Get the free Automobile Insurance - Commercial Vehicle ... - Forte Insurance

Show details

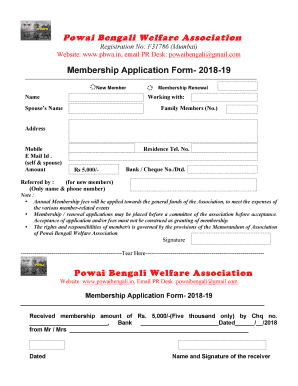

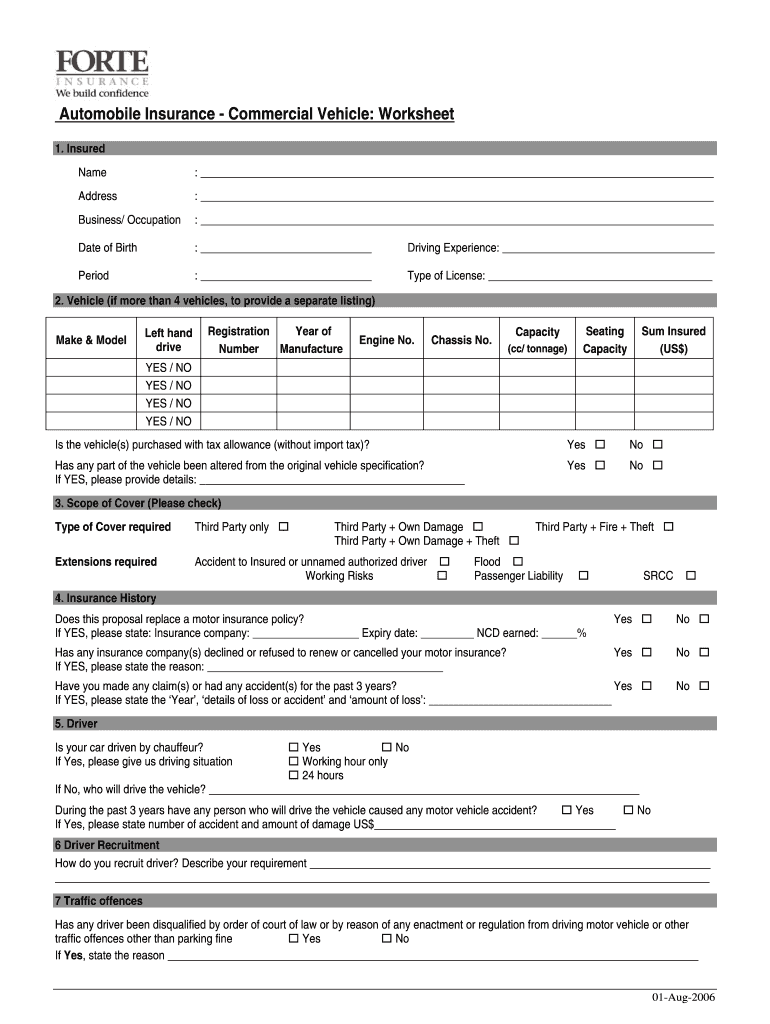

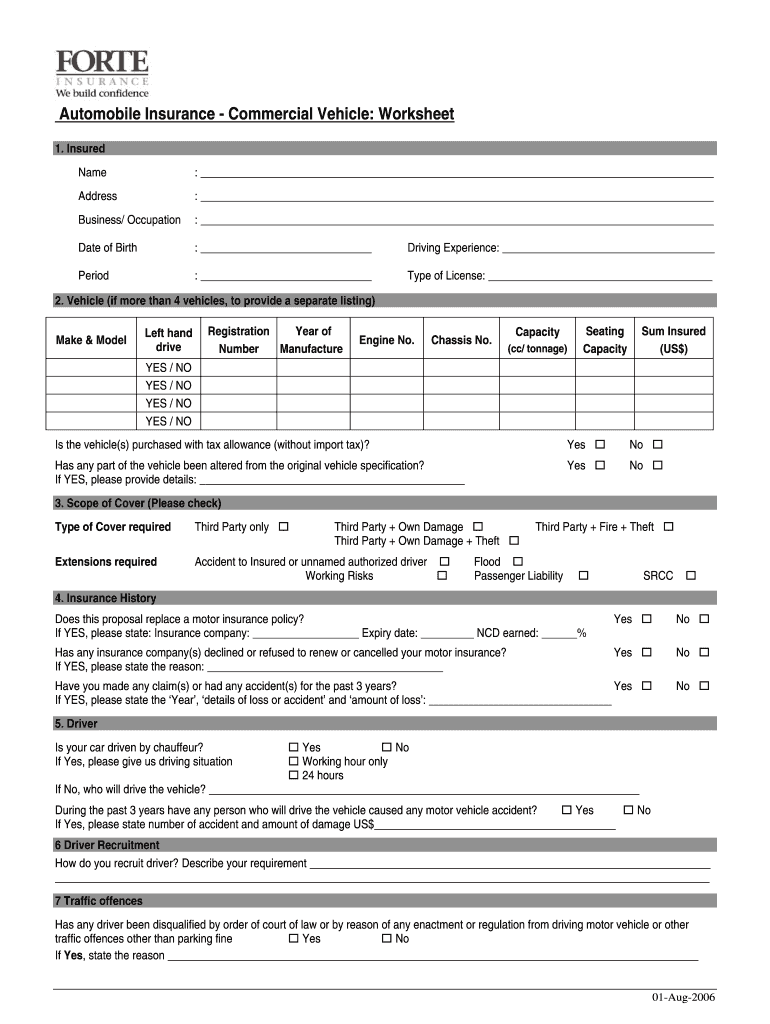

Automobile Insurance Commercial Vehicle: Worksheet 1. Insured Name : Address : Business/ Occupation : Date of Birth : Driving Experience: Period : Type of License: 2. Vehicle (if more than 4 vehicles,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your automobile insurance - commercial form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your automobile insurance - commercial form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit automobile insurance - commercial online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit automobile insurance - commercial. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

How to fill out automobile insurance - commercial

How to fill out automobile insurance - commercial:

01

Gather necessary information: Start by collecting all the essential details of your business, including the name, address, and contact information. Also, gather information about the vehicles you intend to insure, such as make, model, and year.

02

Determine coverage needs: Assess your business's specific needs and risks to determine the appropriate coverage level. Consider factors like the type of vehicles, their usage, and the nature of your business operations.

03

Seek professional advice: Reach out to an insurance agent or broker specializing in commercial automobile insurance. They can guide you through the process, explain various coverage options, and help you make the right choices for your business.

04

Request quotes: Obtain quotes from multiple insurance providers to compare prices and coverage options. Provide accurate and detailed information to ensure you receive accurate quotes tailored to your business.

05

Review and select a policy: Carefully review each policy's terms, conditions, and coverage limits. Consider the cost versus the coverage provided. Once you have evaluated and compared different policies, choose the one that best meets your business's needs and budget.

06

Complete the application: Fill out the application form provided by the chosen insurance company. Provide accurate and comprehensive information, as any inaccuracies or omissions could impact your coverage.

07

Provide supplementary documents: The insurance company may request additional documents, such as vehicle registration papers, driver information, proof of business ownership, and financial records. Make sure to submit all required documents promptly.

08

Review and sign the policy: After the insurance company processes your application, carefully review the policy document. Ensure that all the agreed-upon coverage and terms are properly reflected. If everything is correct, sign the policy to activate your coverage.

Who needs automobile insurance - commercial?

01

Businesses with company-owned vehicles: Companies that own cars, trucks, vans, or other vehicles used for business purposes require commercial automobile insurance coverage.

02

Commercial vehicle operators: Individuals or businesses engaged in activities such as trucking, delivery services, taxi or limousine services, and courier services need commercial automobile insurance to protect against potential liability claims.

03

Contractors and tradespeople: Contractors and tradespeople who use vehicles for their professional activities, such as construction, plumbing, electrical work, or landscaping, should have commercial automobile insurance to safeguard against accidents or damages during business operations.

04

Business fleets: Any business operating a fleet of vehicles, whether for transportation, logistics, or other purposes, should have commercial automobile insurance. This coverage can protect the fleet against risks and provide financial security in case of accidents.

05

Non-profit organizations: Non-profit organizations that operate vehicles for charitable purposes, community services, or transportation of goods must obtain commercial automobile insurance to protect their assets and fulfill legal requirements.

Remember, it is crucial to consult with an insurance professional to determine the specific needs and obligations for your business when it comes to commercial automobile insurance.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is automobile insurance - commercial?

Automobile insurance - commercial provides coverage for vehicles used for business purposes.

Who is required to file automobile insurance - commercial?

Commercial vehicle owners or businesses that use vehicles for business purposes are required to file automobile insurance - commercial.

How to fill out automobile insurance - commercial?

To fill out automobile insurance - commercial, one must provide information about the business, the vehicles being insured, and the coverage needed.

What is the purpose of automobile insurance - commercial?

The purpose of automobile insurance - commercial is to protect businesses from financial losses due to accidents or damages involving their commercial vehicles.

What information must be reported on automobile insurance - commercial?

Information such as the business name, address, vehicle details, driver information, coverage limits, and any past claims must be reported on automobile insurance - commercial.

When is the deadline to file automobile insurance - commercial in 2024?

The deadline to file automobile insurance - commercial in 2024 is usually determined by the insurance provider or regulatory agency and may vary.

What is the penalty for the late filing of automobile insurance - commercial?

Penalties for late filing of automobile insurance - commercial may include fines, loss of coverage, or legal consequences, depending on the jurisdiction.

How can I send automobile insurance - commercial for eSignature?

When you're ready to share your automobile insurance - commercial, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit automobile insurance - commercial online?

With pdfFiller, it's easy to make changes. Open your automobile insurance - commercial in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I fill out the automobile insurance - commercial form on my smartphone?

Use the pdfFiller mobile app to complete and sign automobile insurance - commercial on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Fill out your automobile insurance - commercial online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.