Get the free Christmas Charitable Contribution Form - Webmaster - tmwsolgl

Show details

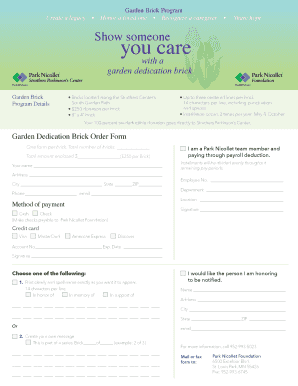

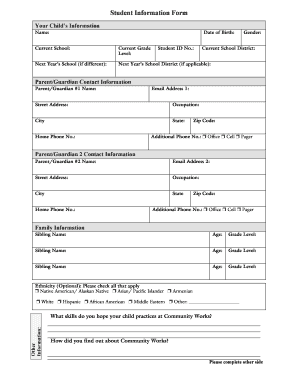

Most Worshipful Sons of Light GL Christmas Charitable Contribution Form Lodge/Chapter Name: Food Item Donated: $25 ×50 ×75 ×100 Check made payable MOLL : Suggested food items include: Hot Links,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your christmas charitable contribution form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your christmas charitable contribution form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit christmas charitable contribution form online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit christmas charitable contribution form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

How to fill out christmas charitable contribution form

How to fill out a Christmas charitable contribution form:

01

Start by gathering all the necessary information. This includes the name and contact information of the charity, the date of the contribution, and the amount donated.

02

Make sure you have proof of the contribution. This can be a receipt from the charity, a canceled check, or a credit card statement. Keep these documents on hand in case the IRS requests proof of your donation.

03

Determine the type of contribution you made. This could be cash, a check, securities, or even property. Be sure to accurately indicate the type of contribution on the form.

04

Fill out your personal information on the form. This may include your name, address, social security number, and possibly your employer identification number if you are claiming a corporate charitable contribution.

05

Fill in the details of your contribution. This includes the amount donated and any specific designation or purpose for the donation if applicable.

06

Calculate your deduction. If you are claiming a tax deduction for your charitable contribution, consult the IRS guidelines or seek professional advice to accurately calculate the amount you can claim.

Who needs a Christmas charitable contribution form?

01

Individuals who have made a financial contribution to a registered charity during the Christmas season and wish to claim a tax deduction for their donation.

02

Businesses or corporations that have made charitable contributions during the Christmas season and want to claim a tax deduction in accordance with the applicable tax laws.

03

Non-profit organizations and charities may also require individuals to fill out a Christmas charitable contribution form for documentation and acknowledgment purposes.

Remember to consult with a tax professional or refer to IRS guidelines for specific instructions on filling out the Christmas charitable contribution form to ensure accuracy and compliance with tax laws.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my christmas charitable contribution form directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your christmas charitable contribution form along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I execute christmas charitable contribution form online?

pdfFiller has made it simple to fill out and eSign christmas charitable contribution form. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I edit christmas charitable contribution form on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute christmas charitable contribution form from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your christmas charitable contribution form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.