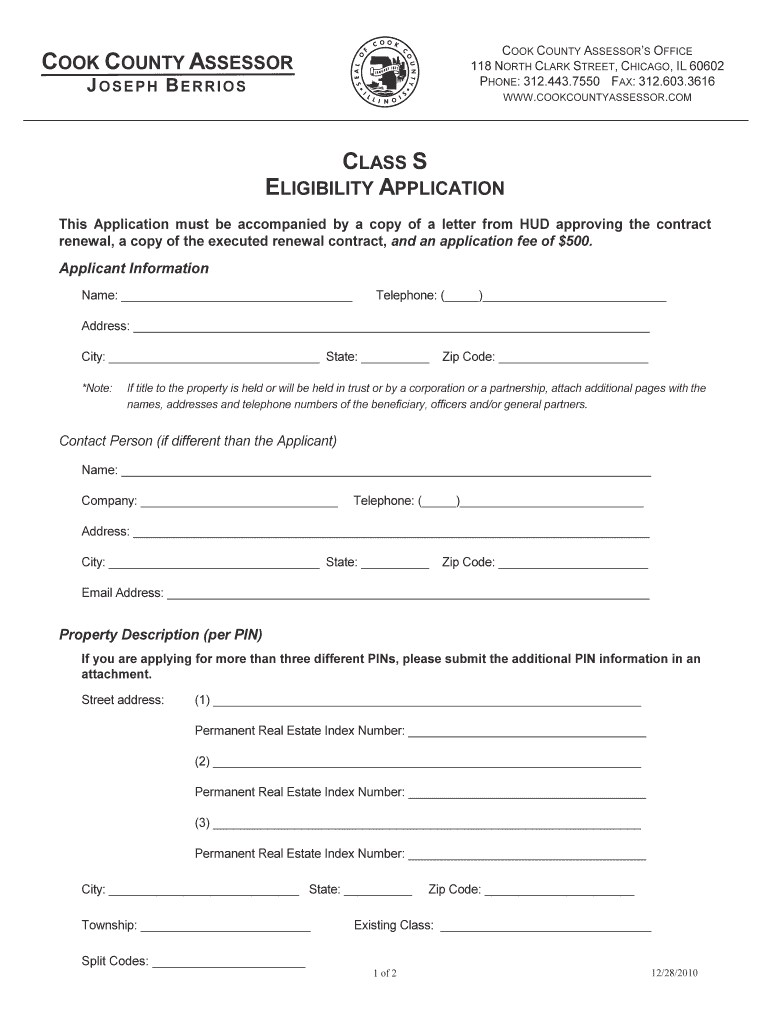

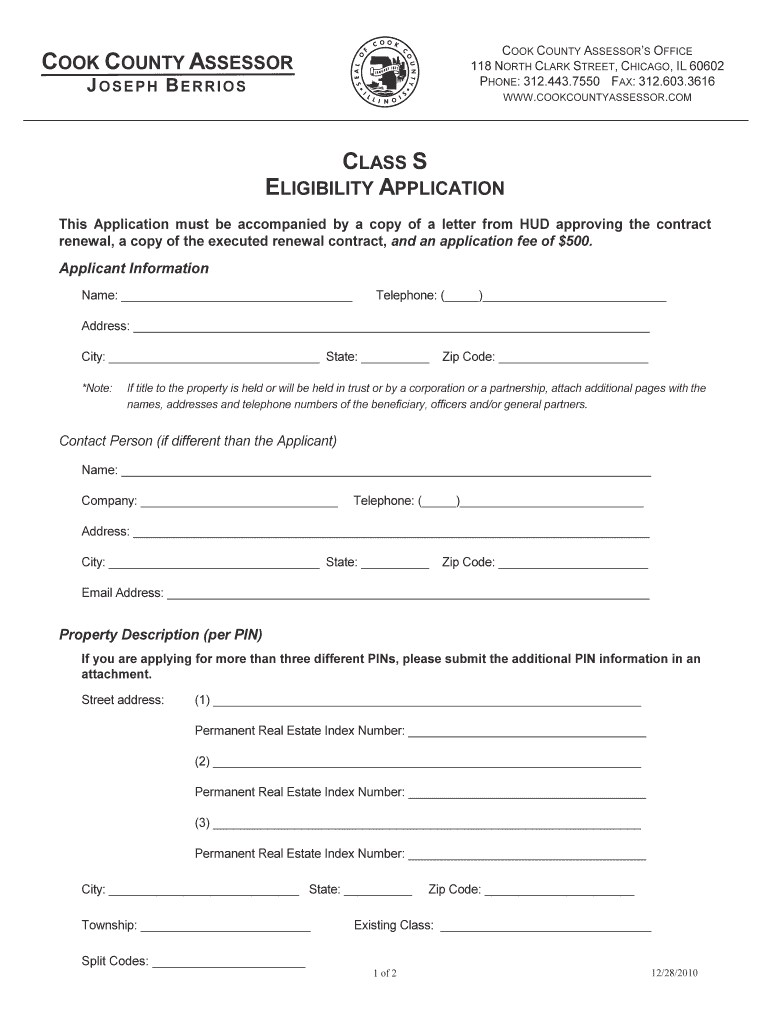

Get the free COOK COUNTY ASSESSOR JOSEPH BERRIOS COOK COUNTY ASSESSOR'S OFFICE 118 NORTH CLARK ST...

Show details

COOK COUNTY ASSESSOR JOSEPH BERRIES COOK COUNTY ASSESSOR'S OFFICE 118 NORTH CLARK STREET, CHICAGO, IL 60602 PHONE: 312.443.7550 FAX: 312.603.3616 WWW.COOKCOUNTYASSESSOR.COM CLASS S ELIGIBILITY APPLICATION

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your cook county assessor joseph form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cook county assessor joseph form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cook county assessor joseph online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit cook county assessor joseph. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out cook county assessor joseph

How to fill out cook county assessor joseph?

01

Visit the official website of Cook County Assessor Joseph and navigate to the section for filling out the form.

02

Carefully read through the instructions provided on the website to understand the required information and documents.

03

Gather all the necessary documents, such as property identification, ownership details, and any relevant supporting documents.

04

Start filling out the form step by step, following the provided instructions. Enter accurate and up-to-date information.

05

Double-check all the fields to ensure that you haven't missed any required information or made any errors.

06

Review the completed form to make sure everything is accurate and complete.

07

Submit the filled-out form as instructed on the website, either by mail, in person, or by using an online submission system.

Who needs cook county assessor joseph?

01

Property owners in Cook County who want to assess the value of their property.

02

Individuals or businesses that need property tax information for legal or financial purposes.

03

Real estate agents and brokers who require information about properties in Cook County for their clients.

04

Lenders and financial institutions that need property valuation for loan or mortgage purposes.

05

Potential buyers or sellers who want to have a better understanding of property values in Cook County before making transactions.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is cook county assessor joseph?

The Cook County Assessor Joseph is the elected official responsible for determining the value of real estate properties within Cook County, Illinois.

Who is required to file cook county assessor joseph?

All property owners within Cook County are required to file the Cook County Assessor Joseph form.

How to fill out cook county assessor joseph?

To fill out the Cook County Assessor Joseph form, property owners must provide information such as property details, ownership information, and income details related to the property.

What is the purpose of cook county assessor joseph?

The purpose of the Cook County Assessor Joseph is to assess and determine the value of real estate properties for tax purposes.

What information must be reported on cook county assessor joseph?

Property owners must report details such as property address, owner information, income from the property, property characteristics, and any exemptions or incentives applicable to the property on the Cook County Assessor Joseph form.

When is the deadline to file cook county assessor joseph in 2023?

The deadline to file the Cook County Assessor Joseph form in 2023 is April 3rd.

What is the penalty for the late filing of cook county assessor joseph?

The penalty for late filing of the Cook County Assessor Joseph form is a 10% fine of the assessed value of the property.

How can I modify cook county assessor joseph without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including cook county assessor joseph, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I edit cook county assessor joseph in Chrome?

cook county assessor joseph can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out cook county assessor joseph on an Android device?

On Android, use the pdfFiller mobile app to finish your cook county assessor joseph. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your cook county assessor joseph online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.