Get the free Understanding Your 1099-B

Show details

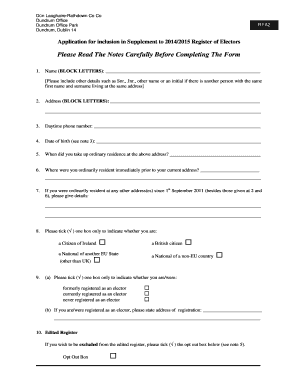

Understanding Your 1099B

The layout of your Form 1099B will help simplify your tax preparation. Short term holdings are separated from your long term

holdings, which are generally taxed at a different

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your understanding your 1099-b form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your understanding your 1099-b form via URL. You can also download, print, or export forms to your preferred cloud storage service.

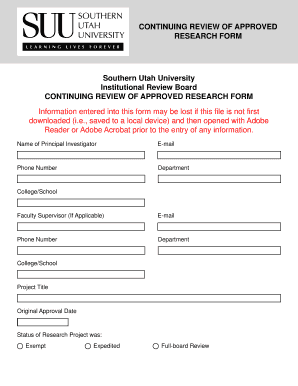

Editing understanding your 1099-b online

Follow the guidelines below to use a professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit understanding your 1099-b. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

How to fill out understanding your 1099-b

How to Fill Out Understanding Your 1099-B:

01

Obtain the correct form: Start by obtaining the official 1099-B form from the Internal Revenue Service (IRS) or your financial institution. Make sure you have the most recent version of the form to ensure accuracy.

02

Gather necessary information: Collect all the relevant information needed to fill out the form. This includes details such as your name, address, Social Security number, and the payer's information. Additionally, you will need the date of the sale or exchange of the assets, as well as the cost basis and proceeds from the transaction.

03

Understand the different sections: Familiarize yourself with the different sections of the 1099-B form. These sections include reporting the gross proceeds from the sale, reporting cost basis information, and indicating whether any adjustments are necessary. It is important to understand the purpose and requirements of each section to accurately fill out the form.

04

Report the transactions: Enter the relevant transaction details in the appropriate sections of the form. Make sure to double-check the accuracy of the information before moving forward. Consider consulting your financial advisor or tax professional if you are unsure about any specific transactions or reporting requirements.

05

Review and reconcile: Once you have completed filling out the form, carefully review all the information provided. Ensure that everything is accurate and matches your records. Take note of any discrepancies and address them accordingly.

Who needs understanding your 1099-B?

01

Investors: Individuals who have engaged in investment activities, such as buying or selling stocks, bonds, mutual funds, or other securities, need to understand their 1099-B form. The form provides crucial information about capital gains or losses and helps investors report their income accurately to the IRS.

02

Taxpayers with investment income: If you have earned income from investments during the tax year, you will likely receive a 1099-B form. Those who receive a Form 1099-B should have an understanding of how to fill it out to accurately report their investment income on their tax returns.

03

Traders and business owners: Traders and business owners who engage in trading activities may also receive a 1099-B form if they meet certain requirements. Understanding the form is essential for these individuals to properly report their capital gains or losses and adhere to tax laws.

In summary, understanding how to fill out a 1099-B form is crucial for investors, taxpayers with investment income, and traders and business owners. By following the step-by-step guide and ensuring accurate reporting, individuals can fulfill their tax obligations effectively.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is understanding your 1099-b?

Understanding your 1099-B involves comprehending the information and tax implications associated with the Form 1099-B, which is used to report capital gains and losses from investment activities.

Who is required to file understanding your 1099-b?

Individuals and entities who engage in certain investment activities, such as selling stocks, bonds, or mutual funds, are generally required to file a Form 1099-B to report their capital gains or losses to the IRS.

How to fill out understanding your 1099-b?

To fill out Form 1099-B, you need to gather information about your investment activities and transactions, including the date of sale, purchase price, sale price, and any associated costs. You then report this information in the appropriate sections of the form, ensuring accuracy and completeness.

What is the purpose of understanding your 1099-b?

The purpose of understanding your 1099-B is to accurately report and document your capital gains and losses from investment activities. This information is used by the IRS to determine your tax liability and ensure compliance with tax laws.

What information must be reported on understanding your 1099-b?

On Form 1099-B, you must report details about each investment transaction, such as the description of the property, the date acquired, the date sold, the proceeds from the sale, and the cost basis. Additional information, such as adjustments and codes, may also be required depending on the specific circumstances.

When is the deadline to file understanding your 1099-b in 2023?

The deadline to file Form 1099-B for the tax year 2023 is generally January 31, 2024. However, certain situations or entities may have different filing deadlines. It is important to consult the IRS guidelines or a tax professional for the specific deadline applicable to your situation.

What is the penalty for the late filing of understanding your 1099-b?

The penalty for late filing of Form 1099-B may vary depending on the circumstances and the amount of time past the deadline. As of now, the penalty ranges from $50 to $550 per information return, depending on the delay. The penalties can increase for intentional disregard or if the IRS determines there was intentional failure to file or furnish correct forms.

How do I modify my understanding your 1099-b in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your understanding your 1099-b along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit understanding your 1099-b straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing understanding your 1099-b.

How can I fill out understanding your 1099-b on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your understanding your 1099-b. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Fill out your understanding your 1099-b online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.