Get the free Form W-8BEN, Certificate of Foreign Status of Beneficial Owner for ...

Show details

*0NB642* 0NB642 Form W8BEN (2014 2) () Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals) (Rev. February 2014) Department of the Treasury

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form w-8ben certificate of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form w-8ben certificate of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form w-8ben certificate of online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form w-8ben certificate of. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

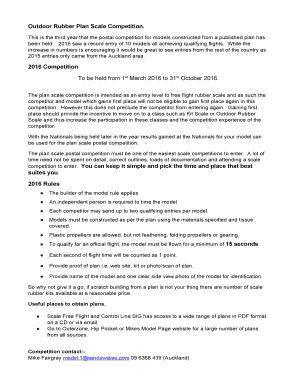

How to fill out form w-8ben certificate of

How to Fill out Form W-8BEN Certificate of

01

Start by carefully reading the instructions provided on the Form W-8BEN. This will help you understand the purpose of the form and the information you need to provide.

02

Begin filling out the form by entering your full name in the designated field. Make sure to use the same name as shown on your tax return.

03

Provide your permanent address. This should be your residential address, not a temporary or mailing address. Include the city, postal code, and country.

04

Indicate your country of citizenship in the next section. If you have dual citizenship, you may need to consult the instructions to determine which country to select.

05

Enter your U.S. taxpayer identification number (TIN). If you don't have a U.S. TIN, you may need to provide your foreign tax identification number or other required identification number.

06

If you have a U.S. TIN, check the appropriate box to indicate whether you are claiming a treaty benefit. If you are, provide the details of the treaty article and the country that qualifies you for the treaty.

07

If you are not claiming treaty benefits, proceed to Part III. Here, you will need to provide your foreign tax identifying number, if applicable, and the country of your tax residence.

08

Next, consult the instructions to determine the appropriate chapter 3 status code for your situation. Enter this code in the designated field on the form.

09

If you receive payments as a beneficial owner, you need to provide the name, address, and TIN, if any, of the withholding agent making the payments.

10

Review the completed form to ensure all the information is accurate and complete. Sign and date the form.

Who Needs Form W-8BEN Certificate of?

01

Non-U.S. individuals who receive income from U.S. sources and want to claim a reduced rate of withholding tax under an income tax treaty.

02

Foreign individuals who receive certain types of income, such as dividends, interest, or royalties, from U.S. financial institutions or other withholding agents.

03

Anyone who is not a U.S. person but has a U.S. taxpayer identification number for the purposes of reporting income on a U.S. tax return.

Remember, it is always advisable to consult a tax professional or refer to the instructions provided with the form for specific guidance based on your individual circumstances.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in form w-8ben certificate of without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing form w-8ben certificate of and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I sign the form w-8ben certificate of electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your form w-8ben certificate of in minutes.

Can I create an electronic signature for signing my form w-8ben certificate of in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your form w-8ben certificate of and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Fill out your form w-8ben certificate of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.