Get the free Coordinated Loan Program of the General Assembly - mdcnw

Show details

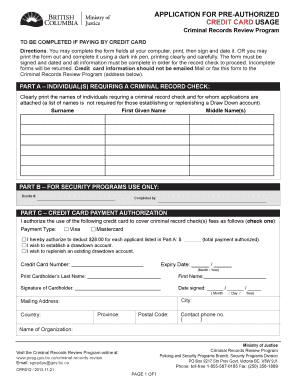

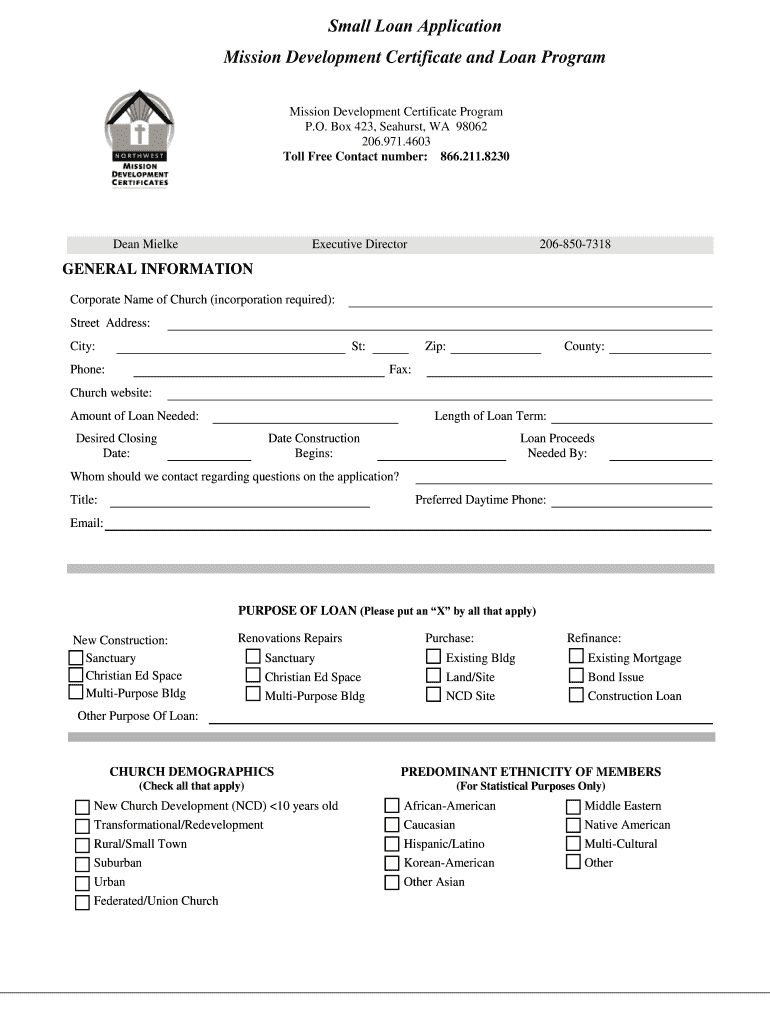

Small Loan Application Mission Development Certificate and Loan Program Mission Development Certificate Program P.O. Box 423, Seahorse, WA 98062 206.971.4603 Toll Free Contact number: 866.211.8230

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign coordinated loan program of

Edit your coordinated loan program of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your coordinated loan program of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit coordinated loan program of online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit coordinated loan program of. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out coordinated loan program of

How to fill out coordinated loan program of?

01

Gather the necessary documents: Before filling out the coordinated loan program application, make sure you have all the required documents ready. These may include identification proof, income statements, employment details, and any additional information requested by the loan program.

02

Read the instructions carefully: It is crucial to carefully read and understand the instructions provided with the application form. This will help you complete the form accurately and avoid any mistakes that could lead to delays or rejections.

03

Provide accurate personal information: Fill in your personal details accurately, including your full name, address, contact information, and social security number. Any inaccuracies can cause complications in the loan process.

04

Enter financial information: Fill out all the financial details required, such as income, assets, debts, and liabilities. This information helps the loan program assess your financial situation and determine your eligibility.

05

Complete employment details: Provide your employment history, including current and previous employers' names, addresses, positions held, and the duration of employment. Include any additional income sources if applicable.

06

Consider seeking professional guidance: If you find the application process complex or are unsure about certain aspects, consider seeking assistance from a financial advisor or loan program representative. They can guide you through the process and ensure that you fill out the form correctly.

Who needs coordinated loan program of?

01

Individuals seeking financial assistance: The coordinated loan program is designed for individuals who require financial assistance to meet their specific needs. It can be utilized for various purposes such as education, home buying, or business expansion.

02

Low-income individuals and families: The coordinated loan program often targets low-income individuals and families who may have difficulty accessing traditional loans. It aims to bridge the gap and provide them with access to much-needed funds.

03

Students pursuing higher education: Students who are unable to cover their education expenses through scholarships, grants, or personal funds may opt for a coordinated loan program. This helps them finance their education and achieve their academic goals.

04

Small business owners: Coordinated loan programs can also benefit small business owners who require capital to start their ventures, expand their operations, or manage cash flow. These loans offer alternative financing options tailored to their specific needs.

05

Individuals with unique financial circumstances: Some individuals may have unique financial circumstances that make it challenging for them to access traditional loans. Coordinated loan programs cater to these individuals, taking their specific circumstances into account.

Remember, each loan program may have specific eligibility criteria and requirements. It is essential to review the details of the specific coordinated loan program you are interested in and ensure that you meet the necessary criteria before filling out the application.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the coordinated loan program of electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your coordinated loan program of and you'll be done in minutes.

Can I create an eSignature for the coordinated loan program of in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your coordinated loan program of and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I complete coordinated loan program of on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your coordinated loan program of from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is coordinated loan program of?

The coordinated loan program is a program designed to track and manage loans that are distributed across multiple parties.

Who is required to file coordinated loan program of?

Lenders, financial institutions, and other entities involved in loan transactions are required to file coordinated loan program reports.

How to fill out coordinated loan program of?

The coordinated loan program report can be filled out online or submitted through a designated portal provided by the governing body.

What is the purpose of coordinated loan program of?

The purpose of the coordinated loan program is to ensure transparency and accountability in loan transactions, as well as to prevent fraud and abuse.

What information must be reported on coordinated loan program of?

The coordinated loan program report typically includes information such as loan amounts, interest rates, repayment terms, and borrower details.

Fill out your coordinated loan program of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Coordinated Loan Program Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.