Get the free In te rnal R e v e n ue Se rvi ce - poundpuplegacy

Show details

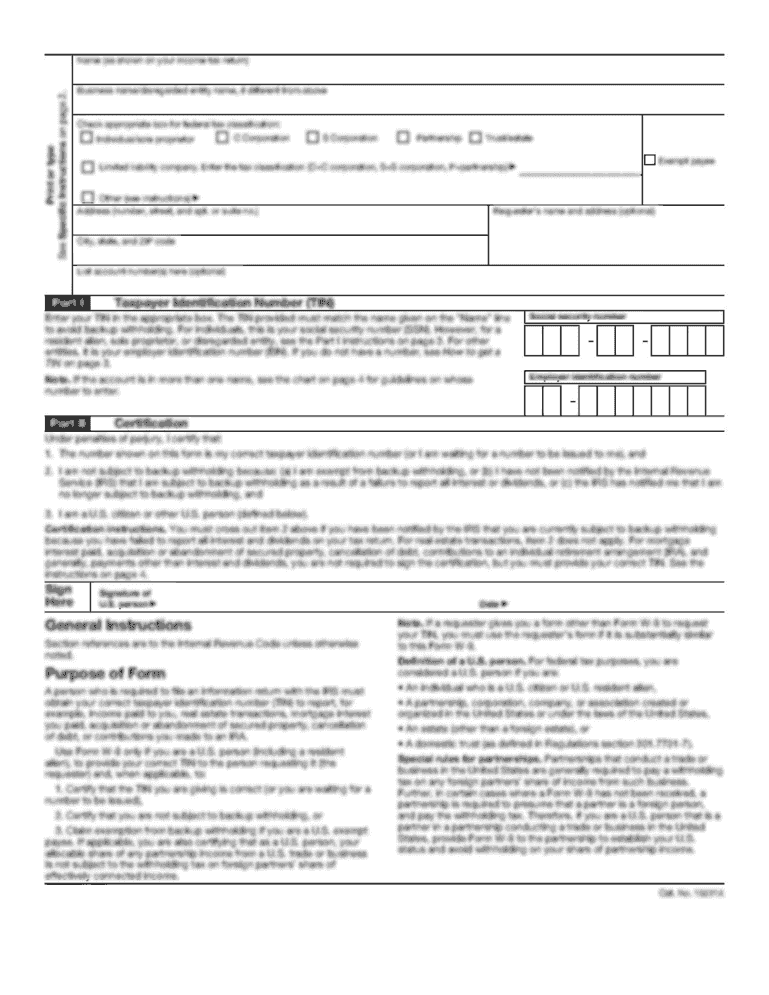

OMB No 1545-0047 Form 990 Return of Organization Exempt From Income Tax Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except black lung benefit trust or private foundation)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your in te rnal r form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your in te rnal r form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing in te rnal r online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit in te rnal r. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out in te rnal r

How to fill out in te rnal r:

01

Start by gathering all the necessary information and documents that are required to fill out the internal r form.

02

Fill in your personal details accurately, including your name, date of birth, and contact information.

03

Provide specific details about the purpose or reason for filling out the internal r form. Be clear and concise in explaining why you need this form.

04

Follow the instructions provided on the form regarding any additional supporting documents or evidence that may be required.

05

Double-check all the information you have provided to ensure accuracy and completeness.

06

Sign and date the form as required.

07

Submit the completed internal r form to the designated department or authority. Keep a copy of the form for your records.

Who needs in te rnal r:

01

Employees of a company or organization may need to fill out an internal r form for various reasons, such as requesting time off, applying for internal positions, or reporting workplace incidents.

02

Students may need to fill out an internal r form for academic purposes, such as requesting course transfers, applying for scholarships, or filing grievances.

03

Individuals who are part of a specific program or membership may need to fill out an internal r form to access certain benefits or services.

04

Applicants for a job position within a company may be required to fill out an internal r form as part of the application process to provide additional information or consent.

05

Any individual who needs to communicate or document internal information or procedures within an organization may need to fill out an internal r form.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is in te rnal r?

Internal R stands for Internal Revenue, which refers to the revenue generated by a country through taxes and other sources.

Who is required to file in te rnal r?

Individuals, businesses, and organizations that have an income or meet certain criteria set by the tax authority are required to file an Internal R.

How to fill out in te rnal r?

To fill out an Internal R, one needs to gather all necessary financial information, such as income, expenses, and deductions, and accurately report them on the provided forms or through online platforms.

What is the purpose of in te rnal r?

The purpose of filing an Internal R is to report and disclose financial information to the tax authorities for the assessment and collection of taxes.

What information must be reported on in te rnal r?

The information required to be reported on an Internal R varies depending on the jurisdiction, but it typically includes details about income, expenses, deductions, and taxes paid.

When is the deadline to file in te rnal r in 2023?

The deadline to file an Internal R in 2023 can vary by jurisdiction. It is best to consult the tax authority or check their official website for the specific deadline.

What is the penalty for the late filing of in te rnal r?

The penalty for late filing of an Internal R can vary depending on the jurisdiction and the amount of tax owed. It can range from financial penalties to interest charges on the outstanding tax balance.

How do I make changes in in te rnal r?

The editing procedure is simple with pdfFiller. Open your in te rnal r in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I make edits in in te rnal r without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your in te rnal r, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I edit in te rnal r on an Android device?

You can make any changes to PDF files, such as in te rnal r, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your in te rnal r online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.