Get the free VAT Day Application 2015

Show details

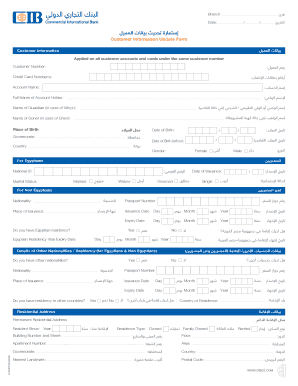

B OLD GO RN T N U IN U A IO T R U HR S O S LE H O G E P N IB T A M IS R T N A D IN T A IO St. Kits and Nevis Inland Revenue Department Discounted VAT Rate Day Application Doc#: Please complete the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your vat day application 2015 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vat day application 2015 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit vat day application 2015 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit vat day application 2015. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

How to fill out vat day application 2015

How to fill out VAT day application 2015:

01

Obtain the VAT day application form. This form can typically be found on the official website of the tax authority in your country.

02

Begin by providing your personal information. Fill in your name, address, contact number, and any other required details.

03

Next, provide your business information. Include your business name, registration number, address, and other relevant details as requested.

04

Specify the tax period for which you are applying for VAT day. This is usually a specific month or quarter.

05

Fill in the details of your sales and purchases during the specified tax period. Include the total sales amount, taxable sales, exempt sales, zero-rated sales, and other relevant information.

06

Compute the VAT owed or refundable. Calculate the total VAT due by deducting the input VAT (VAT on purchases) from the output VAT (VAT on sales). If the result is positive, it means you owe VAT. If it is negative, you may be eligible for a refund.

07

Attach supporting documents. Depending on your tax authority's requirements, you may need to provide invoices, receipts, purchase records, and any other supporting documents as proof of your sales and purchases.

08

Review and double-check your application. Ensure that all the information provided is accurate and complete. Any mistakes or omissions can lead to delays or issues with your VAT application.

09

Sign and submit the application. Once you have thoroughly reviewed the form, sign it as required and submit it to the designated tax authority. You may need to submit it online or physically mail it, depending on the procedures in place.

Who needs VAT day application 2015?

01

Businesses registered for VAT: Any business that is required to charge and collect VAT from its customers will need to fill out a VAT day application. This includes companies that exceed the threshold for VAT registration as determined by the tax authority.

02

Businesses making taxable sales: If your business engages in taxable sales during the specified tax period, you will need to complete a VAT day application. Taxable sales typically include goods or services subject to VAT at the standard rate.

03

Businesses claiming VAT refunds: If your business has incurred input VAT (VAT on purchases) higher than the output VAT (VAT on sales) during the specified tax period, you may be eligible for a VAT refund. In such cases, you will need to fill out a VAT day application to claim the refund.

Note: The specific eligibility criteria and requirements may vary depending on the country and its tax regulations. It is essential to consult the official guidelines provided by the tax authority or seek professional advice to ensure compliance with the VAT day application process.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is vat day application?

Vat day application is a form used to report and pay value-added tax (VAT) to the tax authorities.

Who is required to file vat day application?

Businesses and individuals who are registered for VAT are required to file vat day application.

How to fill out vat day application?

Vat day application can be filled out online or on paper, and it typically requires information about sales, purchases, and VAT owed.

What is the purpose of vat day application?

The purpose of vat day application is to calculate and report the amount of VAT that a business or individual owes to the tax authorities.

What information must be reported on vat day application?

Information such as sales, purchases, VAT owed, and any VAT refunds claimed must be reported on vat day application.

When is the deadline to file vat day application in 2024?

The deadline to file vat day application in 2024 is typically on the 20th of the month following the end of the VAT period.

What is the penalty for the late filing of vat day application?

The penalty for late filing of vat day application is typically a monetary fine or a percentage of the VAT owed, depending on the specific tax authority.

How do I make changes in vat day application 2015?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your vat day application 2015 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit vat day application 2015 straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing vat day application 2015.

How do I complete vat day application 2015 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your vat day application 2015. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your vat day application 2015 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.