Get the free DONATION GIFT AID FORM - sunfield - sunfield org

Show details

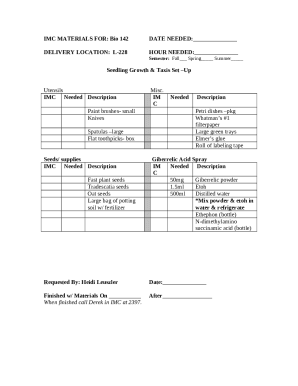

(Registered Charity No. 527552) DONATION & GIFT AID FORM (Please make checks payable to Sun field Children's Homes) I / we enclose a donation of. Towards upgrades to children's residential accommodation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your donation gift aid form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your donation gift aid form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing donation gift aid form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit donation gift aid form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

How to fill out donation gift aid form

How to fill out a donation gift aid form:

01

Start by obtaining a donation gift aid form from the organization or charity you wish to donate to. These forms are usually available on the organization's website or can be requested directly.

02

Begin by providing your personal information. This typically includes your full name, address, and contact details. Make sure to write legibly and double-check for any errors.

03

Indicate the donation amount that you are planning to give. Some forms may require you to specify whether the donation is a one-time gift or if it will be recurring. Follow the instructions provided on the form.

04

If you are a UK taxpayer, check the box or section that confirms your eligibility for gift aid. By doing so, you give permission for the organization to claim tax relief on your donation. This means that they can receive an additional 25% on top of your donation at no extra cost to you.

05

Ensure that you have accurately filled out the declaration section. This is where you confirm that you understand the gift aid rules and that the information provided is correct to the best of your knowledge. Sign and date this section accordingly.

06

If you are donating jointly with a spouse or partner, they may need to provide their information as well. Check the form's instructions for any specific requirements in this situation.

Who needs a donation gift aid form?

01

Individuals or organizations who want to make a donation and are eligible for gift aid may need to fill out a donation gift aid form. Gift aid is a UK tax incentive that allows eligible charities and community amateur sports clubs (CASCs) to claim an additional 25% on top of a donation made by a UK taxpayer.

02

If you are a UK taxpayer and you want to ensure that your donation goes a little further without any additional cost to you, completing a gift aid form is necessary. This form provides the necessary information for the organization to claim the tax relief.

03

Charities and CASCs also depend on donation gift aid forms to accurately track and process these donations. It helps them to comply with tax regulations and maximize the support they receive from eligible donors.

Overall, anyone planning to donate to a UK charity or community amateur sports club and wants to take advantage of gift aid should consider filling out a donation gift aid form. It is a straightforward process that allows your donation to make an even greater impact.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is donation gift aid form?

Donation gift aid form is a form provided by charities to donors to enable them to increase the value of their donations through tax relief.

Who is required to file donation gift aid form?

Donors who want to increase the value of their donations by claiming tax relief are required to file donation gift aid form.

How to fill out donation gift aid form?

Donors can fill out the donation gift aid form provided by the charity with their personal details and declaration of eligibility for tax relief.

What is the purpose of donation gift aid form?

The purpose of donation gift aid form is to enable donors to increase the value of their donations by allowing charities to claim tax relief on their donations.

What information must be reported on donation gift aid form?

Donation gift aid form typically requires the donor's name, address, details of the donation, declaration of eligibility for tax relief, and confirmation of understanding the gift aid rules.

When is the deadline to file donation gift aid form in 2024?

The deadline to file donation gift aid form in 2024 is typically on or before the end of the tax year, which is April 5.

What is the penalty for the late filing of donation gift aid form?

The penalty for late filing of donation gift aid form may vary, but it could result in the loss of tax relief on the donation.

How can I modify donation gift aid form without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including donation gift aid form, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I make changes in donation gift aid form?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your donation gift aid form to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I edit donation gift aid form on an Android device?

You can edit, sign, and distribute donation gift aid form on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your donation gift aid form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.