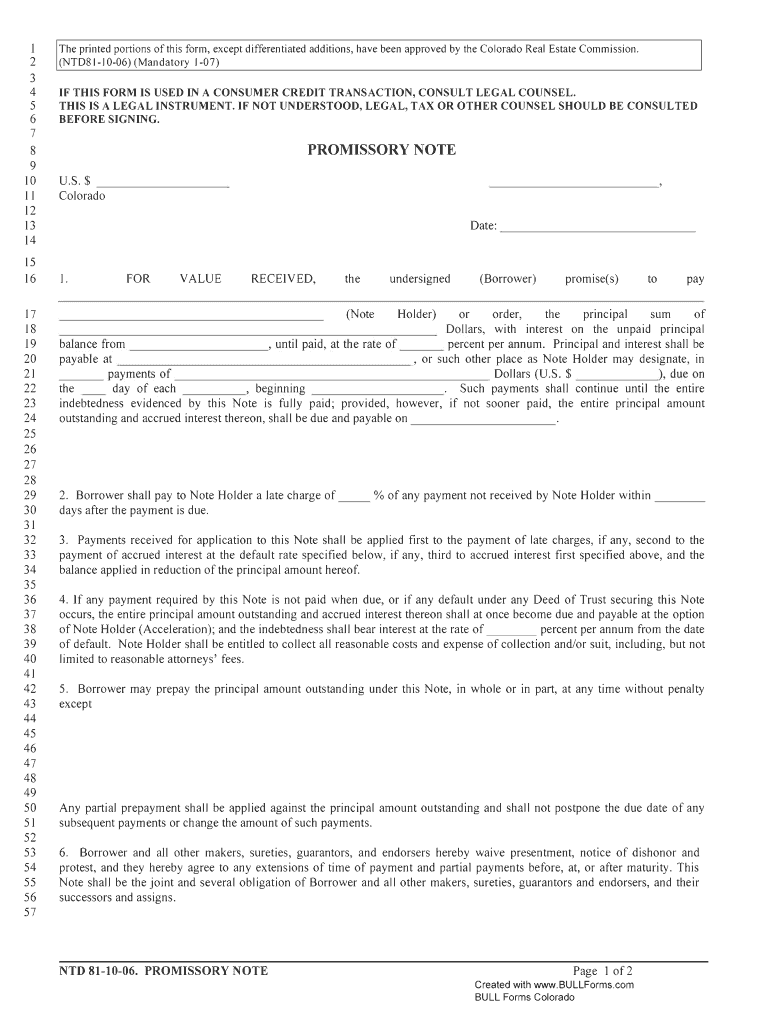

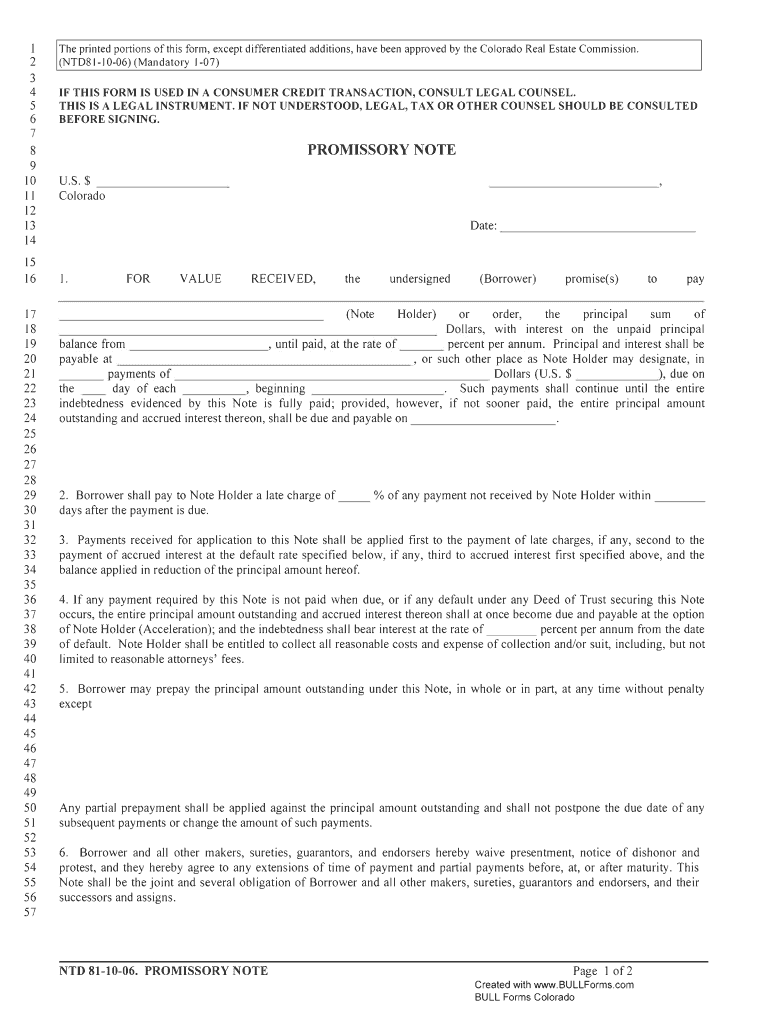

58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 7. Any notice to Borrower

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your colorado ntd 81 10 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your colorado ntd 81 10 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit colorado ntd 81 10 06 online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ntd 81 10 06 note form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

How to fill out colorado ntd 81 10

How to fill out Colorado NTD 81 10:

01

Start by reading the instructions provided on the form. This will give you a clear understanding of the information required and how to fill it out correctly.

02

Gather all the necessary information and documents needed to complete the form. This may include personal details, financial information, and any supporting documentation required.

03

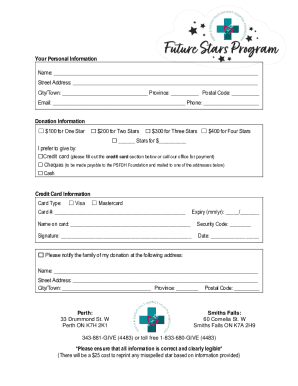

Begin by filling out the basic information section of the form. This will typically include your name, address, contact information, and other relevant details.

04

Proceed to the specific sections of the form that require additional information. This may include details about your employment status, income, expenses, and other related information.

05

Double-check all the information filled out on the form for accuracy and completeness. Ensure that all necessary fields are filled in and that there are no errors or missing information.

06

Sign and date the form as required, following the instructions provided.

07

Make a copy of the completed form for your records before submitting it, if necessary.

Who needs Colorado NTD 81 10:

01

Individuals or businesses that are required by the state of Colorado to report their financial information may need to fill out Colorado NTD 81 10.

02

This form is commonly used by taxpayers to provide detailed information on their financial situation and comply with state tax requirements.

03

It may also be required by certain organizations or entities that have specific reporting obligations to the state.

04

It is recommended to consult with a tax professional or contact the relevant state authorities to determine if you are required to fill out Colorado NTD 81 10.

Fill colorado 81 10 06 online : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file colorado ntd 81 10?

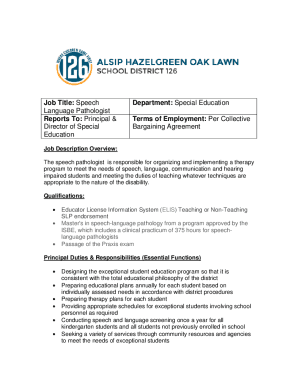

According to the Colorado Department of Revenue, Form DR 81-10 (Nonprofit Organization Exempt Sale of Property Affidavit) is required to be filed by nonprofit organizations in Colorado that are claiming an exemption from paying state sales tax on the sale of tangible personal property.

How to fill out colorado ntd 81 10?

To fill out the Colorado NTD 81-10 form, follow these steps:

1. Start by entering the year and month for which you are reporting data in the "Year-Month" field at the top of the form.

2. In Section A, provide your agency's general information, including the agency name, address, contact person, email, phone number, and NTD ID. Fill out the rest of the fields in this section as needed.

3. In Section B, you will report your agency's transit service statistics. Enter the total vehicle revenue miles (VRM), total vehicle revenue hours (VRH), and total unlinked passenger trips (UPT) for the reporting month. If your agency operates bus, rail, or other modes of transit, you may need to provide further breakdowns in the subsequent rows.

4. In Section C, report your agency's maintenance statistics. Enter the total vehicle revenue miles (VRM) and total vehicle revenue hours (VRH) for maintenance for the reporting month. Again, if your agency operates multiple modes of transit, provide the appropriate breakdowns.

5. In Section D, report your agency's operating expenses. Fill out each field as required, including labor expense, fringe benefits expense, service expense, fuel expense, maintenance expense, and other expense. If your agency has any capital expenses, fill out the corresponding rows as well.

6. Move on to Section E, which requires you to report your agency's project revenue or cost. Fill out the appropriate fields for project revenue or cost, as applicable.

7. In Section F, enter your agency's fare revenue. Provide the total fare revenue for the reporting month and any other fare-related revenue (e.g., transfers, passes sold).

8. Next, in Section G, report your agency's subsidy information. This includes federal subsidy, state subsidy, local subsidy, and other subsidies.

9. Lastly, review the completed form for accuracy and ensure all required fields have been filled out. Sign and date the form.

10. Keep a copy of the completed form for your records, and submit the original to the Colorado Department of Transportation (CDOT) as specified in the instructions.

What information must be reported on colorado ntd 81 10?

The Colorado NTD (National Transit Database) Form 81 10 is used to report financial data for public transportation agencies in Colorado. The following information must be reported on this form:

1. Agency Identification: Name, address, contact information, and the reporting year.

2. Funding Sources: Details of funding sources for the agency, including federal, state, local, and other sources.

3. Operating Expenses: Various operating expenses incurred by the agency during the reporting year, such as labor costs, maintenance expenses, fuel costs, insurance, and other operating expenses.

4. Non-Operating Expenses: Expenses not directly related to the day-to-day operations of the agency, such as interest payments, lease/rental expenses, other non-operating expenses.

5. Capital Expenses: Details of capital expenses, including vehicle purchases, facility construction or improvements, equipment purchases, and other capital expenses.

6. Revenue: Details about the revenue generated by the agency, including fare revenue, advertising revenue, grants, subsidies, and any other revenue sources.

7. Non-Operating Revenue: Revenue not directly related to the day-to-day operations, such as interest income, rental income, and other non-operating revenue sources.

8. Vehicle Information: Information about the agency's fleet, including the number of vehicles in various categories (buses, vans, rail cars, etc.), the age of the fleet, and other vehicle-related details.

9. Passenger Trips: The number of passenger trips made during the reporting year, broken down by various categories (regular route, demand-response, commuter, etc.) and demographics (elderly, disabled, etc.).

10. Service Statistics: Details about the agency's service levels, including the number of service miles or hours provided, service frequency, service coverage area, and any other service-related statistics.

11. Performance Standards: Information about the agency's performance standards, such as on-time performance, safety measures, and customer satisfaction.

These are some of the key information that must be reported on the Colorado NTD Form 81 10. The form may require additional specific details depending on the nature and size of the transit agency.

Can I create an electronic signature for the colorado ntd 81 10 06 in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your ntd 81 10 06 note form in minutes.

How do I edit ntd 81 1006 note on an iOS device?

Create, edit, and share ntd 81 10 06 promissory from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I complete colorado 81 10 06 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your colorado ntd81 10 06 form, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Fill out your colorado ntd 81 10 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ntd 81 1006 Note is not the form you're looking for?Search for another form here.

Keywords relevant to colorado 81 10 06 form

Related to colorado ntd81 10 06

If you believe that this page should be taken down, please follow our DMCA take down process

here

.