Get the free D NIT

Show details

ASHTRAY SPAT NI GAM LIMITED VISAKHAPATNAM STEEL PLANT (A Govt. of India Enterprises) PROJECTS DIVISION CONTRACTS DEPARTMENT, PROJECT OFFICE, A-BLOCK, VISAKHAPATNAM-530 031 Grams: BEAM Phones: (+91)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your d nit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your d nit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit d nit online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit d nit. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

How to fill out d nit

How to fill out a D-NIT:

01

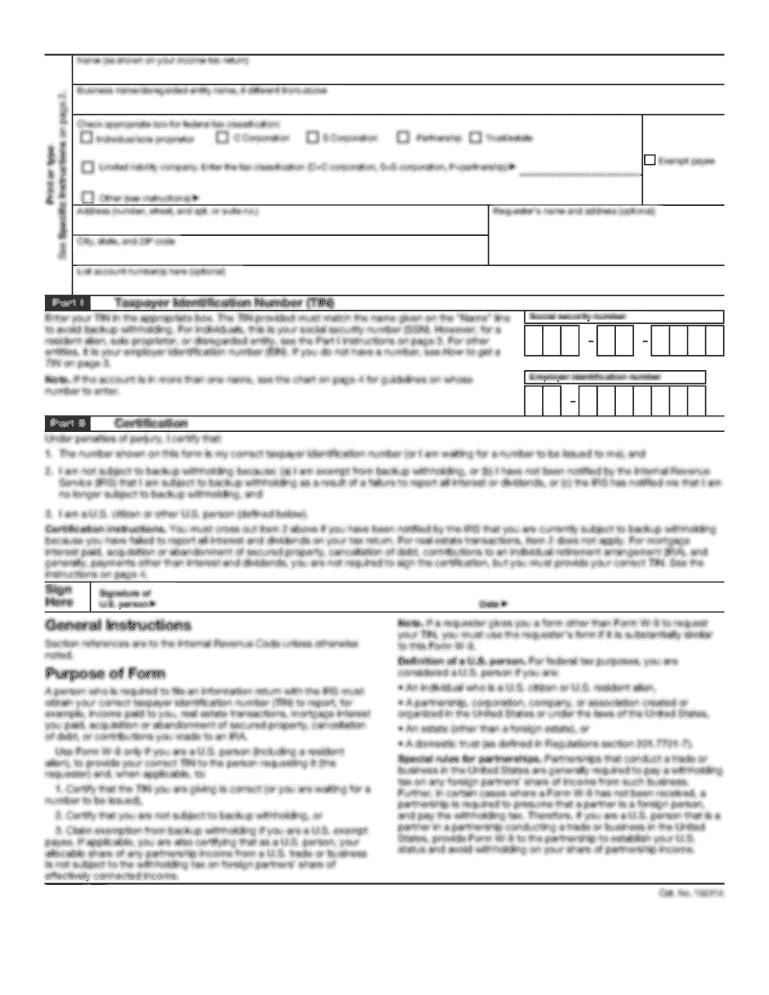

Start by gathering all necessary information and documents required to fill out the D-NIT form. This may include personal identification details, tax identification numbers, income statements, and any specific information related to the purpose of the form.

02

Carefully read the instructions provided with the D-NIT form to ensure you understand the requirements and procedures involved. This is essential to avoid any errors or omissions that may delay processing or cause complications.

03

Begin filling out the D-NIT form by entering your personal details, such as your full name, address, contact information, and tax identification number.

04

Provide accurate and complete information in the sections related to your financial details, such as income, expenses, and assets. This may require referring to supporting documents like bank statements, employment contracts, or other relevant records.

05

Pay close attention to any specific sections that are applicable to your situation or purpose of filling out the D-NIT form. For example, if you are declaring foreign assets or investments, make sure to include the required details and provide any necessary supporting documentation.

06

Double-check all the entered details and make sure they are accurate and error-free before submitting the form. Accuracy is crucial to avoid any potential issues or penalties related to incorrect information.

07

If required, attach any supporting documents or additional forms that are necessary for the completion of the D-NIT form. Ensure these documents are properly labeled and attached securely.

08

After completing the form and attaching any required documents, review everything once again to ensure nothing has been missed or overlooked.

09

Sign the D-NIT form and any other necessary declarations or certifications as required. Ensure that the signature matches the name provided and is clear and legible.

10

Submit the filled-out D-NIT form along with any additional required documents to the appropriate authority or department, following the specified submission procedures, such as mailing, online submission, or in-person delivery.

Who needs D-NIT:

01

Individuals who are residents and are required to declare their income and pay taxes to the tax authority.

02

Businesses and organizations that are registered entities and have tax obligations.

03

Non-resident individuals or foreign entities that have taxable income or financial activities within the jurisdiction where the D-NIT is issued.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

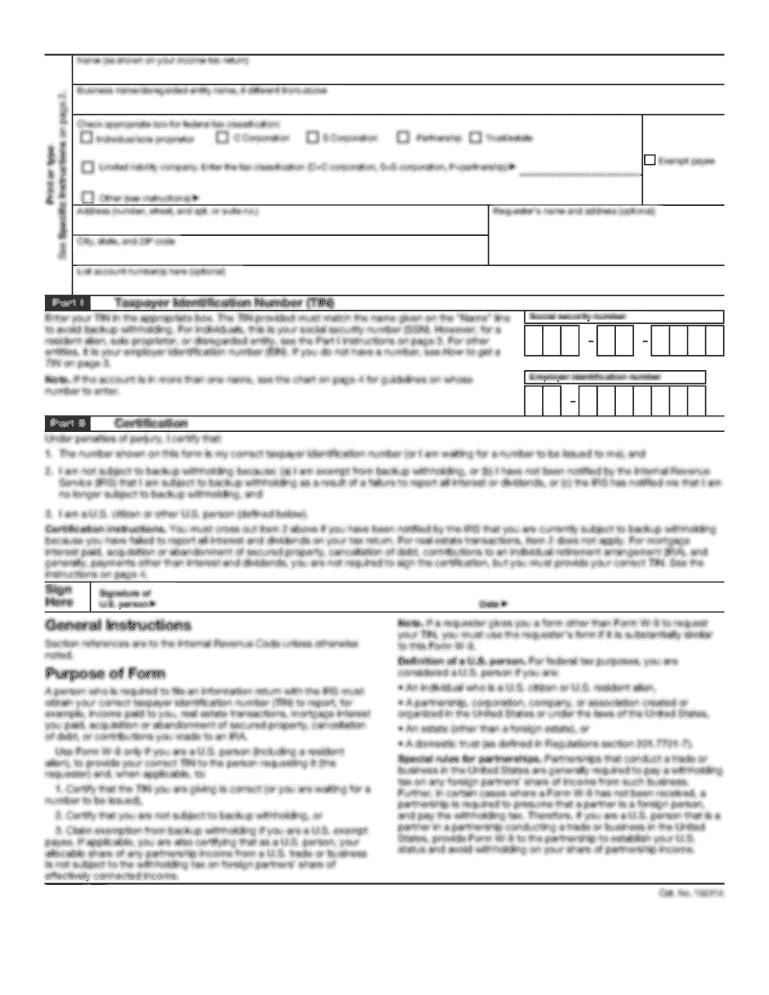

What is d nit?

D NIT stands for Declaration of Non-Individual Taxpayers. It is a tax form used for individuals who are not registered as self-employed workers or companies.

Who is required to file d nit?

Non-individual taxpayers who are not registered as self-employed workers or companies are required to file D NIT.

How to fill out d nit?

To fill out D NIT, you need to provide your personal information, income details, and any applicable deductions. It is recommended to consult a tax professional or refer to the tax authority's guidelines for detailed instructions.

What is the purpose of d nit?

The purpose of D NIT is to report the income and taxes of non-individual taxpayers who are not registered as self-employed workers or companies.

What information must be reported on d nit?

On D NIT, you need to report your personal information, income sources, income amounts, applicable deductions, and any other details required by the tax authority.

When is the deadline to file d nit in 2023?

The deadline to file D NIT in 2023 is typically set by the tax authority. It is advisable to refer to the official tax authority's guidelines or website for the specific deadline.

What is the penalty for the late filing of d nit?

The penalties for the late filing of D NIT can vary depending on the tax regulations and jurisdiction. It is recommended to consult the tax authority's guidelines or seek professional advice to understand the specific penalties for late filing.

How can I get d nit?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the d nit in seconds. Open it immediately and begin modifying it with powerful editing options.

How can I edit d nit on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing d nit right away.

How do I fill out d nit on an Android device?

Use the pdfFiller app for Android to finish your d nit. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your d nit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.