Get the free united american insurance company beneficiary change form - laccd

Show details

Please check one: Beneficiary change for District-paid Life only Beneficiary change for Voluntary Life/ADD only Both Metropolitan Life Insurance Company BENEFICIARY DESIGNATION Employee No. Please

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your united american insurance company form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your united american insurance company form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit united american insurance company online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit united american insurance company. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

How to fill out united american insurance company

How to fill out united american insurance company?

01

Obtain the necessary forms from the United American Insurance Company. These forms are typically available on their website or can be requested through their customer service department.

02

Carefully read all instructions provided with the forms to ensure accurate completion. Make sure to understand the specific requirements and any required supporting documentation.

03

Fill in the personal information section of the forms accurately. This may include your name, address, contact information, and social security number.

04

Provide details about the insurance policy you are applying for. This may include the type of coverage, desired coverage amount, and any additional riders or options you wish to include.

05

Include any necessary medical information, if applicable. Some insurance policies may require you to disclose your medical history or undergo a medical examination.

06

Review the completed forms for any errors or omissions. Double-check the information provided to ensure accuracy.

07

Sign and date the forms as required. Some forms may need to be notarized or witnessed by a third party.

08

Before submitting the forms, make copies for your own records. This can help in case any issues or discrepancies arise later on.

Who needs united american insurance company?

01

Individuals who want to protect their financial well-being and provide for their loved ones in case of unexpected events or the loss of income.

02

Those who are looking for health insurance coverage to help with medical expenses and ensure access to quality healthcare.

03

Business owners or self-employed individuals who want to protect their business assets and manage potential risks.

04

Anyone who wants to plan for their retirement and ensure a stable and comfortable future.

05

Individuals with high-risk professions or hobbies that require additional coverage and protection.

06

Families with dependents or children who want to secure their educational needs and financial stability.

07

Those interested in supplemental insurance coverage to supplement any existing coverage or to fill gaps in specific areas.

08

Individuals looking for peace of mind and financial security during uncertain times.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is united american insurance company?

United American Insurance Company is an insurance provider that offers various types of insurance products to individuals and families. They provide health insurance coverage, including Medicare supplements, cancer insurance, critical illness coverage, life insurance, and other supplemental policies. The company has been operating since 1947 and is known for its focus on customer service and competitive rates. United American Insurance Company aims to provide financial protection and peace of mind to its policyholders.

Who is required to file united american insurance company?

It is not clear what you mean by "required to file United American Insurance Company."

If you are referring to filing taxes, then the company itself is required to file taxes with the relevant tax authorities. This is typically done by the company's financial or accounting department.

If you are referring to filing insurance claims, policyholders or beneficiaries who have incurred a covered loss or are seeking benefits from United American Insurance Company may need to file a claim with the company. This process is typically initiated by the policyholder or beneficiary themselves.

It is always best to consult with an insurance professional or the company directly to understand the specific requirements and procedures for filing with United American Insurance Company.

How to fill out united american insurance company?

To fill out the application for United American Insurance Company, you can follow the steps below:

1. Obtain the application form: You can request the application form from an insurance agent directly, or you may be able to download it from the company's website.

2. Personal information: Start by filling in your personal details such as your full name, date of birth, social security number, address, contact information, and email address. Make sure to provide accurate and up-to-date information.

3. Health information: United American Insurance Company may require you to provide information about your health and medical history. This could include details about any pre-existing conditions, ongoing treatments or medications, previous surgeries, allergies, and any chronic illnesses or disabilities.

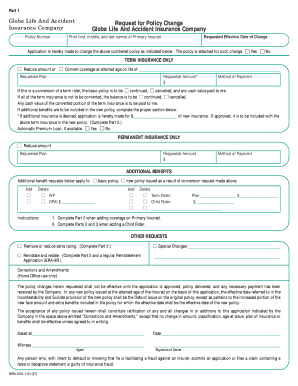

4. Choose your coverage: Determine the type of insurance coverage you are applying for, such as life insurance, health insurance, Medicare Supplement plans, or other available options. Select the specific plan or policy you are interested in.

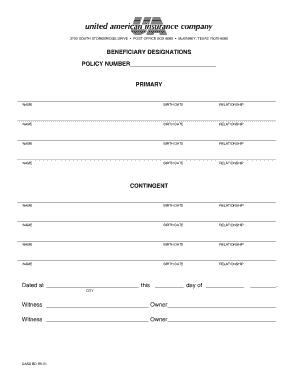

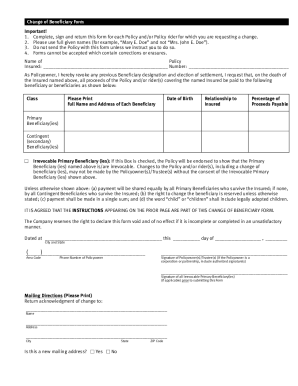

5. Beneficiary details: If you are applying for life insurance, you'll need to indicate who will receive the insurance payout in the event of your death. Provide the full name, contact information, and relationship of the beneficiary.

6. Policy preferences: Decide on the policy options you want, such as coverage amounts, riders, deductibles, or additional benefits. Make sure to carefully review the offered options and choose what best suits your needs.

7. Signature and date: Before submitting the application, read through it to ensure all the information provided is accurate. Sign and date the application form where indicated.

8. Submit your application: Once you have completed the form, you can submit it to United American Insurance Company. The submission process may vary; you can either hand it over to an insurance agent, mail it to the company's address, or submit it digitally if an online option is available.

Remember, it is vital to provide accurate and truthful information on the application, as any discrepancies or misinformation may impact your coverage or claims in the future.

What is the purpose of united american insurance company?

The purpose of United American Insurance Company is to provide insurance services and products to individuals and families across the United States. The company's primary focus is on offering various types of health and life insurance coverage, including Medicare supplement plans, individual health policies, and supplemental accident and disability coverage. The aim is to help customers protect themselves and their loved ones from potential financial hardship due to unforeseen medical expenses or loss of income. Additionally, United American Insurance Company strives to provide personalized customer service and build long-term relationships with policyholders.

What information must be reported on united american insurance company?

The specific information that must be reported on United American Insurance Company may vary depending on the purpose of the report, regulatory requirements, and the specific reporting entity. However, typical information that may be reported includes:

1. Financial Information: This includes the company's financial statements, including balance sheets, income statements, and cash flow statements. It also includes details about the company's assets, liabilities, revenue, expenses, and profitability.

2. Insurance Policies: This involves reporting on the types of insurance policies offered by United American Insurance Company, such as health insurance, life insurance, disability insurance, and annuities. Details about the policy terms, premiums, claims, and policyholders may be included.

3. Market Information: This includes information about the market in which United American Insurance Company operates, its competitive position, market share, and trends affecting the insurance industry.

4. Regulatory Compliance: Reports may include information related to the company's compliance with various regulatory requirements, including licensing, solvency, and consumer protection regulations. Information about regulatory audits, examinations, and any violations may also be reported.

5. Risk Management: Reports may provide information about the risks faced by United American Insurance Company and the strategies implemented to manage those risks. This may include information on underwriting policies, reinsurance arrangements, and risk mitigation measures.

6. Corporate Governance: Reports may contain details about the company's organizational structure, board of directors, executive team, and governance practices. It may include information on any changes in leadership or significant corporate events.

7. Social Responsibility: Some reports may include information on the company's social and environmental impact, such as its sustainability initiatives, community involvement, and corporate social responsibility programs.

It is important to note that the specific reporting requirements may differ based on the jurisdiction, regulatory body, and reporting standards applicable to United American Insurance Company.

Where do I find united american insurance company?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific united american insurance company and other forms. Find the template you want and tweak it with powerful editing tools.

How do I complete united american insurance company on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your united american insurance company. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I complete united american insurance company on an Android device?

On an Android device, use the pdfFiller mobile app to finish your united american insurance company. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your united american insurance company online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.