OPM, by rule, may exempt from the time limitation provisions this paragraph if it determines that the employee or his or her representative has complied substantially with the requirements set forth in Sec. 4.4(a)(1) through (5) and is otherwise authorized to file on or before the close of the 1-year time limit. (e) In lieu of the 1-year period specified in paragraph (d) of this section, an individual may file an application for retirement in connection with separation on a later date, that is, upon attainment of age 62 or upon obtaining disability retirement under 5 U.S.C. app. 2103(2). A former employer receiving a copy of the application for retirement must immediately notify the retiree that the application will be processed no later than the date it is filed. If the application for retirement was filed on a timely basis in the regular application review process, the employee must receive a creditable credit on her or his record for each year during which the application was filed. If the application for retirement was filed more than 1 year after the date of separation, the employee must receive a creditable contribution under Sec. 6.1 for each year the application was not filed. (f) A retirement plan under which a participant who is a member of a pension plan is separated from employment by reason of a separation of employment for cause that occurs within the first year after separation is to be treated for the purpose of the 1-year time limit contained in paragraph (d) of this section as if the separation did not occur until one year after the date the retirement plan was established. (g) The time limit with respect to the application for retirement on or after retirement benefits are due is to run from the day upon which the employee first receives payment under the pension plan. A retired employee can only be entitled to an advance in credits based on time that has elapsed since his or her date of termination of service or from the day he or she first becomes an unreduced participant under a plan to which §403A(d)(8) applies. (h) The time limit contained in this paragraph applies to an employee retired under part I before his or her separation from employment. (i) The time limit contained in this paragraph applies to a retired member under part I who receives or begins receiving pension benefits under chapter 53 of title 5, United States Code, or chapter 84 of title 5, United States Code, or who is entitled to an annuity based on such payments.

Get the free 5 CFR Ch. I (1 1 11 Edition) 831.1205 - edocket access gpo

Show details

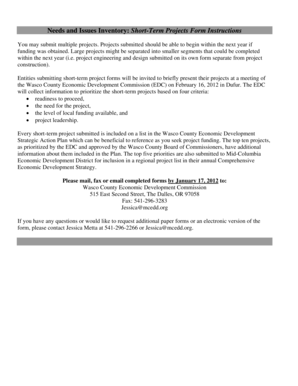

831.1205 form not prescribed by OPM, is deemed timely filed. OPM will not adjudicate the application or make payment until the application is filed on a form prescribed by OPM. (d) OPM may waive the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 5 cfr ch i form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 5 cfr ch i form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 5 cfr ch i online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 5 cfr ch i. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 5 cfr ch i?

5 CFR Ch I refers to Title 5 of the Code of Federal Regulations, which contains regulations governing the administrative personnel of the federal government in the United States.

Who is required to file 5 cfr ch i?

The requirement to file under 5 CFR Ch I depends on the specific regulations within the chapter. It may apply to federal employees, government agencies, or other relevant entities, as specified in the corresponding regulations.

How to fill out 5 cfr ch i?

The process of filling out forms or complying with regulations under 5 CFR Ch I will vary depending on the specific requirements outlined in the chapter. It is important to refer to the relevant regulations and follow the instructions provided.

What is the purpose of 5 cfr ch i?

The purpose of 5 CFR Ch I is to establish regulations and guidelines for the personnel management and administrative operations of the federal government. It aims to ensure consistency, fairness, and efficiency in government processes.

What information must be reported on 5 cfr ch i?

The specific information that needs to be reported on 5 CFR Ch I forms or filings will depend on the regulations within the chapter. It may include details related to personnel management, administrative procedures, financial disclosures, or other relevant information as required by the corresponding regulations.

When is the deadline to file 5 cfr ch i in 2023?

The deadline to file under 5 CFR Ch I in 2023 will depend on the specific regulations and forms applicable to the filing. It is important to refer to the relevant regulations and instructions for the specific deadline.

What is the penalty for the late filing of 5 cfr ch i?

Penalties for the late filing of 5 CFR Ch I will be outlined in the corresponding regulations. The specific penalties may vary depending on the nature of the filing, the timeframe of the delay, and other relevant factors as determined by the governing authorities.

How can I manage my 5 cfr ch i directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your 5 cfr ch i and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I edit 5 cfr ch i straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing 5 cfr ch i right away.

Can I edit 5 cfr ch i on an iOS device?

You certainly can. You can quickly edit, distribute, and sign 5 cfr ch i on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Fill out your 5 cfr ch i online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.