Get the free PSL Gold Loan Scheme - Hindi Form.doc

Show details

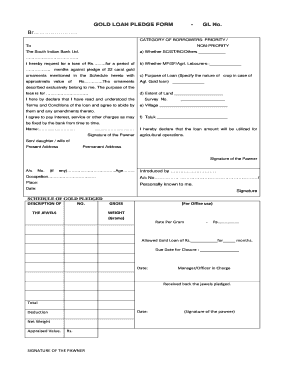

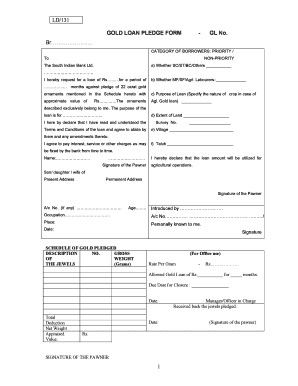

????????? ?????? ??? ????????? 1. ??? ???????? ?????? ? (??????? ??????) ??????----------------------------------------------???????? ???.---------------------------------------- ?????---------------------------------------

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your psl gold loan scheme form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your psl gold loan scheme form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing psl gold loan scheme online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit psl gold loan scheme. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

How to fill out psl gold loan scheme

How to fill out psl gold loan scheme?

01

Visit the nearest bank branch that offers the psl gold loan scheme.

02

Bring all the necessary documents such as identification, proof of address, and proof of ownership of gold.

03

Ask for the psl gold loan application form and fill it out accurately and completely.

04

Provide all the required information, such as personal details, loan amount desired, and the details of the gold being pledged.

05

Attach all the necessary documents along with the application form, including KYC documents and gold ownership proof.

06

Submit the completed application form and documents to the bank representative.

07

Wait for the bank to evaluate your application and assess the value of the gold being pledged.

08

Once the evaluation is complete, the bank will decide on the loan amount that can be sanctioned.

09

If approved, review the terms and conditions of the loan, including interest rates, repayment options, and any additional charges.

10

Sign the loan agreement and provide any additional documentation required by the bank.

11

After completing the necessary formalities, the approved loan amount will be disbursed to your bank account.

Who needs psl gold loan scheme?

01

Individuals who require financial assistance and have gold assets that can be pledged as collateral.

02

Small business owners or entrepreneurs who need funds for their business operations.

03

Farmers or individuals involved in the agricultural sector who require funds for agricultural investments or activities.

04

Individuals who do not have a credit history or are unable to access traditional forms of credit.

05

Anyone in need of quick access to funds with gold assets that can be used as collateral.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is psl gold loan scheme?

PSL gold loan scheme refers to a loan scheme implemented under the Priority Sector Lending (PSL) guidelines of the Reserve Bank of India (RBI). PSL is a framework that mandates banks to allocate a specific percentage of their loans to sectors categorized as priority sectors, such as agriculture, micro, small and medium enterprises (MSMEs), education, housing, etc.

Under the PSL gold loan scheme, banks extend loans against the security of gold as collateral, specifically targeting borrowers engaged in agriculture and associated activities. These loans are provided at a concessional interest rate to meet the credit needs of farmers, small-scale industries, rural artisans, and other rural individuals involved in the agricultural and allied sectors.

The loan amount is determined based on the market value of the gold pledged by the borrower, up to a certain limit prescribed by the bank. The borrower needs to repay the loan amount within the specified duration, along with accumulated interest, failing which the bank may have the right to liquidate the gold collateral to recover the outstanding dues.

The PSL gold loan scheme helps boost the availability of credit to priority sectors, particularly in rural areas, contributing to the overall development and growth of the agricultural and allied sectors.

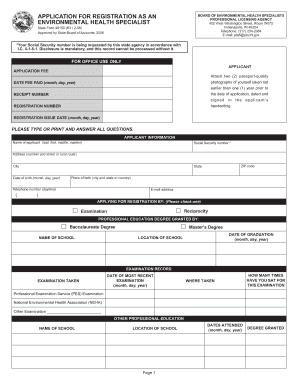

Who is required to file psl gold loan scheme?

The specific requirements for filing a PSL Gold Loan Scheme may vary depending on the jurisdiction and the specific rules set by the relevant government or financial institution. Generally, individuals or businesses seeking to avail of a PSL Gold Loan would need to meet certain criteria.

In India, for example, the gold loan scheme falls under Priority Sector Lending (PSL) guidelines by the Reserve Bank of India (RBI). Under these guidelines, banks are required to extend a certain percentage of their total advances to specified sectors, including agriculture, micro-enterprises, and other priority areas.

Therefore, individuals or businesses who meet the requirements for priority sector lending, such as small farmers, micro-enterprises, self-help groups, or individuals engaged in allied activities, may be eligible to apply for a PSL Gold Loan.

How to fill out psl gold loan scheme?

To fill out the PSL Gold Loan scheme, follow these steps:

1. Visit the website or branch of the bank offering the scheme.

2. Obtain and fill out the application form for the gold loan scheme. You may also find this form on the bank's website that you can download and print.

3. Provide your personal details such as your name, address, contact number, and identification proof (e.g., Aadhaar card, PAN card, or passport).

4. Provide details about the gold you are pledging, such as the type of gold (ornaments, coins, bars), weight, purity, and hallmark details.

5. Indicate the loan amount you require and the tenure for repayment. The loan amount will typically depend on the value of the gold pledged.

6. Review the terms and conditions of the loan carefully before signing the form. Ensure that you understand the interest rates, processing fees, repayment options, and any other applicable charges.

7. Attach the required documents along with the application form. These documents may include identification proof, address proof, a recent photograph, and any other documents as specified by the bank.

8. Submit the completed application form and supporting documents to the bank representative at the branch or through the online application portal.

9. Pay the processing fees, if applicable, as instructed by the bank.

10. Once your application is submitted, the bank will evaluate the gold's value and your eligibility for the loan. If approved, the loan amount will be disbursed to your account or provided in cash, depending on the bank's procedures.

11. Ensure timely repayment of the loan as per the agreed terms to avoid any penalties or additional charges.

Note: The steps may vary slightly depending on the specific bank and its requirements for the PSL Gold Loan scheme. It is always recommended to contact the bank directly or refer to their official website for the most accurate and up-to-date information.

What is the purpose of psl gold loan scheme?

The purpose of the PSL Gold Loan scheme is to enhance the availability of credit for farmers and individuals in the rural and semi-urban areas of India. This scheme allows individuals to avail loans by pledging their gold ornaments or jewelry as collateral. The loans granted through this scheme can be used for various purposes, including agricultural and allied activities, small business activities, education, medical emergencies, and personal expenses. The scheme aims to provide timely and affordable credit to those who may not have access to traditional banking channels or may not meet the stringent eligibility criteria of regular loans.

How do I make changes in psl gold loan scheme?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your psl gold loan scheme and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an electronic signature for signing my psl gold loan scheme in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your psl gold loan scheme and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I complete psl gold loan scheme on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your psl gold loan scheme. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Fill out your psl gold loan scheme online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.