Get the free Trustees weigh tax rate hike - Canton Public Library - cantonpl

Show details

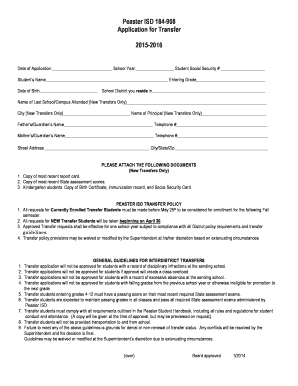

'? 11 Canton Observer MONDAY. SKKTKMBKR 26. 1994 ?CANTON, MICHIGAN ? 44 ? PACKS VOLUME 20 NUMBER 23 FIFTY CENTS Trustees weigh tax rate hike IN THE PAPER TODAY The Canton Township Board on Tuesday

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your trustees weigh tax rate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your trustees weigh tax rate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing trustees weigh tax rate online

To use our professional PDF editor, follow these steps:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit trustees weigh tax rate. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

How to fill out trustees weigh tax rate

How to fill out trustees weigh tax rate:

01

Start by gathering all necessary financial documents, including income statements, expense records, and any other relevant information.

02

Use a spreadsheet or tax software to input the financial data and calculate the tax rate. Make sure to accurately categorize and label each item to ensure accurate calculations.

03

Review the tax rates applicable to trustees in your jurisdiction. This information can typically be found on government tax websites or by consulting with a tax professional.

04

Compare the calculated tax rate with the applicable tax rate for trustees to determine if any adjustments or changes need to be made.

05

Make any necessary adjustments to the financial data to ensure compliance with the applicable tax rate.

06

Double-check all calculations and ensure that the tax return is completed accurately and thoroughly.

07

Submit the completed tax return to the appropriate tax authorities within the designated deadline.

Who needs trustees weigh tax rate?

01

Trustees of trusts: Individuals who have been appointed as trustees of a trust need to weigh the tax rate applicable to trust income. This is important to ensure compliance with tax laws and to accurately report and pay taxes on behalf of the trust.

02

Beneficiaries of trusts: Beneficiaries who receive income from a trust may also need to understand the tax rate applicable to trust distributions. This knowledge can help them plan their personal taxes and ensure accurate reporting of trust income.

03

Professionals involved in trust administration: Lawyers, accountants, and financial advisors who provide services related to trust administration need to be aware of the tax rate applicable to trustees. This knowledge allows them to appropriately advise their clients and ensure proper tax planning and compliance for trusts.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is trustees weigh tax rate?

Trustees weigh tax rate is a tax rate imposed on the trustees of a trust. It is the rate at which the trustees are required to pay taxes on the income earned by the trust.

Who is required to file trustees weigh tax rate?

The trustees of a trust are required to file trustees weigh tax rate. It is their responsibility to ensure that the tax return is submitted accurately and on time.

How to fill out trustees weigh tax rate?

To fill out trustees weigh tax rate, the trustees need to gather all relevant financial information of the trust, such as income, expenses, and deductions. They should then use this information to complete the appropriate tax forms provided by the tax authorities.

What is the purpose of trustees weigh tax rate?

The purpose of trustees weigh tax rate is to ensure that the trustees of a trust fulfill their tax obligations and pay taxes on the income generated by the trust. It helps to generate revenue for the government and maintain tax compliance.

What information must be reported on trustees weigh tax rate?

On trustees weigh tax rate, trustees must report various details related to the trust's income, expenses, deductions, and financial transactions. This may include information such as the trust's identification number, income sources, investments, and distributions.

When is the deadline to file trustees weigh tax rate in 2023?

The deadline to file trustees weigh tax rate in 2023 has not been specified. It is advisable to consult the tax authorities or refer to the relevant tax laws and regulations for accurate information.

What is the penalty for the late filing of trustees weigh tax rate?

The penalty for the late filing of trustees weigh tax rate can vary depending on the jurisdiction and specific circumstances. It is usually expressed as a percentage of the tax owed and may accrue interest over time. It is important for trustees to file their tax returns on time to avoid penalties and interest charges.

How do I make changes in trustees weigh tax rate?

The editing procedure is simple with pdfFiller. Open your trustees weigh tax rate in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I make edits in trustees weigh tax rate without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit trustees weigh tax rate and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I fill out the trustees weigh tax rate form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign trustees weigh tax rate and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your trustees weigh tax rate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.