Get the free Two Way CA for Acquirers of 0191

Show details

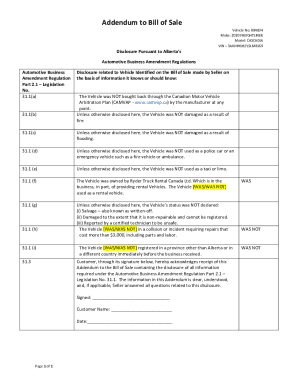

Two Way Confidentiality Agreement Permitted Purpose: To allow the parties to share confidential information and to engage in discussions for the purpose of Party 2 or one of its associates to acquire

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your two way ca for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your two way ca for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing two way ca for online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit two way ca for. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out two way ca for

How to fill out a two way CA form:

01

Begin by writing the name and contact information of the person filling out the form. This includes their full name, address, telephone number, and email address.

02

Next, specify the purpose for which the two way CA is being requested. This could be for a business transaction, a legal agreement, or any other relevant reason.

03

Identify the parties involved in the agreement. This includes providing the names, addresses, and other pertinent details of both the party initiating the agreement and the party they are entering into the agreement with.

04

Describe the terms and conditions of the agreement. This entails specifying the obligations, rights, and responsibilities of both parties, as well as any deadlines or performance standards that need to be met.

05

Include any necessary provisions or clauses that are relevant to the agreement. This could cover areas such as confidentiality, dispute resolution mechanisms, termination procedures, indemnification, or any other specific requirements.

06

Ensure that all parties involved sign and date the two way CA form. This signifies their agreement to the terms and conditions outlined in the document.

Who needs a two way CA form:

01

Businesses engaging in a partnership or joint venture often require a two way CA to establish the terms and responsibilities of each party involved.

02

Individuals or organizations entering into a mutual non-disclosure agreement may need a two way CA form. This ensures that both parties agree to keep certain information confidential.

03

For transactions involving the exchange of goods or services, a two way CA can help clarify the terms and conditions, as well as provide legal protection for both the buyer and seller.

In summary, anyone seeking to establish clear terms and conditions, protect confidential information, or clarify obligations and responsibilities between two parties may require a two way CA form.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

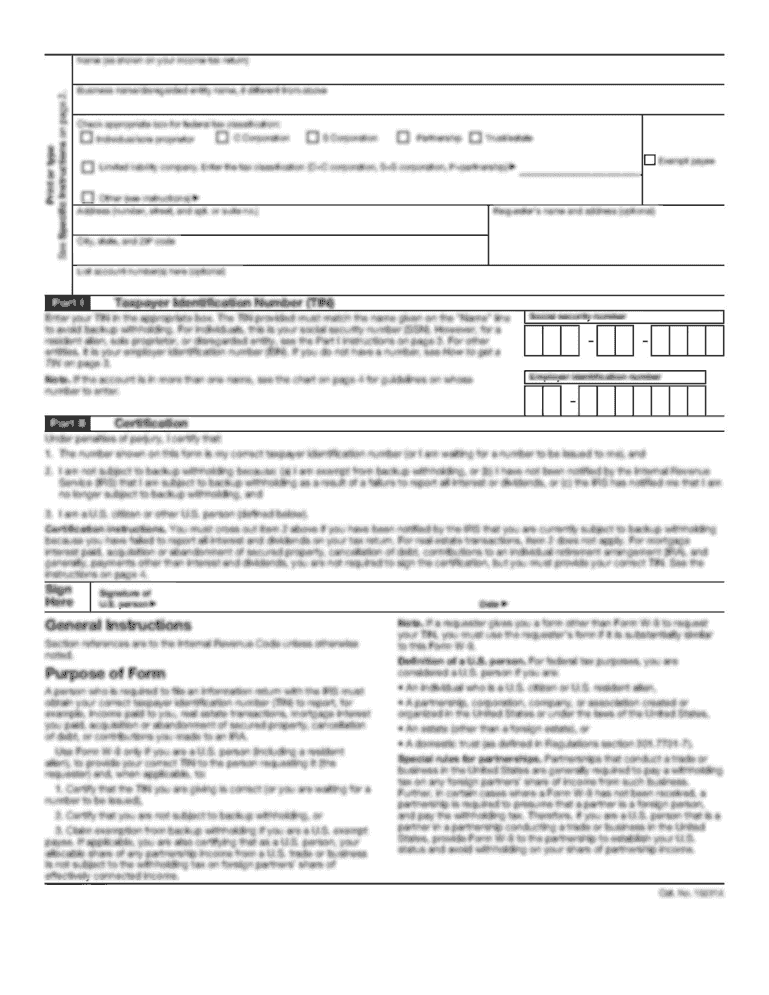

What is two way ca for?

The Two Way CA form is used for reporting cross-border transactions by US residents with foreign individuals or businesses. It is required to report and document these transactions for tax purposes.

Who is required to file two way ca for?

US residents who engage in cross-border transactions with foreign individuals or businesses are required to file the Two Way CA form.

How to fill out two way ca for?

To fill out the Two Way CA form, you need to provide information about the cross-border transactions, such as the nature of the transaction, the amount involved, the date, and the parties involved. The form can be completed electronically or manually.

What is the purpose of two way ca for?

The purpose of the Two Way CA form is to report cross-border transactions, track money flow between US residents and foreign entities, and ensure compliance with tax regulations.

What information must be reported on two way ca for?

The Two Way CA form requires reporting of details such as the type of transaction, the parties involved, the amount, the date, and any other relevant information that helps identify and document the cross-border transaction.

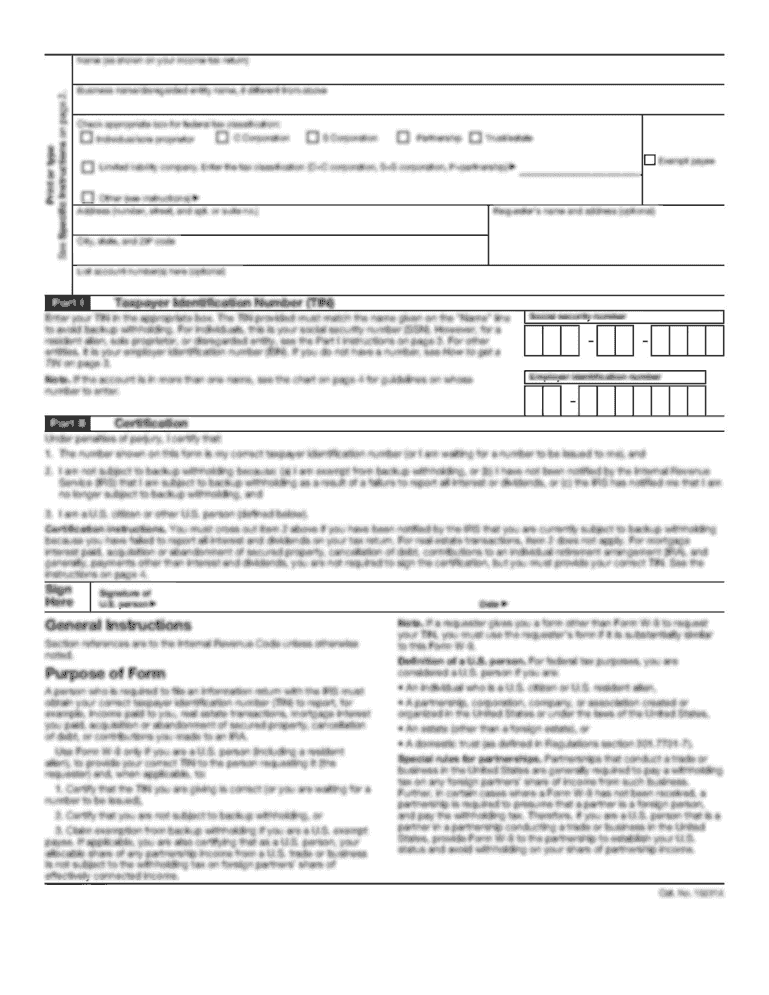

When is the deadline to file two way ca for in 2023?

The deadline to file the Two Way CA form for the year 2023 is typically April 15th, the same as the general tax filing deadline for individual taxpayers in the United States. However, it is always advisable to verify the deadline with the Internal Revenue Service (IRS) or consult a tax professional.

What is the penalty for the late filing of two way ca for?

The penalty for the late filing of the Two Way CA form can vary depending on the specific circumstances and regulations. It is best to consult the IRS guidelines and regulations or seek advice from a tax professional to determine the exact penalty amount and implications of late filing.

How do I edit two way ca for online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your two way ca for and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an electronic signature for the two way ca for in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your two way ca for in seconds.

How do I fill out two way ca for on an Android device?

Use the pdfFiller Android app to finish your two way ca for and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your two way ca for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.