Get the free MEIER FAMILY FOUNDATION LTD

Show details

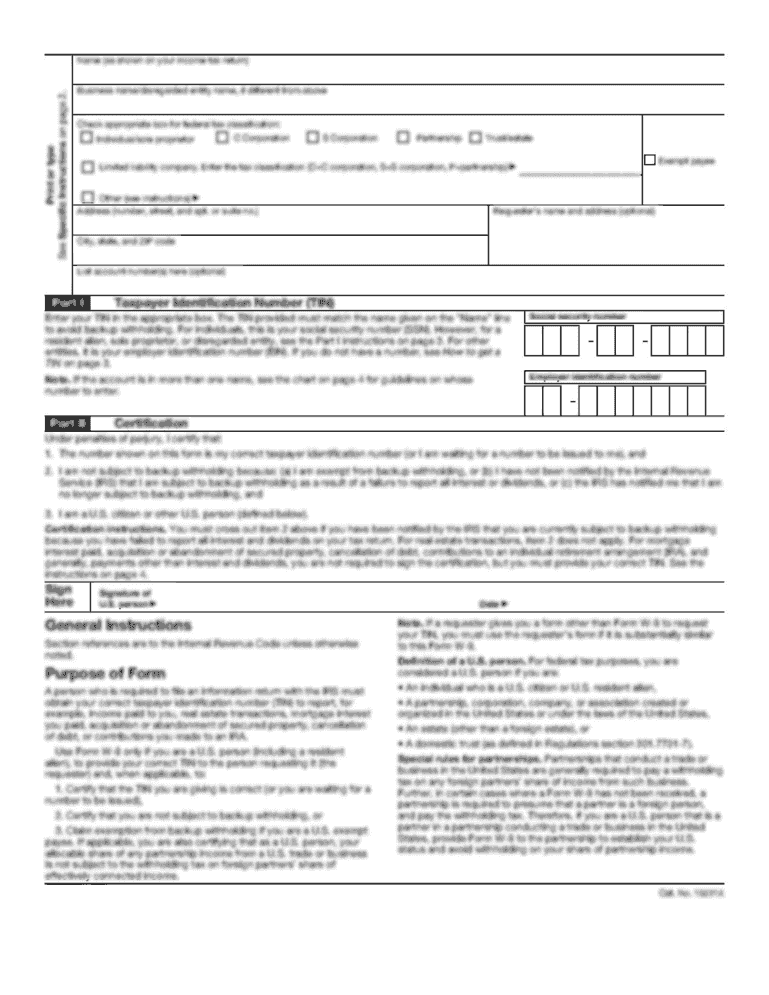

L file Form GRAPHIC print — DO NOT PROCESS As Filed Data DAN: 93491196003011 OMB No Return of Private Foundation 990 -PF 1545-0052 or Section 4947 (a)(1) Nonexempt Charitable Trust Treated as a

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your meier family foundation ltd form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your meier family foundation ltd form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit meier family foundation ltd online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit meier family foundation ltd. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

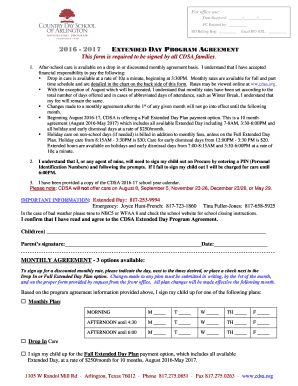

How to fill out meier family foundation ltd

How to fill out Meier Family Foundation Ltd:

01

Start by gathering all the necessary information and documents required for filling out the foundation paperwork. This may include personal identification documents, financial statements, and any relevant information about the foundation's purpose and goals.

02

Carefully review the guidelines and requirements provided by the Meier Family Foundation Ltd. This will help ensure that you are aware of any specific instructions or restrictions for filling out the paperwork.

03

Begin by filling out the basic information section, which typically includes details such as the foundation's name, address, and contact information. Make sure to provide accurate and up-to-date information.

04

Next, provide information about the foundation's purpose, goals, and mission. This section is crucial as it outlines the primary objectives of the foundation and helps demonstrate its eligibility for assistance or grants.

05

Detail the foundation's financial information, including its assets, income, and any significant financial transactions. This will help provide a complete picture of the foundation's financial standing and ensure transparency.

06

If required, provide information about the board members or trustees of the foundation. Include their contact details, qualifications, and any affiliations they may have with other organizations.

07

Double-check all the filled-out information for accuracy and completeness. Any errors or missing information may delay the processing of the foundation's paperwork.

08

Once you have completed filling out all the necessary sections, submit the paperwork to the Meier Family Foundation Ltd. Follow the provided instructions for submission, whether it's through mail, email, or an online portal.

Who needs Meier Family Foundation Ltd:

01

Individuals or families who wish to establish a philanthropic entity to support various charitable causes and organizations may need the Meier Family Foundation Ltd. This foundation can provide a structure and legal entity to manage and distribute funds to support their chosen charitable endeavors.

02

Non-profit organizations or charities that are looking for potential funding sources may also find the Meier Family Foundation Ltd relevant. Such organizations can explore the foundation's grant programs or funding opportunities to support their activities and projects aligned with the foundation's mission.

03

Professional advisors, such as attorneys or financial planners, who work closely with individuals or families seeking to establish their own foundations, may need to be knowledgeable about Meier Family Foundation Ltd. This understanding can help them guide their clients in aligning with the foundation's purposes and requirements effectively.

In summary, filling out the Meier Family Foundation Ltd involves gathering necessary information, carefully reviewing guidelines, providing accurate and comprehensive details about the foundation's purpose, financial standing, and board members. This foundation is relevant for individuals or families seeking to establish a philanthropic entity, non-profit organizations searching for funding sources, and professional advisors assisting clients with establishing their own foundations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is meier family foundation ltd?

The Meier Family Foundation Ltd is a private foundation established by the Meier family to support charitable and philanthropic activities.

Who is required to file meier family foundation ltd?

The Meier Family Foundation Ltd is required to file annual tax returns with the appropriate tax authorities.

How to fill out meier family foundation ltd?

To fill out the Meier Family Foundation Ltd annual tax returns, you must gather all relevant financial information and complete the required forms provided by the tax authorities.

What is the purpose of meier family foundation ltd?

The purpose of the Meier Family Foundation Ltd is to support charitable and philanthropic activities that align with the foundation's mission and values.

What information must be reported on meier family foundation ltd?

The Meier Family Foundation Ltd must report its financial activities, including income, expenses, assets, and grants made to charitable organizations.

When is the deadline to file meier family foundation ltd in 2023?

The deadline to file the Meier Family Foundation Ltd annual tax returns in 2023 is typically determined by the tax authorities and may vary depending on the jurisdiction. Please consult the relevant tax authority for the exact deadline.

What is the penalty for the late filing of meier family foundation ltd?

The penalty for the late filing of the Meier Family Foundation Ltd annual tax returns may vary depending on the jurisdiction and specific circumstances. It is recommended to consult with a tax professional or the relevant tax authority for detailed information.

How can I modify meier family foundation ltd without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your meier family foundation ltd into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I execute meier family foundation ltd online?

With pdfFiller, you may easily complete and sign meier family foundation ltd online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How can I edit meier family foundation ltd on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing meier family foundation ltd.

Fill out your meier family foundation ltd online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.