Get the free Reductions for people with disabilities application form - Sevenoaks ... - sevenoaks...

Show details

REDUCTIONS FOR PEOPLE WITH DISABILITIES A person liable to pay Council Tax may apply for a reduction in the bill under the Disabilities Regulations. Under the Regulations, a reduction is applicable

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your reductions for people with form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your reductions for people with form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit reductions for people with online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit reductions for people with. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

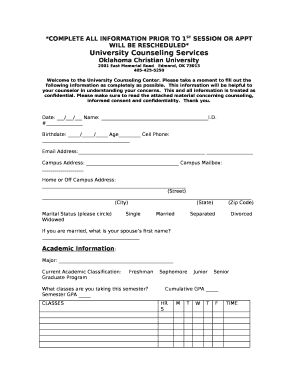

How to fill out reductions for people with

How to fill out reductions for people with:

01

Gather all the necessary documents such as financial statements, medical records, and proof of disability or special needs.

02

Review the instructions provided by the relevant agency or organization to ensure you understand the requirements for filling out reductions accurately.

03

Begin by providing your personal information, including name, address, contact details, and any identification numbers.

04

Specify the type of reduction you are applying for, whether it is a medical expense reduction, disability reduction, or any other applicable category.

05

Provide detailed information about your financial situation, including income, expenses, and any financial assistance or support you receive.

06

Clearly explain the reasons why you require the reduction, providing medical or disability-related information to support your claim.

07

Attach all the necessary supporting documents, making sure they are organized and labeled correctly.

08

Double-check all the information provided to ensure accuracy and completeness before submitting the reductions.

Who needs reductions for people with:

01

Individuals with disabilities: People with physical or mental disabilities may need reductions to assist them in managing their medical expenses or daily living costs.

02

Low-income families: Families or individuals who have limited financial resources may require reductions to alleviate the burden of expenses and improve their overall financial situation.

03

Senior citizens: Older adults who may be living on a fixed income or facing rising healthcare costs often seek reductions to help offset their financial challenges.

04

People with specific medical conditions: Individuals with chronic illnesses or medical conditions that require frequent medical expenses may benefit from reductions to ease the financial strain.

05

Students with special needs: Students who have special educational needs or disabilities may be eligible for reductions to ensure they receive proper support and services in their educational setting.

In conclusion, reductions are necessary for various individuals and groups, including individuals with disabilities, low-income families, senior citizens, people with specific medical conditions, and students with special needs. By understanding the process of filling out reductions accurately and providing the required documentation, these individuals can access the financial assistance they need to alleviate their financial burdens.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is reductions for people with?

Reductions for people with refer to the process of reducing certain taxes or fees for individuals who meet specific criteria or qualifications, such as low-income individuals or individuals with disabilities.

Who is required to file reductions for people with?

Individuals who meet the eligibility requirements for reductions for people with are required to file for these reductions. This may vary depending on the specific program or benefit.

How to fill out reductions for people with?

To fill out reductions for people with, individuals typically need to complete and submit the appropriate application or form provided by the relevant authority. The form may require information about the individual's income, assets, or disability status, depending on the specific requirements of the program.

What is the purpose of reductions for people with?

The purpose of reductions for people with is to provide financial assistance or relief to individuals who may have difficulty paying certain taxes or fees due to their financial circumstances or disabilities. These reductions aim to promote equity and support those in need.

What information must be reported on reductions for people with?

The specific information that must be reported on reductions for people with can vary depending on the program or benefit. However, common information required may include income details, assets, disability status, household size, and any other relevant eligibility criteria.

When is the deadline to file reductions for people with in 2023?

The deadline to file reductions for people with in 2023 may vary depending on the specific program or benefit. It is advisable to consult the relevant authority or refer to the program guidelines to determine the exact deadline.

What is the penalty for the late filing of reductions for people with?

The penalty for the late filing of reductions for people with can vary depending on the specific program or benefit. In some cases, individuals may face a reduction in the amount of the benefit they are eligible to receive, while in other cases, there may be additional financial penalties or consequences. It is important to adhere to the designated deadlines to avoid any potential penalties.

How can I modify reductions for people with without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your reductions for people with into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I make edits in reductions for people with without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing reductions for people with and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I edit reductions for people with on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute reductions for people with from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your reductions for people with online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.