Get the free SPEClAL SAVlNGS REDUCED RATES

Show details

SPECIAL savings ? ? Reduced rates no single supplement See Inside into the arctic A Voyage to Greenland and the Canadian Arctic Aboard the All-Suite, 100-Gues t Celia II July 31 – August 15, 2010,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your speclal savlngs reduced rates form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your speclal savlngs reduced rates form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing speclal savlngs reduced rates online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit speclal savlngs reduced rates. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

How to fill out speclal savlngs reduced rates

How to fill out special savings reduced rates:

01

Start by obtaining the necessary form for special savings reduced rates from the relevant financial institution or government agency. This form is typically available online or at the institution's branch.

02

Carefully read all the instructions provided on the form. Ensure you understand the eligibility criteria and requirements for qualifying for special savings reduced rates.

03

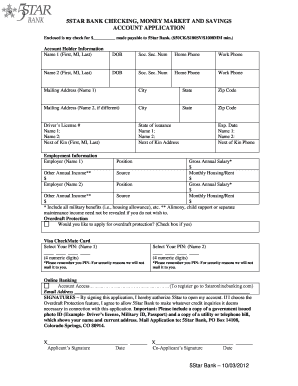

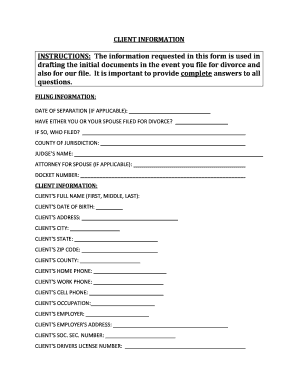

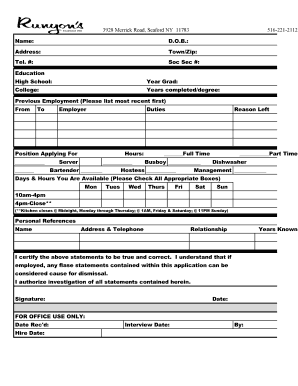

Fill in your personal information accurately and completely. This may include your full name, contact details, social security number, and any other information requested on the form.

04

Provide details about your current financial situation. This may include information about your annual income, employment status, any dependents you have, and any assets or liabilities you possess.

05

Indicate the type of savings account you wish to apply special savings reduced rates for. Specify the purpose of your savings and how long you intend to hold the savings in the account.

06

Review your completed form to ensure all fields are filled out correctly and no information is missing. Double-check for any errors or inconsistencies.

07

Attach any necessary supporting documents as required by the institution or agency. These may include copies of identification documents, income statements, or other relevant paperwork.

08

Sign and date the form at the designated area. Make sure your signature matches the one provided on your identification documents.

09

Make copies of the completed form and all supporting documents for your records before submitting the original documents to the respective institution or agency.

Who needs special savings reduced rates:

01

Individuals with lower income levels who are looking for ways to maximize their savings.

02

People who have specific financial goals and want to take advantage of reduced rates to grow their savings faster.

03

Eligible individuals who meet the criteria set by the financial institution or government agency providing these special savings reduced rates.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is speclal savlngs reduced rates?

Special savings reduced rates are a type of financial benefit provided to certain individuals or entities, which allow them to save money by paying reduced interest rates on savings or investment products.

Who is required to file speclal savlngs reduced rates?

The specific requirements for filing special savings reduced rates vary depending on the jurisdiction and the specific program. Generally, individuals or entities who meet certain criteria, such as low-income individuals or nonprofit organizations, may be eligible to file for special savings reduced rates.

How to fill out speclal savlngs reduced rates?

To fill out the application for special savings reduced rates, you typically need to provide personal or organizational information, such as your name, address, income details, and other relevant financial information. The exact process and required documentation may vary depending on the specific program and jurisdiction.

What is the purpose of speclal savlngs reduced rates?

The purpose of special savings reduced rates is to provide financial assistance or incentives to individuals or entities who may need it the most. By offering reduced interest rates on savings or investment products, these programs aim to promote savings, economic stability, and overall financial well-being.

What information must be reported on speclal savlngs reduced rates?

The specific information that must be reported on special savings reduced rates can vary depending on the program and jurisdiction. However, common information that may be required includes personal or organizational details, income information, financial asset details, and any other relevant financial information that may determine eligibility for the program.

When is the deadline to file speclal savlngs reduced rates in 2023?

The deadline to file for special savings reduced rates in 2023 varies depending on the specific program and jurisdiction. It is recommended to check with the relevant authorities or the program's official documentation to determine the exact deadline.

What is the penalty for the late filing of speclal savlngs reduced rates?

The penalties for late filing of special savings reduced rates can vary depending on the program and jurisdiction. Common penalties may include financial penalties, loss of eligibility for reduced rates, or other consequences as outlined in the program's guidelines or regulations. It is advisable to consult the specific program's documentation or contact the relevant authorities for details on the penalties for late filing.

How can I send speclal savlngs reduced rates for eSignature?

Once you are ready to share your speclal savlngs reduced rates, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I make changes in speclal savlngs reduced rates?

The editing procedure is simple with pdfFiller. Open your speclal savlngs reduced rates in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I complete speclal savlngs reduced rates on an Android device?

Use the pdfFiller Android app to finish your speclal savlngs reduced rates and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your speclal savlngs reduced rates online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.