Get the free Stocks and Shares ISA - This domain has been registered by BT

Show details

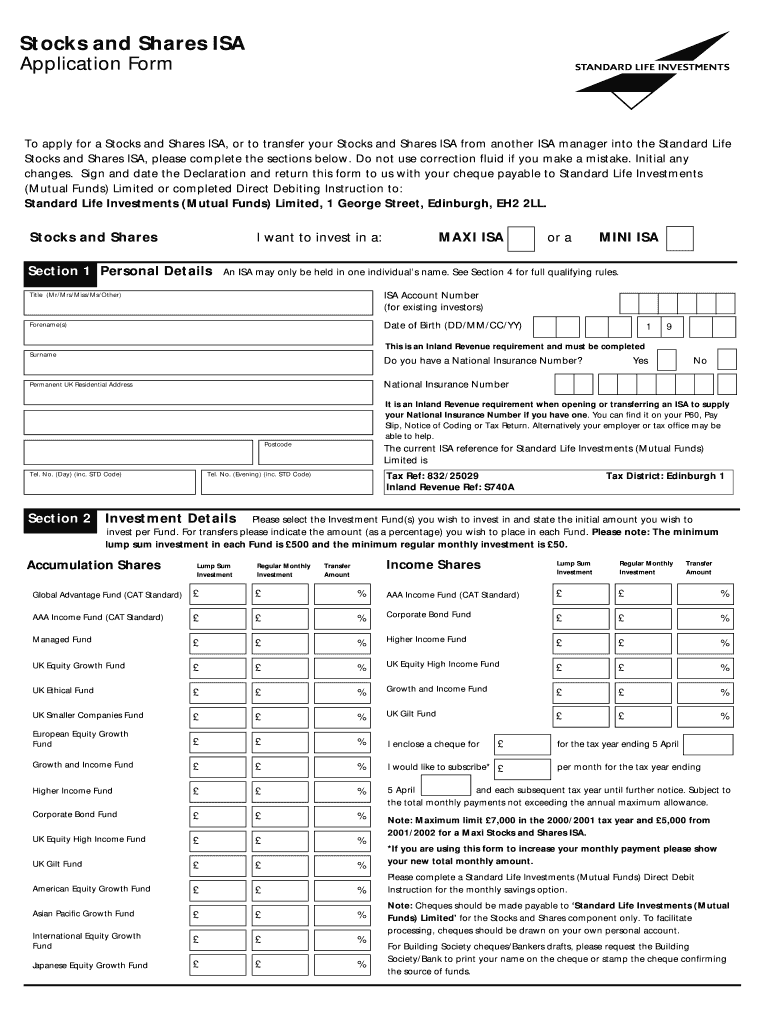

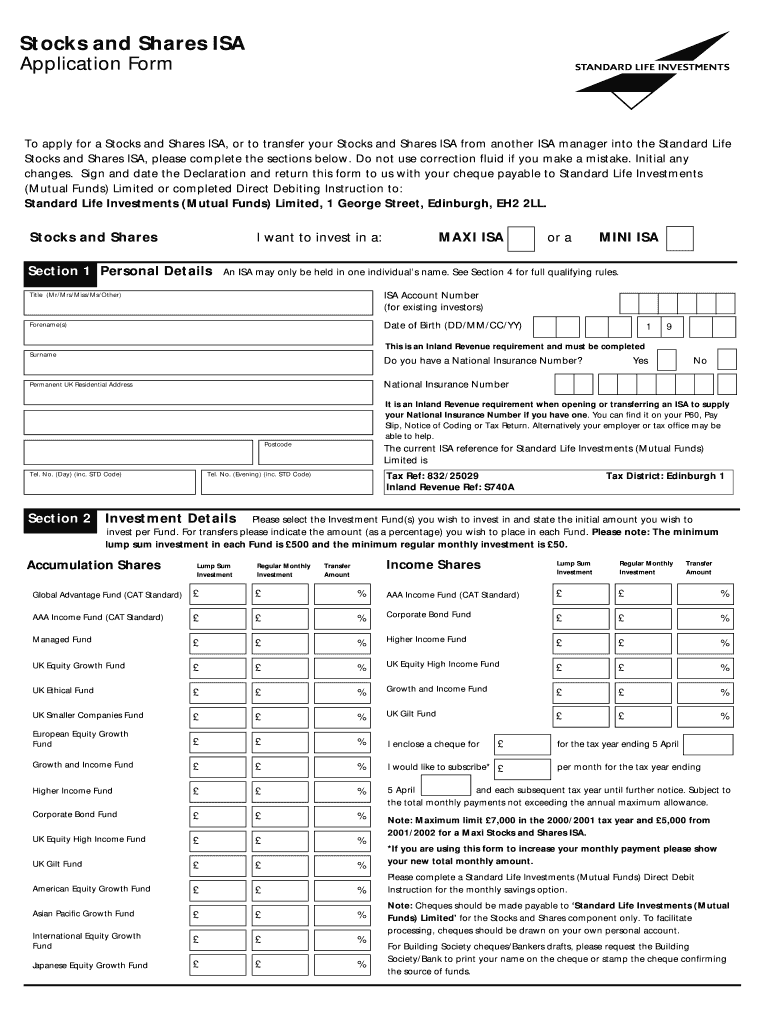

Stocks and Shares ISA Application Form To apply for a stock and Shares ISA, or to transfer your Stocks and Shares ISA from another ISA manager into the Standard Life Stocks and Shares ISA, please

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your stocks and shares isa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your stocks and shares isa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing stocks and shares isa online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit stocks and shares isa. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out stocks and shares isa

How to fill out stocks and shares ISA?

01

Research and choose a provider: Start by researching different providers that offer stocks and shares ISA accounts. Look into their fees, investment options, customer reviews, and any additional features they may offer. Once you've selected a provider, sign up for an account online or via the provider's application process.

02

Understand your risk tolerance: Before investing in stocks and shares, it's important to assess your risk tolerance. Determine how comfortable you are with market fluctuations and potential losses. This will help you choose the right investment strategy and select appropriate investment funds for your ISA.

03

Determine your investment goals: Consider your financial goals, such as saving for a down payment on a house, retirement planning, or funding a child's education. These goals will help shape your investment strategy within your stocks and shares ISA.

04

Select your investments: Within your chosen provider's platform, you'll have a range of investment options to choose from. This can include individual stocks, bonds, or funds. Consider your risk tolerance, investment goals, and the level of diversification you desire when selecting your investments.

05

Contribute to your ISA: Determine how much money you want to invest within your stocks and shares ISA and set up regular contributions. You can contribute up to the annual ISA allowance, which may change each tax year. Ensure you stay within the limits to maximize your tax advantages.

06

Monitor and review your investments: Regularly monitor the performance of your investments within your stocks and shares ISA. This will allow you to make informed decisions about rebalancing your portfolio or making changes as needed. Stay updated on market news and trends that may affect your investments.

Who needs stocks and shares ISA?

01

Individuals looking for potential higher returns: Stocks and shares ISAs can provide an opportunity for higher returns compared to traditional savings accounts. They allow individuals to invest in a wide range of assets and benefit from potential growth in the stock market.

02

Investors seeking tax-efficient savings: Stocks and shares ISAs offer tax advantages, allowing individuals to shield their investment gains from income tax and capital gains tax. This makes them a suitable option for investors looking to maximize their returns without incurring unnecessary tax liabilities.

03

Individuals with long-term investment goals: Stocks and shares ISAs are ideal for individuals with long-term investment goals such as retirement planning or saving for a child's education. By investing in growth-oriented assets, such as equities or funds, individuals can potentially benefit from compounding returns over time.

04

Investors comfortable with market fluctuations: The stock market can be volatile, and stocks and shares ISAs are subject to market risks. Therefore, individuals who are comfortable with the possibility of market fluctuations and potential losses may find stocks and shares ISAs suitable for their investment needs.

05

Those looking for investment diversification: Stocks and shares ISAs offer a variety of investment options, allowing individuals to diversify their portfolios. This mitigates risk by spreading investments across different asset classes, sectors, and geographical regions.

Remember, it's always advisable to seek professional financial advice before making any investment decisions, especially if you're unsure about your personal circumstances or risk tolerance.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is stocks and shares isa?

A stocks and shares ISA is a type of individual savings account that allows individuals to invest in the stock market and other types of investments.

Who is required to file stocks and shares isa?

Any individual in the UK who wishes to invest in stocks and shares can open a stocks and shares ISA.

How to fill out stocks and shares isa?

To fill out a stocks and shares ISA, individuals need to choose a provider, open an account, decide on their investments, and provide the necessary information and funds to their chosen provider.

What is the purpose of stocks and shares isa?

The purpose of a stocks and shares ISA is to allow individuals to benefit from potential investment returns in the stock market, while also providing tax advantages such as income tax and capital gains tax savings.

What information must be reported on stocks and shares isa?

The information that must be reported on a stocks and shares ISA includes the individual's personal details, investment choices, contributions, and any income or gains generated from the investments.

When is the deadline to file stocks and shares isa in 2023?

The deadline to file stocks and shares ISA in 2023 is usually on the tax year end date, which is April 5th.

What is the penalty for the late filing of stocks and shares isa?

The penalty for the late filing of stocks and shares ISA can vary, but individuals may face financial penalties, loss of tax benefits, and potential legal consequences.

How do I modify my stocks and shares isa in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your stocks and shares isa and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I sign the stocks and shares isa electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your stocks and shares isa in minutes.

How do I edit stocks and shares isa on an Android device?

With the pdfFiller Android app, you can edit, sign, and share stocks and shares isa on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

Fill out your stocks and shares isa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.