Get the free Understanding your home equity loan

Show details

Understanding your home equity loan

and planning for repayment in the future

What is a home equity loan, and

what are my loan options?

A home equity loan allows you to borrow against the value of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your understanding your home equity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your understanding your home equity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing understanding your home equity online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit understanding your home equity. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

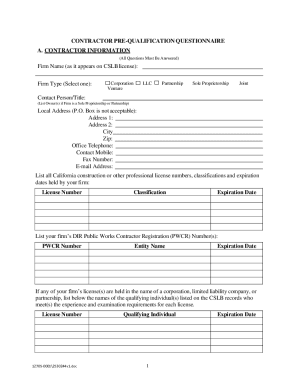

How to fill out understanding your home equity

How to fill out understanding your home equity:

01

Gather the necessary information: Start by collecting all relevant documents related to your home, including your mortgage statement, property tax assessments, and any records of improvements or renovations made to your property.

02

Calculate your current home value: Use online tools or consult with a professional appraiser to determine the current market value of your home. This will provide you with a baseline for understanding your home equity.

03

Determine your outstanding mortgage balance: Refer to your mortgage statement to determine how much you still owe on your home loan. This information is crucial for calculating your home equity.

04

Calculate your home equity: Subtract your outstanding mortgage balance from the current market value of your home. This will give you an estimation of your home equity. For example, if your home is valued at $300,000 and you owe $200,000 on your mortgage, your home equity would be $100,000.

05

Understand the different types of home equity: Familiarize yourself with the two types of home equity – loan-to-value (LTV) ratio and equity percentage. LTV ratio is calculated by dividing your mortgage balance by your home value, expressed as a percentage. Equity percentage is calculated by dividing your home equity by your home value.

06

Interpret your home equity: Once you have determined your home equity, try to interpret what it means for your financial situation. Having a high home equity can be advantageous for various purposes such as obtaining a home equity loan or line of credit, refinancing your mortgage, or selling your home for a profit.

07

Seek professional advice if needed: If you find it challenging to understand or calculate your home equity, consider consulting with a financial advisor or a real estate professional. They can provide you with personalized guidance and insights based on your specific circumstances.

Who needs understanding your home equity?

01

Homeowners: Understanding your home equity is crucial for homeowners who want to gain insights into their overall financial position and utilize their home as an asset for future financial decisions.

02

Potential homebuyers: Potential homebuyers who are considering purchasing a property can benefit from understanding home equity as it helps them determine the potential equity they may have in the future if they decide to sell or refinance the property.

03

Real estate investors: Real estate investors often rely on the concept of home equity to evaluate the returns on their investments and make informed decisions regarding rental properties or property flipping.

04

Those considering home equity loans or lines of credit: Individuals who are contemplating borrowing against their home equity to fund major expenses, such as home renovations or education, need to have a clear understanding of their home equity to make informed borrowing decisions.

05

Home sellers: Understanding your home equity is essential for home sellers who want to accurately price their property and negotiate favorable terms during the selling process. It can also help them estimate their potential proceeds from the sale.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit understanding your home equity in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your understanding your home equity, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I fill out understanding your home equity using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign understanding your home equity and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Can I edit understanding your home equity on an iOS device?

You certainly can. You can quickly edit, distribute, and sign understanding your home equity on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Fill out your understanding your home equity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.