Get the free gtc power of attorney form

Show details

B/L or Reg #: PRESENTATION OF LOSS AND DAMAGE CLAIM GOLDEN TRANSFER COMPANY 111 South Pratt Parkway; PO Box 907 Longmont, CO 80502-0907 303-776-3882 800-525-3290 (fax)303-772-4085 www.goldenvanlines.com

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gtc power of attorney

Edit your gtc power of attorney form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gtc power of attorney form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gtc power of attorney online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit gtc power of attorney. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

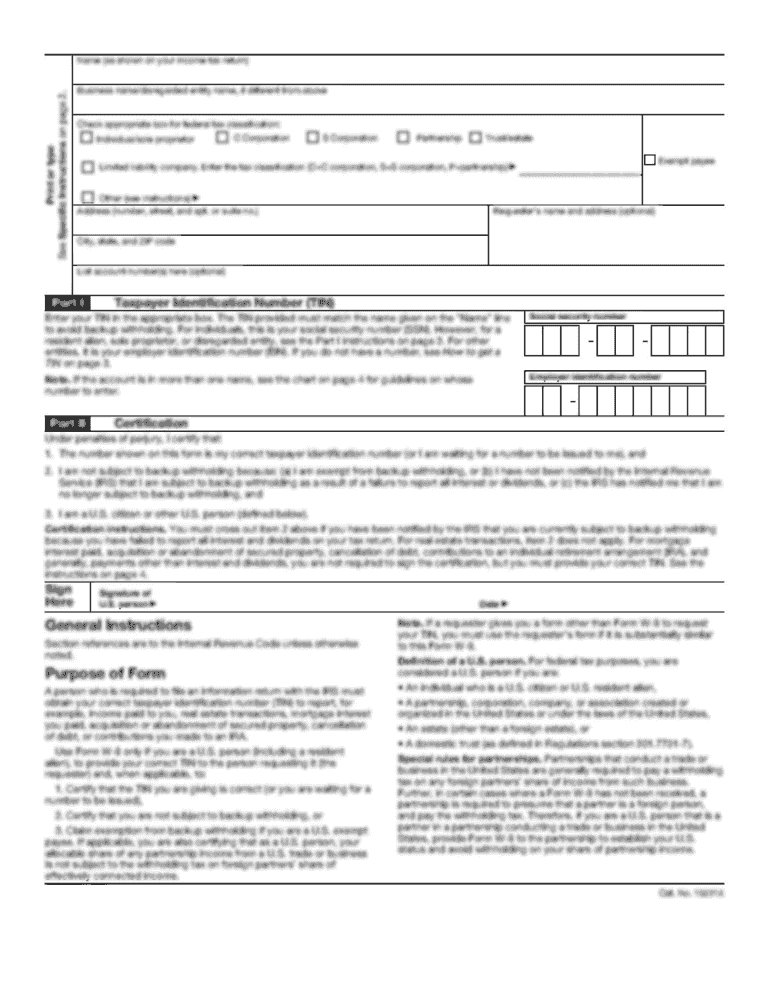

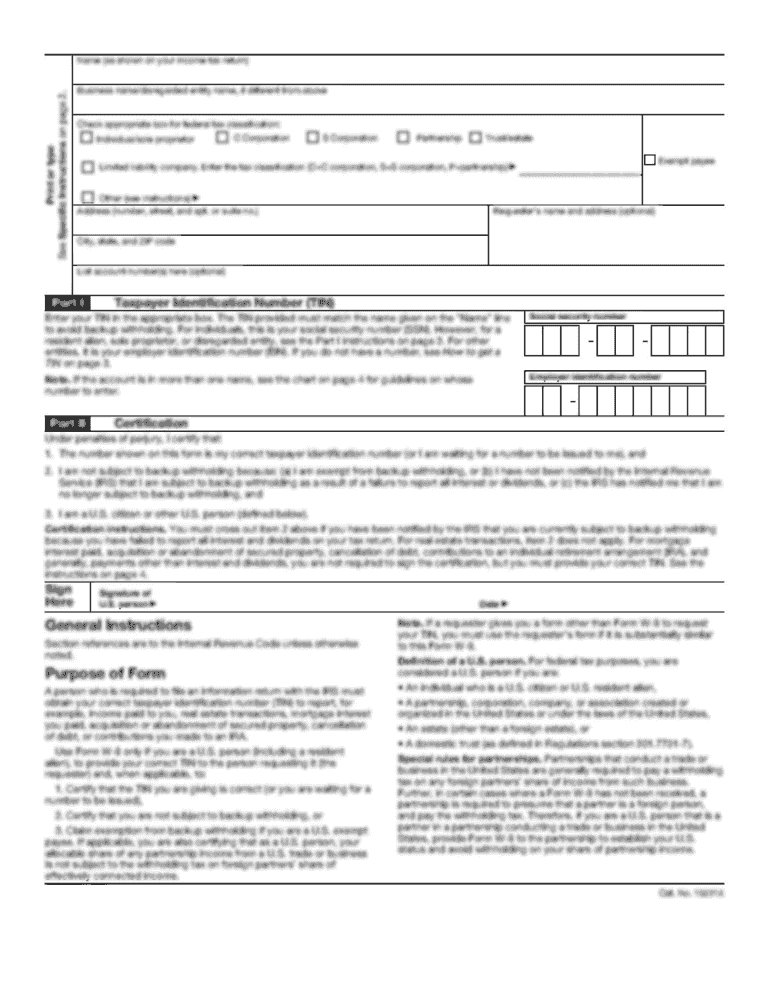

How to fill out gtc power of attorney

How to fill out gtc power of attorney:

01

Gather all necessary information and documents such as identification, contact information, and relevant details about the person granting the power of attorney (the principal) and the person being appointed as the attorney-in-fact (the agent).

02

Carefully read and understand the gtc power of attorney form. Ensure that you have the correct and updated version of the form as requirements may vary by jurisdiction.

03

Start by entering your personal information as the principal, including your full legal name, address, and contact details. Provide any additional required information, such as your social security number or date of birth.

04

Identify the agent by providing their full legal name, address, and contact details. If there is more than one agent, clearly indicate their roles and responsibilities.

05

Determine the powers and limitations to be granted to the agent. Specify whether the power of attorney is durable (continues even if the principal becomes incapacitated) or limited (for specific purposes or duration). Detail the specific powers that the agent will have, such as managing finances, making healthcare decisions, or handling legal matters.

06

If desired, appoint a successor agent who will take over if the initially appointed agent is unable or unwilling to fulfill their duties.

07

Sign and date the gtc power of attorney form in the presence of a notary public or witnesses, as required by your jurisdiction. Follow any additional instructions for execution and submission of the form.

08

Keep a copy of the executed gtc power of attorney form for your records and provide copies to the agent and any other relevant parties, such as banks or healthcare providers, as necessary.

Who needs gtc power of attorney:

01

Individuals who want to appoint someone they trust to handle their financial, legal, or healthcare matters in the event they become incapacitated or unable to make decisions.

02

People who anticipate being unavailable or unable to manage their affairs due to travel, illness, or other circumstances and want to grant authority to another person to act on their behalf.

03

Individuals who want to ensure that their wishes and preferences are followed when it comes to their financial, legal, or healthcare matters.

04

People who may not have family members or close friends who can readily assist them, and thus choose to appoint a trusted professional or organization to act as their agent.

05

Anyone who wants to have peace of mind knowing that their affairs will be managed by a responsible and trustworthy person if they are unable to do so themselves.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify gtc power of attorney without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including gtc power of attorney, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I edit gtc power of attorney in Chrome?

gtc power of attorney can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I edit gtc power of attorney straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing gtc power of attorney.

What is gtc power of attorney?

A GTC power of attorney is a legal document that grants someone the authority to act on your behalf in financial matters related to your GTC (Global Tax Compliance) obligations.

Who is required to file gtc power of attorney?

Any individual or entity who wants to authorize another person or entity to handle their GTC obligations is required to file a GTC power of attorney.

How to fill out gtc power of attorney?

To fill out a GTC power of attorney, you need to provide your personal information, identify the authorized representative, specify the scope of authority, and sign the document in the presence of witnesses or a notary public.

What is the purpose of gtc power of attorney?

The purpose of a GTC power of attorney is to legally empower another person or entity to handle your GTC obligations, such as filing taxes, making financial transactions, or communicating with tax authorities on your behalf.

What information must be reported on gtc power of attorney?

A GTC power of attorney typically requires the reporting of personal information of the grantor and authorized representative, including their names, addresses, contact details, and any specific limitations or conditions on the representative's authority.

Fill out your gtc power of attorney online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gtc Power Of Attorney is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.