Get the free 2009 Estimated Tax

Show details

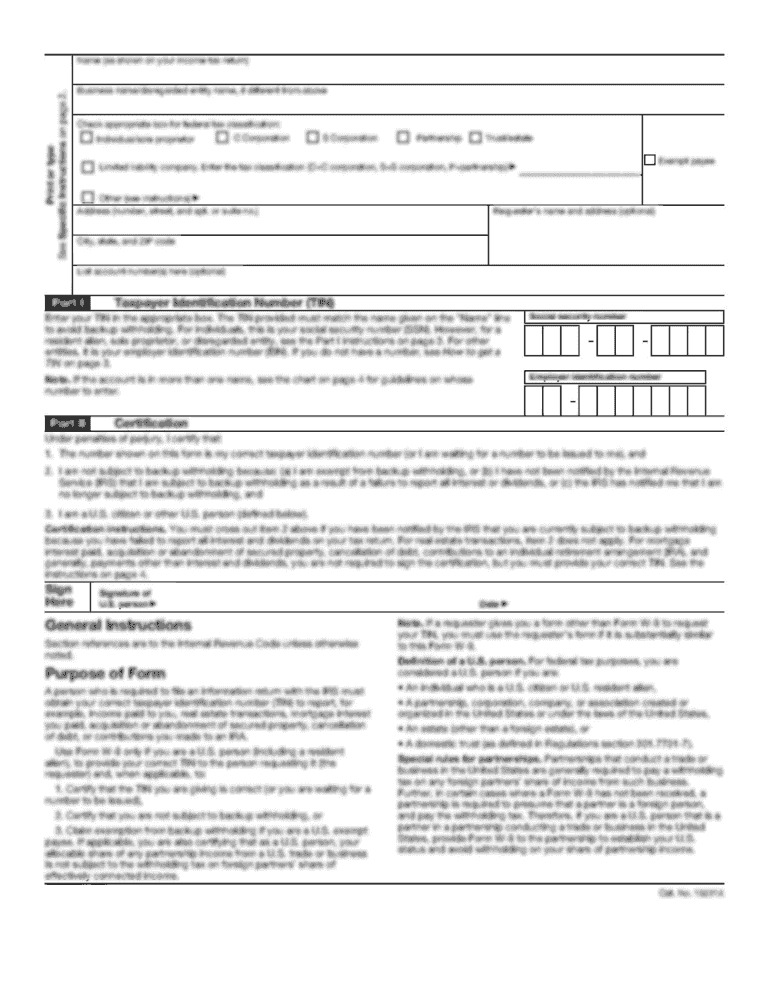

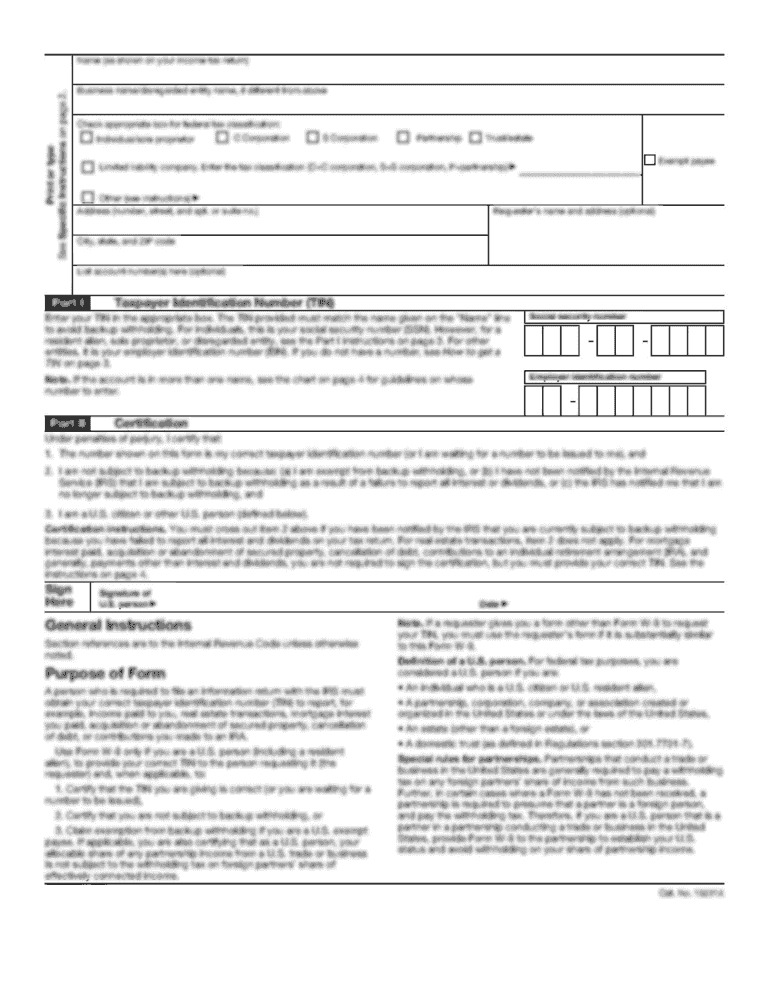

STF NQHV1002.1 Form 1040-ES Department of the Treasury Internal Revenue Service 2009 Estimated Tax File only if you are making a payment of estimated tax by check or money order. Mail this voucher

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2009 estimated tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2009 estimated tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2009 estimated tax online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2009 estimated tax. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

How to fill out 2009 estimated tax

How to fill out 2009 estimated tax:

01

Gather all necessary documents and information: Start by collecting all relevant financial documents for the year 2009, such as income statements, receipts, and records of deductions. Make sure you have accurate figures to calculate your estimated tax.

02

Determine if you need to pay estimated tax: Estimated tax is typically required if you expect to owe at least $1,000 in tax for the year and have insufficient withholding from your income. Check your tax liability for 2009 and assess if you need to file estimated tax.

03

Download the appropriate forms: Visit the IRS website or contact the IRS to obtain the necessary forms for filing your estimated tax for the year 2009. These forms may include Form 1040-ES (Estimated Tax for Individuals) and its instructions.

04

Calculate your estimated tax: Use the information gathered in step 1 to calculate your estimated tax liability for the year 2009. Refer to the instructions provided with the form to determine the correct method for calculating your estimated tax.

05

Complete the Form 1040-ES: Fill out the necessary fields on Form 1040-ES accurately and completely. This includes providing your personal information, estimated tax liability, deductions, and any additional information required by the form.

06

Make your estimated tax payments: Once you have calculated your estimated tax liability and completed Form 1040-ES, you need to make payments. You can choose to either make equal quarterly payments or adjust the payment amounts based on your income fluctuations throughout the year.

07

Keep records of your estimated tax payments: It is essential to maintain a record of your estimated tax payments for future reference and to assist in filing your actual tax return for the year 2009. This includes keeping copies of checks, payment receipts, and any other supporting documentation.

Who needs 2009 estimated tax:

01

Self-employed individuals: If you were self-employed during the tax year 2009, you likely need to pay estimated tax. Since self-employed individuals do not have taxes withheld from their income, estimated tax is necessary to ensure you meet your tax obligations.

02

Freelancers and gig workers: Similar to self-employed individuals, freelancers and gig workers may also need to pay estimated tax for the year 2009. If you received income from various sources that did not withhold taxes, estimated tax allows you to fulfill your tax liabilities.

03

Individuals with substantial investment income: If you earned a significant amount of income from investments, such as dividends, interest, or capital gains, you may need to pay estimated tax. This ensures you meet your tax obligations on this type of income.

04

Individuals with irregular income: If you had irregular income during the tax year 2009, estimated tax may be necessary. This could be due to factors like seasonal work, freelance projects, or significant fluctuations in income throughout the year.

Overall, anyone who expects to owe at least $1,000 in tax for the year and does not have sufficient withholding may need to pay estimated tax for the year 2009. It is advised to consult with a tax professional or refer to IRS guidelines to determine if you specifically need to pay estimated tax for that particular year.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is estimated tax?

Estimated tax is a method used to pay tax on income that is not subject to withholding tax, such as self-employment income, dividends, interest, and rental income. It is an approximation of the taxes owed on this type of income and is typically paid quarterly throughout the year.

Who is required to file estimated tax?

Individuals who expect to owe at least $1,000 in tax after subtracting their withholding and refundable credits, or those who had a tax liability in the previous year, are generally required to file estimated tax.

How to fill out estimated tax?

To fill out estimated tax, you need to estimate your expected income and deductions for the year, calculate your tax liability using the appropriate tax rates, and determine the amount of tax you need to pay in quarterly installments. The IRS provides Form 1040-ES to help individuals calculate and pay their estimated tax.

What is the purpose of estimated tax?

The purpose of estimated tax is to ensure that individuals and businesses pay their tax liabilities in a timely manner throughout the year, rather than waiting until the end of the year to pay in one lump sum. It helps in meeting the pay-as-you-go system of taxation.

What information must be reported on estimated tax?

When filing estimated tax, you need to report your estimated income, deductions, tax credits, and any other relevant information that affects your tax liability for the year.

When is the deadline to file estimated tax in 2023?

The deadlines to file estimated tax in 2023 are April 18, June 15, September 15, and January 16, 2024.

What is the penalty for the late filing of estimated tax?

The penalty for late filing of estimated tax is generally calculated based on the amount of underpayment and the number of days the payment is late. The IRS provides specific guidelines for calculating and paying the penalty.

How can I edit 2009 estimated tax from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including 2009 estimated tax, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I complete 2009 estimated tax on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your 2009 estimated tax, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I edit 2009 estimated tax on an Android device?

You can edit, sign, and distribute 2009 estimated tax on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your 2009 estimated tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.