Get the free General Liability Application - Alarm Installation andor Monitoring Fire Extinguishe...

Show details

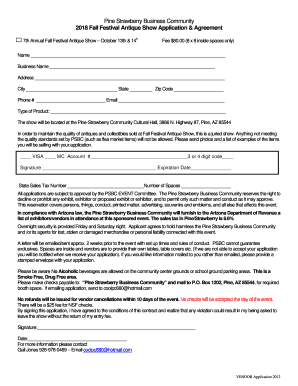

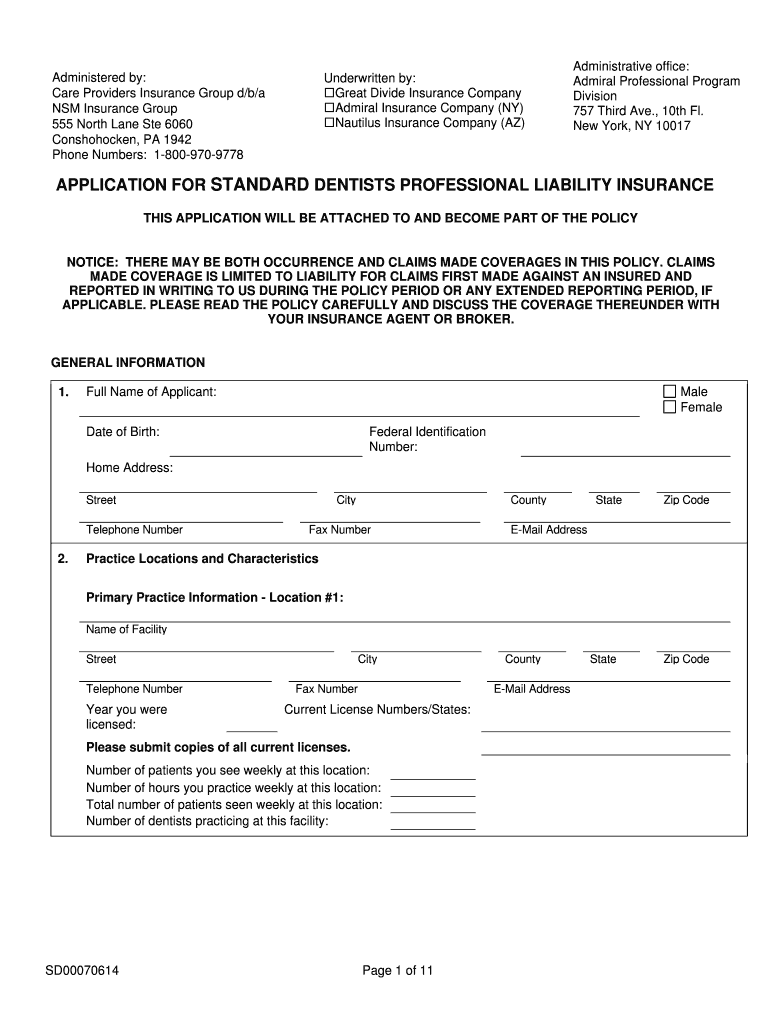

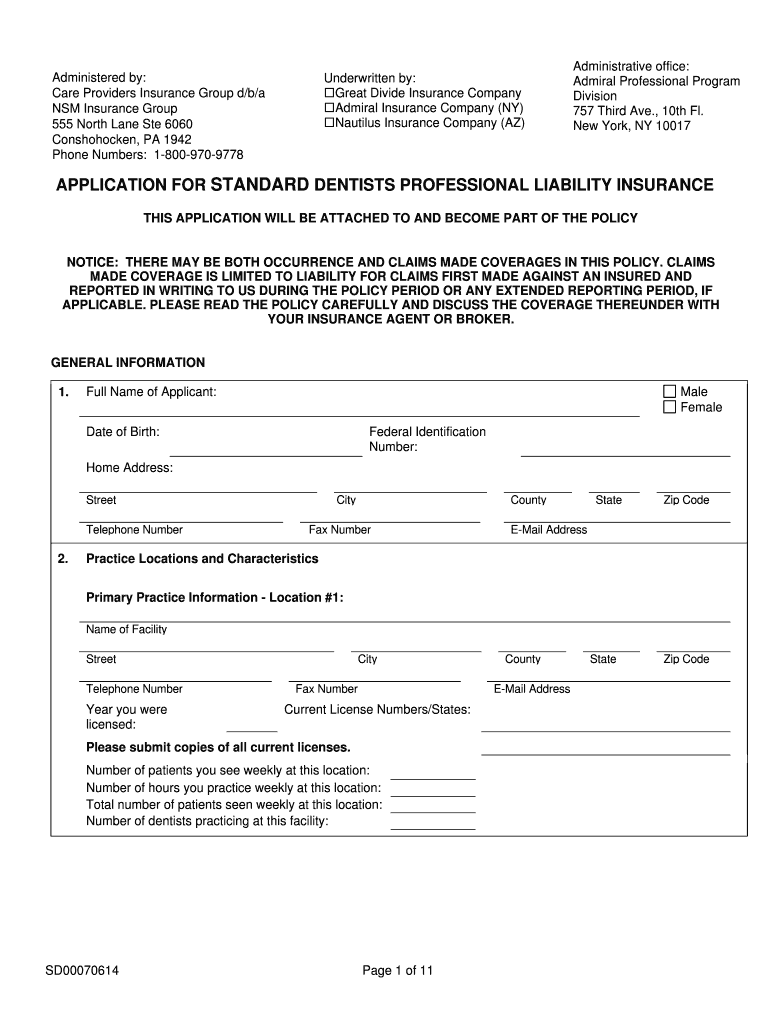

Administered by: Care Providers Insurance Group d/b/a NSM Insurance Group 555 North Lane Ste 6060 Conshohocken, PA 1942 Phone Numbers: 1-800-970-9778 Underwritten by: Great Divide Insurance Company

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your general liability application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your general liability application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing general liability application online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit general liability application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

How to fill out general liability application

How to fill out general liability application:

01

Start by gathering all necessary information: Before filling out the general liability application, collect all relevant details about your business, such as its name, address, contact information, nature of operations, and any previous insurance coverage.

02

Provide accurate business information: Fill in the application with precise and up-to-date information about your business. This includes the type of industry you operate in, the number of employees, annual revenue, and any subcontractors you may hire.

03

Describe your operations: Explain your business operations in detail, including the services or products you offer and any specific risks or hazards associated with your industry. Be clear and concise when describing the scope and nature of your activities.

04

Disclose any claims or losses: Ensure to disclose any prior claims, losses, or lawsuits your business has faced. This information helps insurers assess risks accurately and provide you with appropriate coverage.

05

Customize coverage limits: Determine the appropriate coverage limits for your business. Consider factors such as the size of your company, the potential risks involved, and any contractual requirements. Tailor the policy limits to meet your specific business needs.

06

Seek professional assistance if needed: If you encounter any difficulties or uncertainties while filling out the application, don't hesitate to consult an insurance broker or agent. They can provide guidance, help you understand insurance terminology, and ensure that you complete the application accurately.

Who needs general liability application:

01

Start-ups and small businesses: Any new or small business that wants to establish a comprehensive insurance coverage base should consider a general liability application. It protects businesses from liability claims related to property damage, bodily injury, advertising mistakes, or personal injury.

02

Contractors and tradespeople: Contractors and tradespeople who work at clients' properties face various risks, such as accidental damage or injuries. Having a general liability policy safeguards them from potential legal and financial complications.

03

Service-based businesses: Industries like consulting, accounting, marketing, or IT services should consider general liability insurance. These businesses often interact with clients, handle sensitive data, or provide advice, and may be exposed to lawsuits regarding negligence or mistakes.

04

Retail businesses: Stores, boutiques, or restaurants should also have general liability coverage. Accidents like slips or falls, damaged property, or product-related injuries can lead to legal claims that could be financially devastating without appropriate insurance.

05

Home-based businesses: Even if you run a business from your home, you might still need general liability coverage. This insurance protects your personal assets in case of lawsuits or claims arising from business-related incidents.

Note: It is always recommended to consult with an insurance professional to understand your specific needs and ensure adequate coverage for your business.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send general liability application to be eSigned by others?

Once your general liability application is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I sign the general liability application electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your general liability application in seconds.

How do I edit general liability application on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share general liability application from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Fill out your general liability application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.