Get the free Van K

Show details

Van K. Tharp, Ph.D. Putting Peak Performance to Work for Yuan Interview with John Mauldin

Part TwoCreativityBy

Van K. Tharp, Ph.D. By

Van K. Tharp, Ph.D. Last night I attended a two-hour workshop

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your van k form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your van k form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit van k online

Follow the steps below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit van k. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

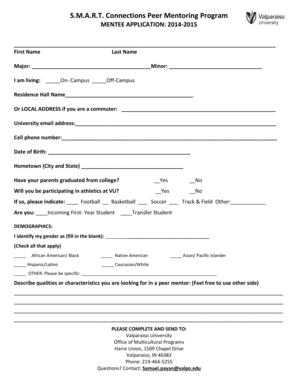

How to fill out van k

How to fill out van k:

01

Start by gathering all the necessary information, such as your personal details, employment history, and financial information.

02

Carefully read the instructions and guidelines provided with the van k form to ensure you understand the requirements and any supporting documents needed.

03

Begin with providing your full name, contact information, and social security number in the designated fields.

04

Fill in your current employment details, including your job title, employer's name and address, and the duration of your employment.

05

If you have had multiple employers within the year, make sure to list them all, along with the corresponding dates of employment.

06

If applicable, provide information about any additional sources of income, such as investments or rental properties.

07

Proceed to answer the financial information section, which may include questions about your assets, debts, and monthly expenses.

08

Make sure to double-check all the information entered to ensure accuracy and avoid any potential errors.

09

Finally, sign and date the form, certifying that all the information provided is true and complete to the best of your knowledge.

Who needs van k:

01

Individuals who are self-employed or own a small business would need van k to report their income and expenses for tax purposes.

02

Employees who receive additional income from rental properties or investments may also need van k to report these earnings accurately.

03

Anyone with complex financial situations, such as multiple sources of income or significant deductions, would benefit from using van k to organize and report their financial information efficiently.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is van k?

Van k is a tax form used to report investments in foreign financial accounts.

Who is required to file van k?

U.S. taxpayers who have a financial interest in or signature authority over foreign financial accounts.

How to fill out van k?

Van k can be filled out electronically through the Financial Crimes Enforcement Network (FinCEN) website.

What is the purpose of van k?

The purpose of van k is to combat money laundering and tax evasion by tracking foreign financial accounts.

What information must be reported on van k?

Information such as the account number, name and address of the foreign financial institution, and maximum value of the account during the reporting period.

When is the deadline to file van k in 2024?

The deadline to file van k in 2024 is April 15, 2025.

What is the penalty for the late filing of van k?

The penalty for the late filing of van k can range from $250 to $10,000 per violation, depending on the circumstances of the case.

How can I send van k for eSignature?

When you're ready to share your van k, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I make edits in van k without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing van k and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I edit van k on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign van k right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Fill out your van k online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.