Get the free 5327 07/23/2015 12 04 PM Return of Organization Exempt From Income Tax Form 990 Unde...

Show details

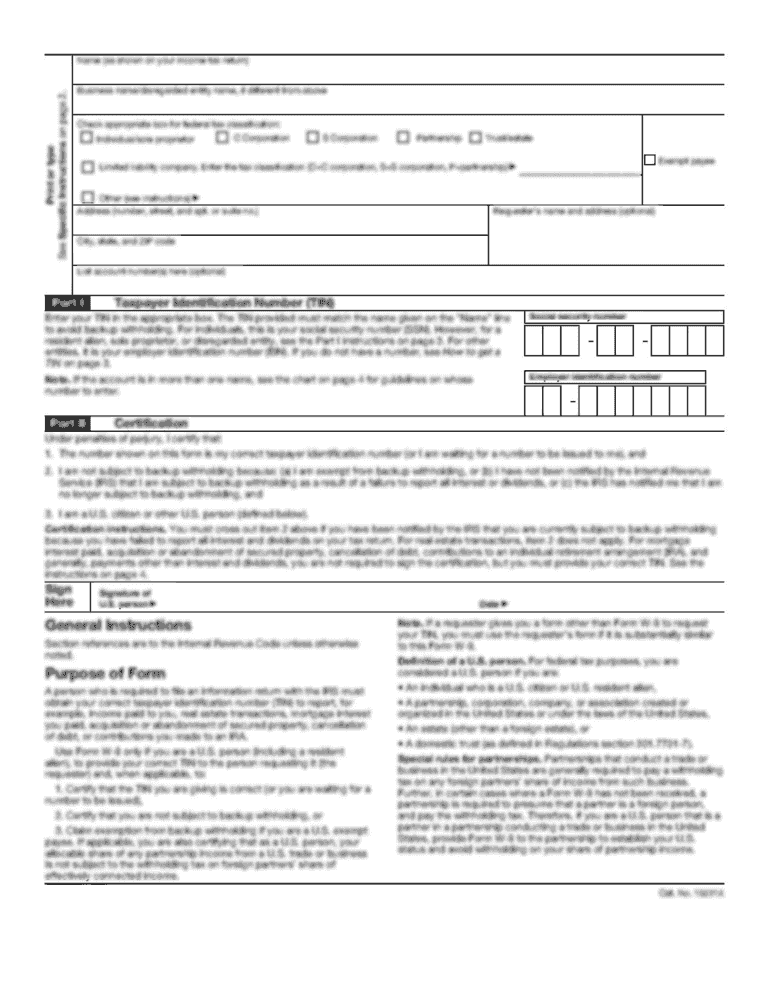

5327 07/23/2015 12 04 PM Return of Organization Exempt From Income Tax Form 990 Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except private foundations) Department of the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 5327 07232015 12 04 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 5327 07232015 12 04 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 5327 07232015 12 04 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 5327 07232015 12 04. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

How to fill out 5327 07232015 12 04

To fill out 5327 07232015 12 04, follow these steps:

01

Start by writing your name and contact information in the designated fields. This will help identify who is submitting the form.

02

Next, fill in the date section with the date of submission. In this case, it would be July 23, 2015.

03

The numbers "12" and "04" might refer to a specific time or event. Ensure that you enter the corresponding details accurately.

04

If there are any additional sections or fields on the form, review the instructions provided to properly complete them. Follow any specific guidelines or requirements mentioned.

As for who needs 5327 07232015 12 04, it is unclear without further information. The form could be required by a specific organization, company, or institution. It is best to consult the relevant authorities or individuals who provided the form to determine who it is intended for.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 5327 07232015 12 04?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the 5327 07232015 12 04 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an electronic signature for signing my 5327 07232015 12 04 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your 5327 07232015 12 04 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I complete 5327 07232015 12 04 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your 5327 07232015 12 04 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your 5327 07232015 12 04 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.