Get the free 990 - CharitablePlanning.com

Show details

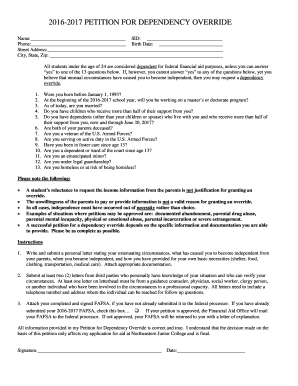

NHF 08/08/2008 1:34 PM Form 990 Return of Organization Exempt From Income Tax OMB No. 1545-0047 2007 Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung benefit

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 990 - charitableplanningcom form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 990 - charitableplanningcom form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 990 - charitableplanningcom online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 990 - charitableplanningcom. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

How to fill out 990 - charitableplanningcom

How to fill out 990 - charitableplanningcom:

01

Begin by gathering all necessary financial information, such as your organization's income, expenses, assets, and liabilities.

02

Review the instructions provided by charitableplanningcom for filling out the 990 form. Familiarize yourself with the different sections and requirements.

03

Start by filling out the basic information about your organization, including its name, address, EIN (Employer Identification Number), and mission statement.

04

Proceed to report your organization's revenue and expenses. This includes detailing any grants, donations, fundraising events, program service revenue, and any other sources of income. Also, document all expenses, such as salaries, rent, utilities, and program-related costs.

05

Provide information about your organization's assets and liabilities, including any investments, bank accounts, real estate, and debts.

06

If applicable, report on any transactions or relationships that may be considered conflict of interest or potential conflicts of interest.

07

Attach any necessary schedules or additional forms as instructed by charitableplanningcom.

08

Review and double-check all the information you have entered before submitting the form. Make sure it is accurate and complete.

09

Sign and date the form to certify its accuracy and completeness.

10

Keep a copy of the completed 990 form for your records.

Who needs 990 - charitableplanningcom?

01

Nonprofit organizations that are recognized as tax-exempt under section 501(c)(3) of the Internal Revenue Code are typically required to fill out and submit Form 990.

02

It is also necessary for organizations that are not specifically 501(c)(3) entities but still qualify for tax-exempt status under a different section of the code, such as 501(c)(4) social welfare organizations or 501(c)(6) trade associations.

03

Even if an organization falls under the exempted categories, there are some exceptions and threshold requirements. It is important to consult with a tax professional or the IRS to determine if the organization needs to file Form 990.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 990 - charitableplanningcom directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your 990 - charitableplanningcom and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send 990 - charitableplanningcom to be eSigned by others?

When you're ready to share your 990 - charitableplanningcom, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Where do I find 990 - charitableplanningcom?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the 990 - charitableplanningcom in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Fill out your 990 - charitableplanningcom online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.