Get the free Premiere Select Retirement Plan Beneficiary ... - Atlantic Financial

Show details

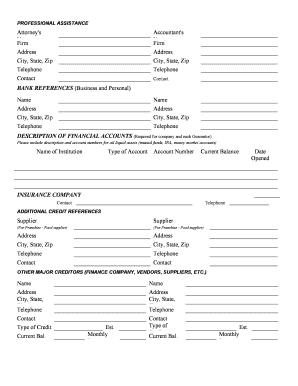

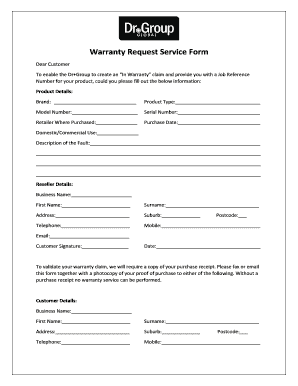

Premiere Select Retirement Plan Beneficiary Distribution Account (BDA) Application Client Instructions IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING A NEW ACCOUNT To help the government fight

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your premiere select retirement plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your premiere select retirement plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing premiere select retirement plan online

Follow the steps below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit premiere select retirement plan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

How to fill out premiere select retirement plan

How to fill out premiere select retirement plan:

01

Start by gathering all the necessary information and documents, such as your personal identification details, employment information, and financial records.

02

Visit the official website or contact the premiere select retirement plan provider to obtain the necessary forms and documents required for enrollment.

03

Carefully read through the instructions provided in the enrollment form and make sure you understand each section before proceeding.

04

Begin filling out the form by providing your personal information, such as your full name, Social Security number, date of birth, and contact details.

05

Proceed to the employment section of the form and provide details about your current or previous employment, including your job title, salary, and length of service.

06

Fill in the financial section by providing information about your current income, savings, investments, and any other retirement accounts you may have.

07

Review all the sections thoroughly to ensure that you have not missed any required information or fields.

08

If necessary, attach any supporting documents requested, such as proof of identification or employment.

09

Sign and date the form according to the instructions provided, and make a copy for your records before submitting it.

10

Contact the premiere select retirement plan provider if you have any questions or need further assistance during the enrollment process.

Who needs premiere select retirement plan:

01

Employees who are looking for a comprehensive retirement plan with various investment options and potential tax advantages may benefit from the premiere select retirement plan.

02

Individuals who want to take advantage of employer matching contributions or employer-sponsored retirement benefits may find the premiere select retirement plan suitable.

03

Those who are planning for retirement and want to ensure a secure financial future by investing in a retirement account with flexibility and control may consider the premiere select retirement plan.

04

Self-employed individuals or freelancers who are not covered by an employer-sponsored retirement plan may opt for the premiere select retirement plan as a way to save for retirement.

05

Employees who are looking for a retirement plan that allows for both pre-tax and after-tax contributions, giving them flexibility in managing their tax obligations, may find the premiere select retirement plan appealing.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is premiere select retirement plan?

The premiere select retirement plan is a retirement savings plan available to eligible individuals, which allows them to contribute a portion of their income towards their retirement. It is designed to provide financial security and income during retirement.

Who is required to file premiere select retirement plan?

The premiere select retirement plan is not something that individuals file. Instead, it is a plan that individuals can choose to participate in if they meet the eligibility criteria.

How to fill out premiere select retirement plan?

To participate in the premiere select retirement plan, individuals need to contact their employer or retirement plan provider to enroll in the plan. They will then need to complete the necessary paperwork and provide the required information, such as their personal details, contribution amount, and beneficiary information.

What is the purpose of premiere select retirement plan?

The purpose of the premiere select retirement plan is to encourage individuals to save for their retirement by providing them with a tax-advantaged savings vehicle. It helps individuals build a nest egg for their retirement years and ensures a stable source of income during their non-working years.

What information must be reported on premiere select retirement plan?

The premiere select retirement plan requires individuals to report their personal information, including their full name, date of birth, and Social Security number. They also need to report their contribution amounts, investment choices, and beneficiary designations. Additionally, any changes to personal or financial information should be reported promptly to the plan administrator.

When is the deadline to file premiere select retirement plan in 2023?

Since the premiere select retirement plan is not filed, there is no specific deadline for filing it. However, individuals are required to contribute to the plan within the designated contribution periods as determined by the plan rules and regulations.

What is the penalty for the late filing of premiere select retirement plan?

There is no penalty for the late filing of the premiere select retirement plan, as it is not something that individuals file. However, individuals may face penalties or additional taxes if they fail to meet the contribution deadlines set by the plan or if they withdraw funds from the plan before reaching the eligible retirement age.

How do I edit premiere select retirement plan in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your premiere select retirement plan, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an eSignature for the premiere select retirement plan in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your premiere select retirement plan and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I complete premiere select retirement plan on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your premiere select retirement plan, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Fill out your premiere select retirement plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.