Get the free Credit Application Form - Wood Fibers Inc.

Show details

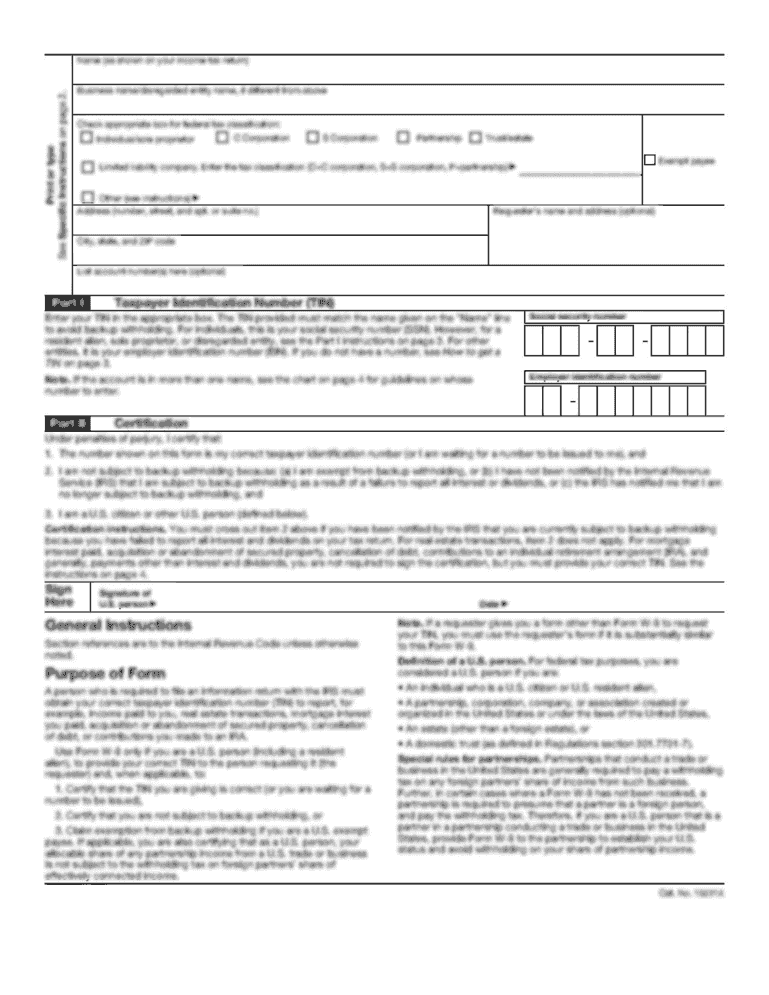

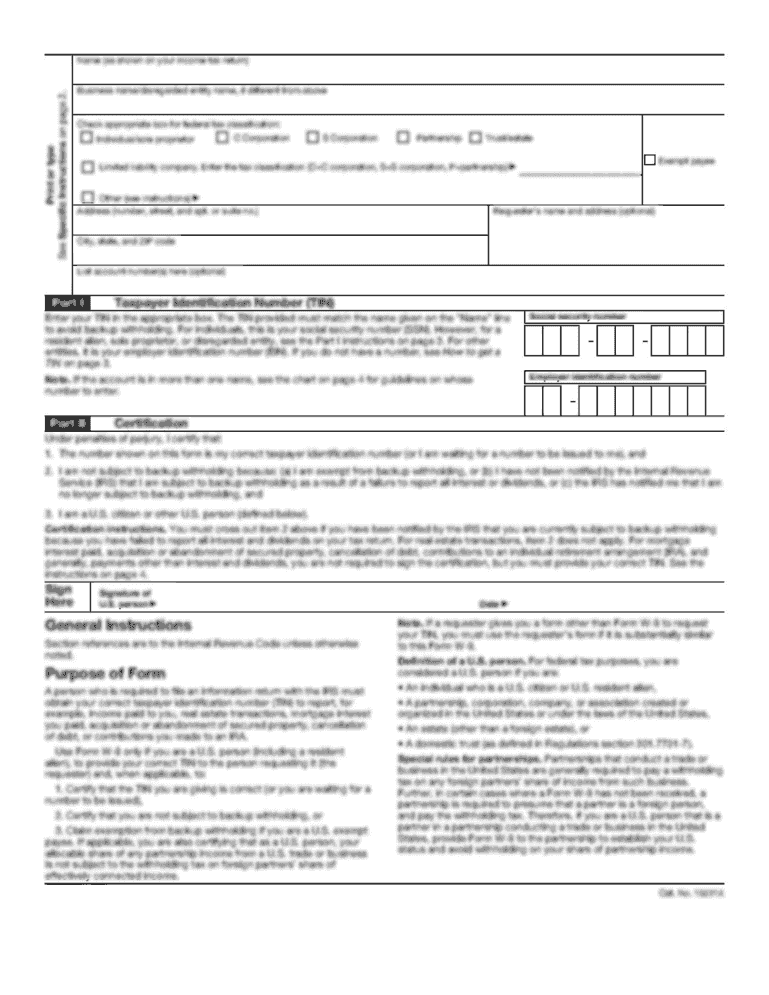

Credit Application Form COMPANY PROFILE Company Name Street Address City State Zip Phone Fax Billing Address (if different from above) City State Zip Email Address Accounts Payable Phone Number Accounts

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your credit application form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit application form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit application form online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit credit application form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

How to fill out credit application form

How to fill out a credit application form:

01

Gather all necessary information: Before starting to fill out the credit application form, make sure you have all the required information readily available. This may include personal details, employment history, financial information, and references.

02

Read the instructions carefully: Take the time to carefully read through the instructions provided on the credit application form. Familiarize yourself with any specific requirements or additional documents that may be needed.

03

Provide accurate personal information: Begin by accurately filling in your personal details, such as your full name, current address, contact information, and social security number. Double-check for any typing errors or misspellings.

04

Employment history: Fill in your employment history, including the names of previous employers, job titles, dates of employment, and salary details. It is important to be honest and provide accurate information.

05

Financial information: The credit application form will likely require you to divulge financial information such as your annual income, bank account details, and any existing loans or debts. Make sure to provide accurate figures and supporting documentation if required.

06

Provide references: Some credit application forms may ask for personal or professional references. Ensure you have permission from the individuals you wish to list as references, and accurately provide their contact information.

07

Review and sign the form: Once you have completed filling out the credit application form, thoroughly review all the information provided. Check for any mistakes or missing details. If everything is accurate, sign the form as required, indicating that the information you provided is true to the best of your knowledge.

Who needs a credit application form?

01

Individuals applying for a loan: When applying for a loan, financial institutions typically require the completion of a credit application form. This allows them to assess your creditworthiness and determine whether you qualify for the loan.

02

Businesses seeking credit: Businesses often need credit to fund their operations or invest in new ventures. Therefore, they may be required to complete credit application forms to apply for business loans or lines of credit.

03

Landlords and property managers: When screening potential tenants, landlords and property managers may request applicants to fill out a credit application form. This helps them evaluate an applicant's financial responsibility and ability to pay rent on time.

04

Credit card issuers: Applicants looking to obtain a credit card may be asked to complete a credit application form to provide the necessary information for a credit check. This helps the credit card issuer assess the applicant's creditworthiness and determine their credit limit.

05

Individuals seeking financing: Whether it's for purchasing a vehicle, furniture, or any other major item, individuals looking for financing options may need to complete a credit application form. This allows the financing company to evaluate their ability to make regular payments.

In summary, credit application forms are necessary for individuals and businesses applying for loans or credit, landlords conducting tenant screenings, credit card issuers, and individuals seeking financing options for various purchases.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is credit application form?

A credit application form is a document used by individuals or businesses to apply for credit from a financial institution or creditor. It includes personal, financial, and business information that helps assess the creditworthiness of the applicant.

Who is required to file credit application form?

Any individual or business seeking credit from a financial institution or creditor is required to file a credit application form.

How to fill out credit application form?

To fill out a credit application form, you need to provide accurate personal, financial, and business information. This may include your name, address, social security number, employment details, income sources, and details about your financial obligations and assets.

What is the purpose of credit application form?

The purpose of a credit application form is to gather relevant information about the applicant's creditworthiness. It helps financial institutions and creditors assess the risk associated with extending credit and make informed decisions.

What information must be reported on credit application form?

A credit application form typically requires personal information such as name, address, contact details, social security number, employment history, income details, monthly expenses, and information about existing debts and assets.

When is the deadline to file credit application form in 2023?

The specific deadline to file a credit application form in 2023 may vary depending on the financial institution or creditor. It is recommended to contact them directly or refer to their guidelines for the exact deadline.

What is the penalty for the late filing of credit application form?

Penalties for the late filing of a credit application form can vary depending on the financial institution or creditor. It is advisable to review their terms and conditions or contact them directly for information about any penalties or consequences of late filing.

How can I send credit application form to be eSigned by others?

Once you are ready to share your credit application form, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Where do I find credit application form?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific credit application form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an eSignature for the credit application form in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your credit application form and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Fill out your credit application form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.