Get the free PAYROLL STATUS CHANGE/ADDITION

Show details

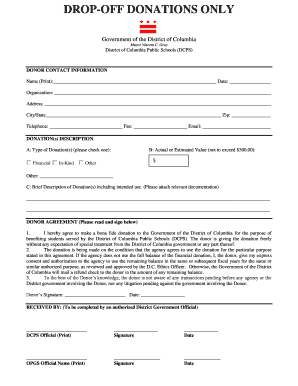

PAYROLL STATUS CHANGE/ADDITION THE FOLLOWING SECTIONS MUST BE FILLED OUT BY PERSON AUTHORIZING CHANGE/ADDITION: EFFECTIVE DATE EMPLOYEE INFORMATION NAME SS # STREET CITY, STATE, ZIP PHONE NUMBER IS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your payroll status changeaddition form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payroll status changeaddition form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing payroll status changeaddition online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit payroll status changeaddition. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

How to fill out payroll status changeaddition

How to fill out payroll status change addition:

01

Start by obtaining the necessary form from your employer's human resources department or payroll department. This form is typically called "Payroll Status Change Addition" or something similar.

02

Read the form carefully to understand the information it requires. Pay attention to any instructions or guidelines provided.

03

Begin by filling out your personal information, such as your name, employee ID, and contact details. Make sure to provide accurate and up-to-date information.

04

Next, indicate the effective date of the payroll status change addition. This is the date from which the change will take effect, such as the start of a new pay period or the next payroll cycle.

05

Specify the reason for the payroll status change addition. Common reasons include a promotion, change in job title, change in pay rate, or change in employment status (full-time to part-time or vice versa).

06

Include any additional details or comments that may be required or relevant. This could include specific instructions from your supervisor or any additional information necessary for processing the change.

07

Review the completed form for accuracy and completeness. Double-check all the information provided to ensure there are no errors or missing details.

08

Sign and date the form to certify and confirm that the information you have provided is accurate and true to the best of your knowledge.

09

Submit the filled-out form to your employer's human resources or payroll department. Follow any instructions or procedures they have in place for submitting such forms.

10

Keep a copy of the filled-out form for your records.

Who needs payroll status change addition?

Payroll status change additions are typically required by employees who have experienced a change in their employment status or compensation. This could include individuals who have been promoted, transferred to a new role, received a pay raise or reduction, changed their work schedule, or experienced any other change that affects their payroll status. It is important to consult with your employer's human resources or payroll department to determine if you need to fill out a payroll status change addition form.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is payroll status changeaddition?

Payroll status change addition refers to the process of updating or modifying an employee's payroll status, such as changes in job position, salary, or employment status.

Who is required to file payroll status changeaddition?

Employers or human resources departments are responsible for filing payroll status change additions for their employees.

How to fill out payroll status changeaddition?

To fill out a payroll status change addition, the employer or HR department needs to gather the necessary information, such as the employee's name, employee ID, effective date of the status change, and the specific details of the change. This information should be included in the designated forms or systems used by the organization.

What is the purpose of payroll status changeaddition?

The purpose of payroll status change addition is to maintain accurate and up-to-date records of employee payroll information. It ensures that employees' salary and employment status are correctly reflected in the payroll system.

What information must be reported on payroll status changeaddition?

The information that must be reported on a payroll status change addition includes the employee's name, employee ID, effective date of the change, and details of the status change (e.g., new job position, salary adjustment, change in employment status). Additional information may be required based on the organization's specific payroll processes and procedures.

When is the deadline to file payroll status changeaddition in 2023?

The specific deadline to file a payroll status change addition in 2023 may vary depending on the organization's internal policies and applicable regulations. It is recommended to consult the employer or HR department to determine the exact deadline.

What is the penalty for the late filing of payroll status changeaddition?

The penalty for the late filing of a payroll status change addition can vary depending on the jurisdiction and applicable laws. Common penalties may include financial fines or penalties, potential legal consequences, or other administrative measures. It is advisable to consult with legal or payroll professionals to understand the specific penalties that may apply in a particular situation.

Where do I find payroll status changeaddition?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the payroll status changeaddition in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit payroll status changeaddition in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your payroll status changeaddition, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I edit payroll status changeaddition on an iOS device?

Create, modify, and share payroll status changeaddition using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your payroll status changeaddition online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.