Get the free Lesson 29 a son and his father: the parable of the prodigal son - stthomassunvalley

Show details

LESSON 29

A SON AND HIS FATHER:

THE PARABLE OF THE PRODIGAL SON

Summary of Today's Story

The parable of the prodigal son is a response to the

question: Who deserves Gods love?

A man younger son takes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your lesson 29 a son form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lesson 29 a son form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit lesson 29 a son online

To use the services of a skilled PDF editor, follow these steps below:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit lesson 29 a son. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

How to fill out lesson 29 a son

How to fill out lesson 29 a son:

01

Start by reviewing the lesson materials carefully, including any reading materials, videos, or supplementary resources provided.

02

Take notes as you go through the lesson, highlighting key concepts, important details, and any questions or areas of confusion you may have.

03

Complete any assigned tasks or exercises related to the lesson. This may include practicing specific skills, solving problems, or analyzing case studies.

04

Seek help or clarification if needed. If you encounter difficulties or have any questions, don't hesitate to reach out to your instructor or classmates for assistance.

05

Reflect on what you have learned and how it connects to previous lessons or knowledge. Consider the practical applications or real-world implications of the concepts covered in lesson 29.

06

Review your notes and consolidate your understanding of the lesson. Summarize the main points and key takeaways to ensure retention and comprehension.

Who needs lesson 29 a son:

01

Students enrolled in a course or program that covers the topic of lesson 29.

02

Individuals interested in gaining knowledge or skills related to the subject matter of lesson 29.

03

Professionals seeking to enhance their expertise or stay updated in their field of work, which includes lesson 29.

04

Researchers or academics conducting studies or investigations in the area covered by lesson 29.

05

Anyone curious and eager to broaden their intellectual horizons and explore new subjects, such as lesson 29.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

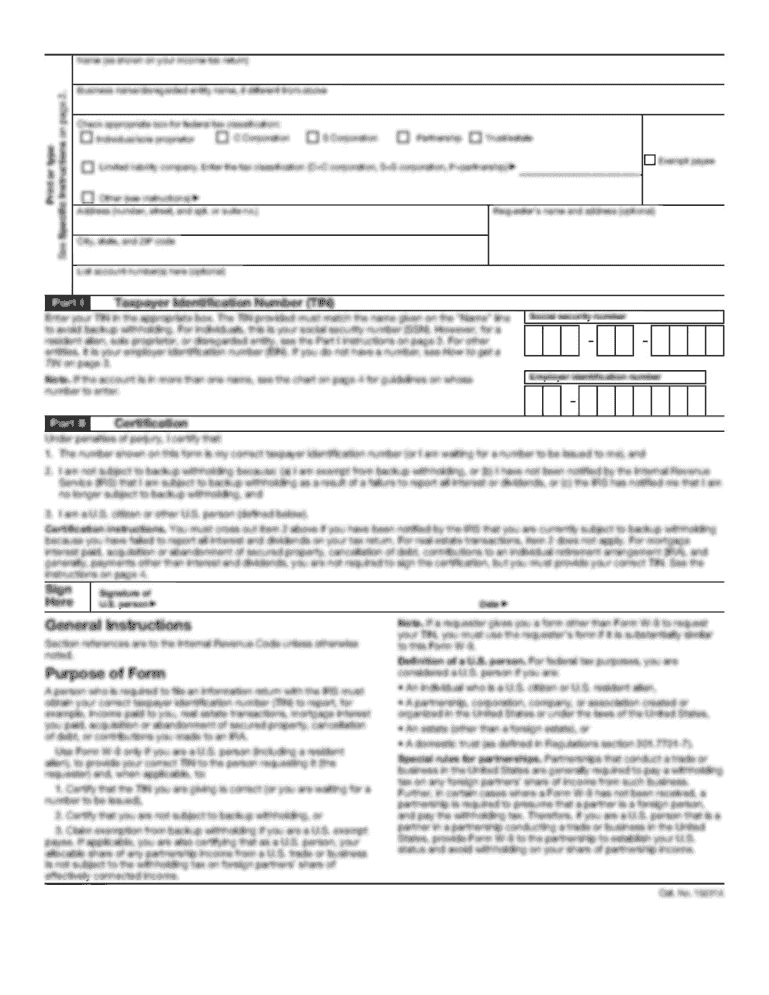

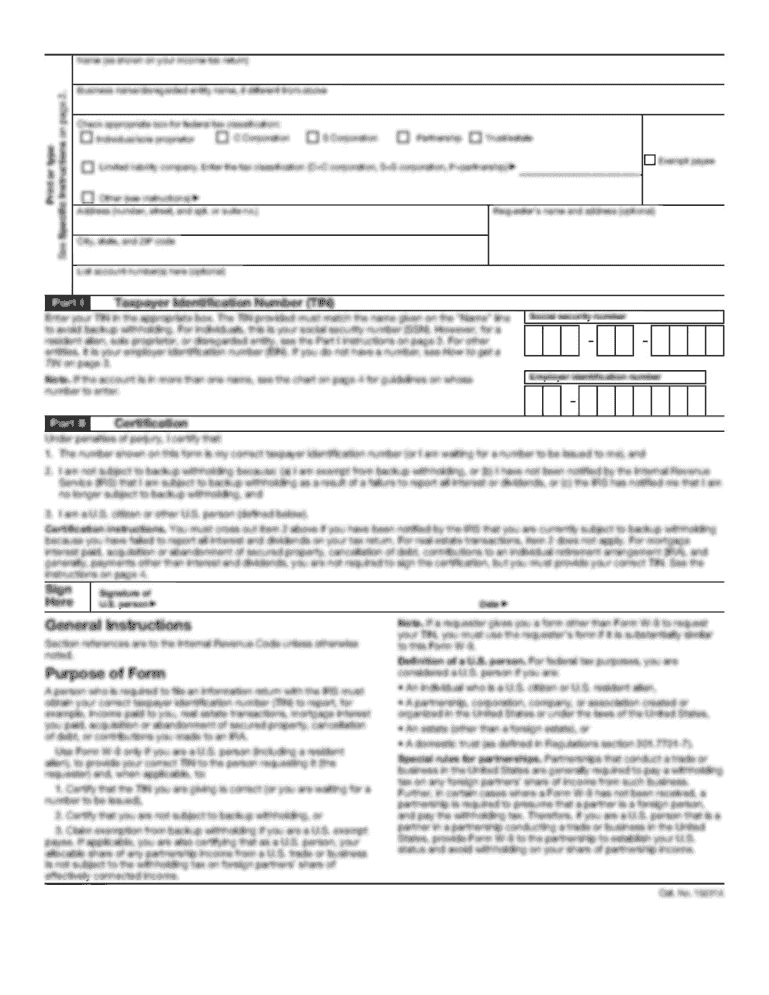

What is lesson 29 a son?

Lesson 29 a son is a form used for reporting certain types of income to the tax authorities.

Who is required to file lesson 29 a son?

Individuals or entities who have received income that needs to be reported on lesson 29 a son are required to file it.

How to fill out lesson 29 a son?

Lesson 29 a son can be filled out manually or electronically, following the instructions provided by the tax authorities.

What is the purpose of lesson 29 a son?

The purpose of lesson 29 a son is to accurately report income and ensure compliance with tax laws.

What information must be reported on lesson 29 a son?

Information such as the type and amount of income received must be reported on lesson 29 a son.

When is the deadline to file lesson 29 a son in 2024?

The deadline to file lesson 29 a son in 2024 is typically April 15th, but it is always best to check with the tax authorities for the exact deadline.

What is the penalty for the late filing of lesson 29 a son?

The penalty for late filing of lesson 29 a son can vary, but it may include fines or interest on any unpaid taxes.

How can I send lesson 29 a son to be eSigned by others?

lesson 29 a son is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I complete lesson 29 a son online?

pdfFiller has made it easy to fill out and sign lesson 29 a son. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I fill out lesson 29 a son on an Android device?

Use the pdfFiller mobile app to complete your lesson 29 a son on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your lesson 29 a son online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.