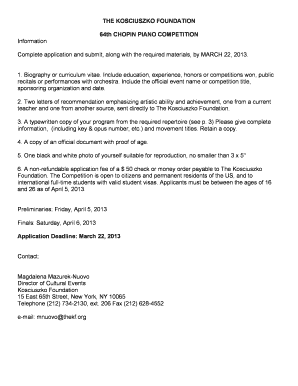

Get the free t STATE OF CALIFORNIA HEALTH AND HUMAN SERVICES AGENCY CALIFORNIA DEPARTMENT OF SOCI...

Show details

T STATE OF CALIFORNIA HEALTH AND HUMAN SERVICES AGENCY CALIFORNIA DEPARTMENT OF SOCIAL SERVICES COMMUNITY CARE LICENSING DIVISION CIVIL PENALTY ASSESSMENT IMMEDIATE COLD Regional Office, 7575 METROPOLITAN

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your t state of california form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your t state of california form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit t state of california online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit t state of california. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

How to fill out t state of california

How to fill out T state of California:

01

Obtain the necessary forms: Visit the California Franchise Tax Board website or your local tax office to download or request the T state form. Alternatively, you can file online through the FTB website.

02

Provide personal information: Fill in your full name, address, social security number, and any other required identification details as specified on the form. Be sure to double-check the accuracy of this information to avoid any processing issues.

03

Report your income: Indicate all sources of income earned during the tax year. This includes wages, self-employment income, rental income, interest, dividends, and any other applicable types of income. Attach any necessary supporting documentation, such as W-2 forms or 1099s.

04

Calculate deductions: Determine if you are eligible for any deductions, such as mortgage interest, student loan interest, medical expenses, or charitable contributions. Subtract these deductions from your total income to arrive at your taxable income.

05

Determine tax liability or refund: Use the tax brackets and rates provided on the T state form or the FTB instructions to calculate your tax liability. Compare this amount to any payments already made throughout the year, such as payroll withholdings or estimated tax payments. If you have overpaid, you may be entitled to a refund.

06

Sign and submit: After reviewing the completed form for accuracy and completeness, sign and date your T state of California form. If filing electronically, follow the instructions to digitally sign and submit your return. If filing by mail, make sure to include any required payment and mail the form to the appropriate address.

Who needs T state of California:

01

California residents: Any individual who is a resident of California for tax purposes, meaning they lived in the state for more than six months during the tax year, must file a T state of California form.

02

Nonresident individuals: Nonresidents who earned income from California sources that exceeds the minimum filing threshold are also required to file a T state return.

03

Part-year residents: Individuals who moved in or out of California during the tax year may need to file a T state form to report income earned while a resident of the state.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my t state of california in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your t state of california and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I create an electronic signature for signing my t state of california in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your t state of california and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out the t state of california form on my smartphone?

Use the pdfFiller mobile app to complete and sign t state of california on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Fill out your t state of california online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.